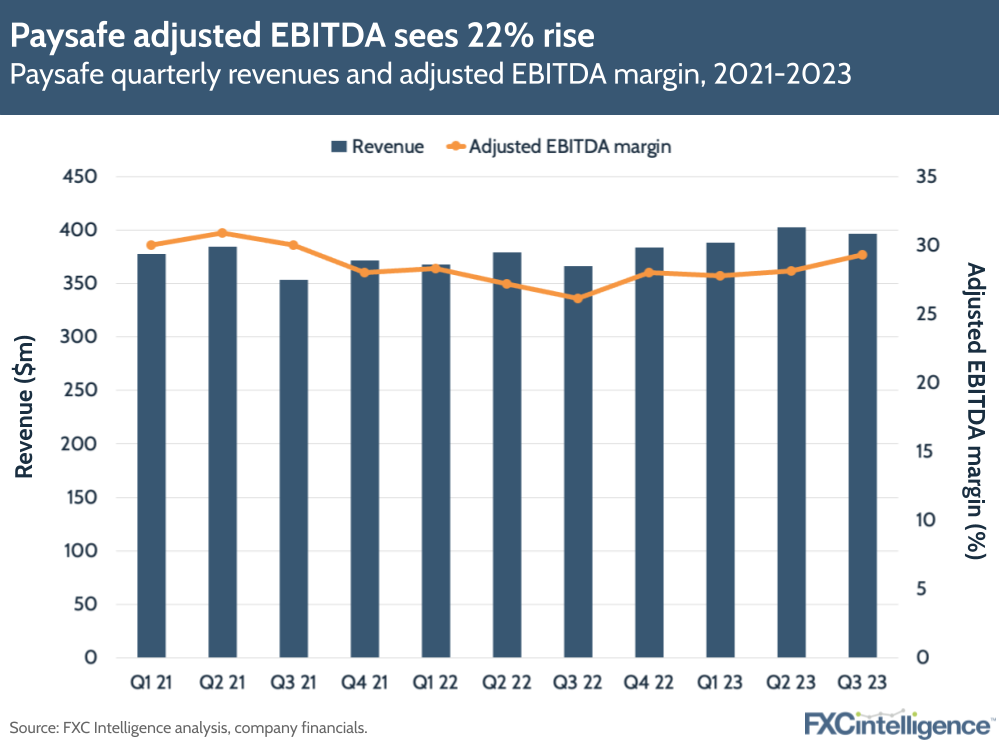

Payment processor Paysafe grew revenues by 8% to $396.4m in Q3 2023 and saw its adjusted EBITDA rise by 22% to $116.1m, backed by a payment volume rise of 8% to $35.1bn. A fifth consecutive quarter of revenue growth led the company to keep its FY revenue guidance the same, which spurred a positive response from investors.

Adjusted EBITDA margin was at 29.3% and was driven by lower credit losses as well as continued operating leverage during the quarter, during which the company has continued to focus on cutting down its debts (totalling $2.5bn at the end of Q3).

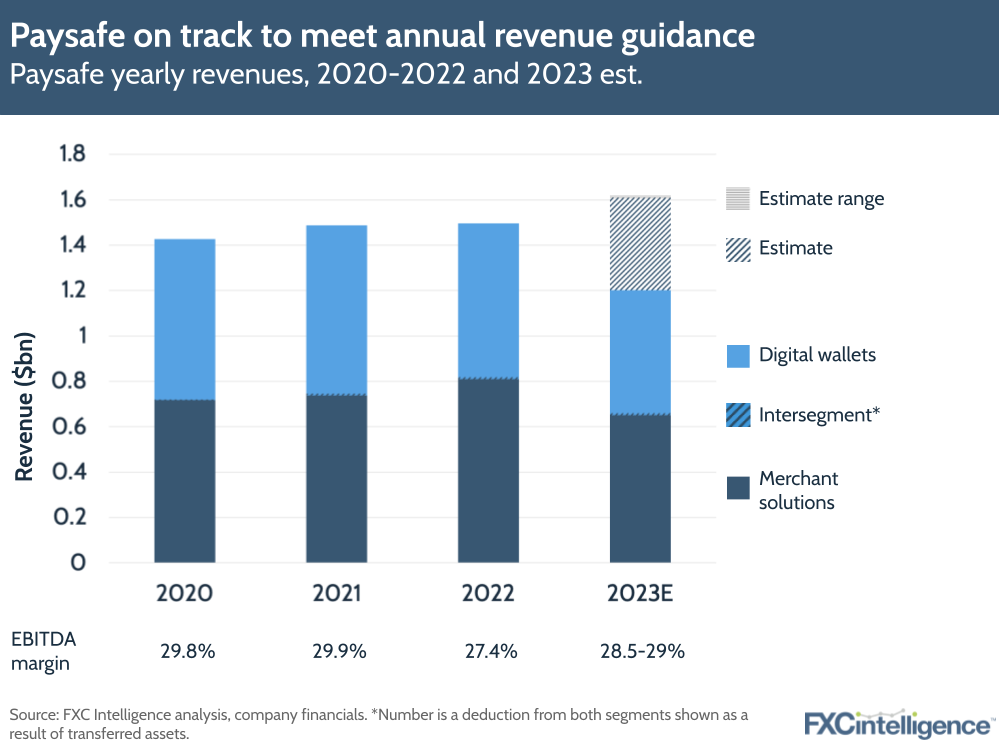

For the full year, Paysafe is still predicting total revenues to rise by 6.5-7.5% to around $1.6bn, while adjusted EBITDA is expected to rise by around 11-13% to $454-462m, giving a 28.5-29% EBITDA margin.

