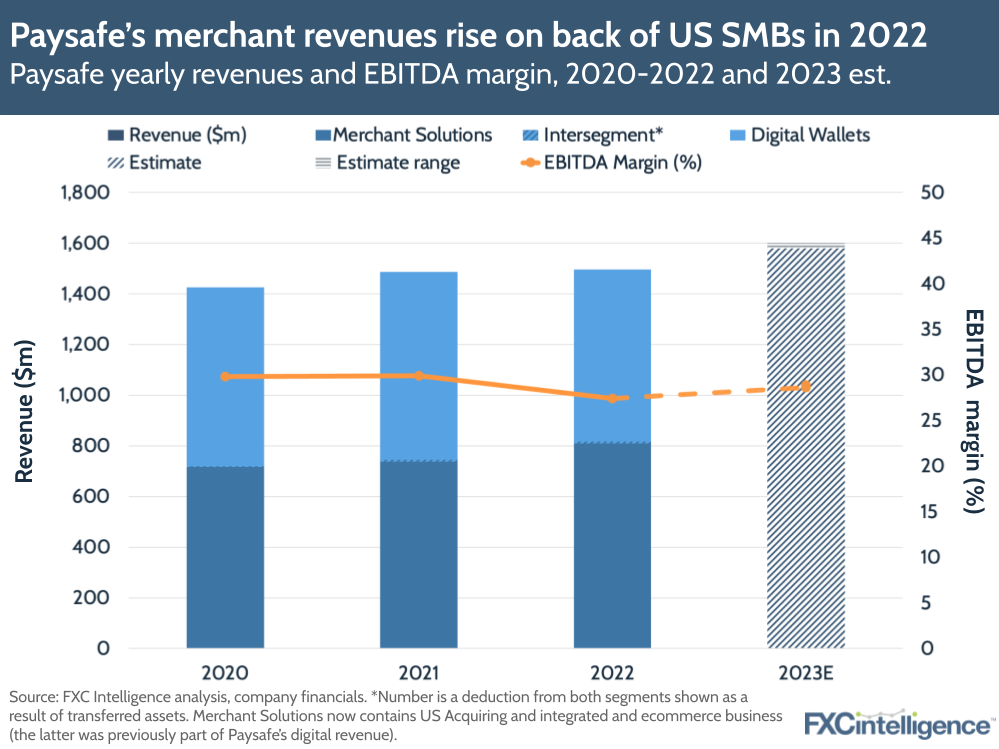

Paysafe’s revenue growth slowed in 2022, but was still slightly above the company’s guidance for the year. While Q4 revenues rose 3.2% YoY to $383.6m, FY 2022 revenues increased just 0.6% to $1.5bn. Growth was 6% excluding currency fluctuations and the impact of war in Russia, Ukraine and Belarus.

This week, Paysafe withdrew its on-ramp/off-ramping support for Binance in the UK, forcing the crypto exchange to halt deposits and withdrawals in British pounds for new customers. Paysafe cited regulatory pressures for the move, but did clarify that the UK portion of its business with Binance is small and that it would continue to work with the company in Latin America and other European countries.

For the full year, total payment volume increased 6% to $130.1m. However, adjusted EBITDA declined 7.6% to $410m, giving an adjusted EBITDA margin of 27.4% (down from 29.9% in 2021). The company’s take rate was 1.1% in 2022, compared to 1.2% the previous year.

On the plus side, rising demand across retail, hospitality, travel and leisure drove the company’s Merchant Solutions segment, particularly for US-based small and medium-sized businesses. Note that Merchant Solutions, previously called US Acquiring, now also contains Paysafe’s integrated and ecommerce business.

Digital Wallets saw positive impact from the company’s recent acquisitions, including Latin American payment providers SafetyPay and PagoEfectivo. However, the Russia-Ukraine war, European gambling regulations and FX headwinds meant that revenue for this segment declined 4% in Q4 and 9% over the year.

Next year, Paysafe is looking to expand its profit margin by expanding geographically within its existing merchant base, as well as boosting user numbers through an improved Digital Wallet experience. At an investor day this week, Paysafe outlined plans to significantly grow its iGaming segment, which accounted for 30% of revenues in 2022.

In 2023, the company believes it will see a 6-7% revenue increase to $1.58bn-1.6bn and an adjusted EBITDA of $452m-462m, giving a potential adjusted EBITDA margin of 28.5% to 29%.