Paysafe revenue drivers in Q3 2023

Merchant solutions revenue grew 6% to $217m, powered by double-digit growth in ecommerce solutions, while Paysafe’s digital wallets segment revenue grew by 12% to $183m, though this was a 5% increase on a constant currency basis.

Paysafe CEO Bruce Lowthers mentioned strong growth in the SMB space (which accounts for over 20% of the company’s total revenues) as well as Clover, the company’s payments solution designed for quick-serve restaurants.

Paysafe also saw 17% revenue growth across its classic digital wallets (i.e. excluding e-cash solutions), which include Skrill and NETELLER. Average transactions per active user have grown by 40%, while average revenue per user (excluding interest revenues) has gone up by 25%.

Paysafe’s growth has increased but has tended towards the lower end of the spectrum when compared to some of the other cross-border payment processors we track. Having said this, its year-to-date revenue has grown at 7%, faster than this time last year, while ecommerce revenue YTD rose 29% compared to a 3% loss last year. Meanwhile, Paysafe’s classic digital wallet segment has seen 15% growth in YTD revenue, compared to a 13% loss over the same period last year.

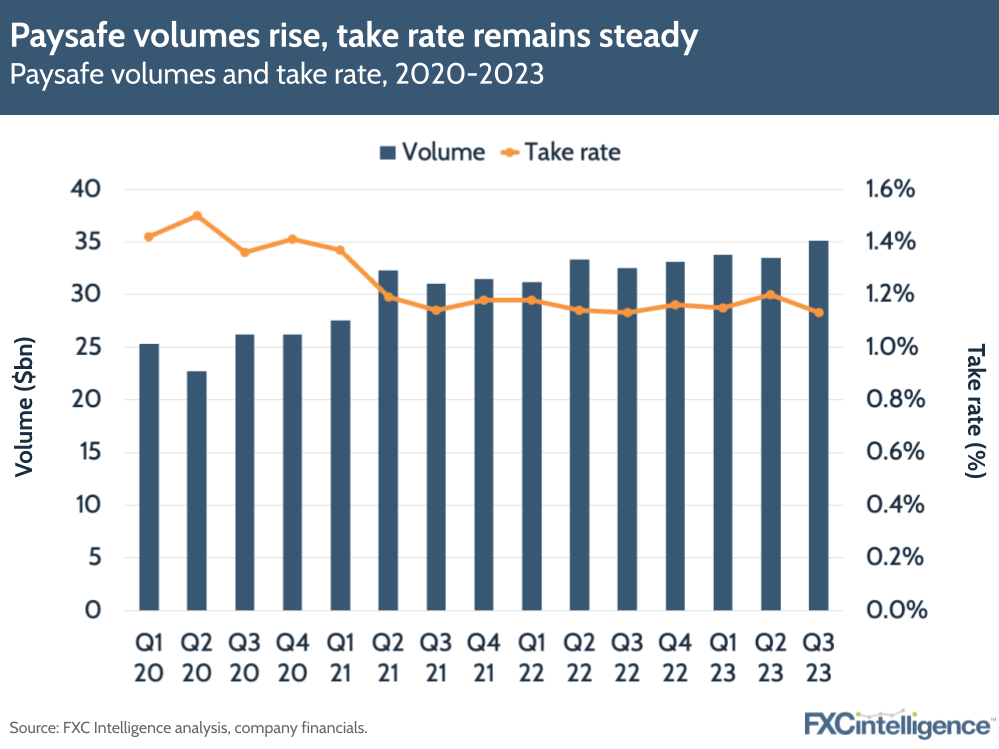

Seen over a longer period, Paysafe’s volumes have tended to rise YoY but revenues have fallen in some quarters, meaning the company’s take rate is lower low than it was in 2021, and in Q3 23 was at the same level as last year (1.1%).

Foreign exchange and debt impacts

Paysafe still has some way to go to pay off debts, with $112m paid off YTD through September (compared to $2.5bn remaining), and it said that this would continue to be a priority going into Q4. As we’ve explored before in this report, FX fluctuations and dollar strength can affect cross-border processors based in the US if they work with lots of merchants in other countries.

The company mentioned that, overall, it had seen an $11.9m benefit from foreign exchange rates, without which total revenue increased by 5%. However, Paysafe mentioned that due to its geographical mix, every 1% that the euro weakens against the dollar has an unfavourable impact of $7m on annualised revenue.

As a result, if rates remain at their present levels or drop lower, this could see the company deliver revenues at the lower end of its projected range. However, it still expects to see high single-digit/low-double digit growth in its mid-term guidance. Looking forward to 2024, the company wants to continue to enhance its products, expand its acquisition strategy and grow its salesforce to combat “softness” in its US acquiring business.