In April, speculation emerged that banks were considering using P2P payment platform Zelle as an alternative to cards for ecommerce transactions. However, could the technology succeed in Europe?

Already used in the US to settle payments among individuals and with small payments, Zelle is backed by major US banks and available to use by their clients. Using its own payment rails, Zelle can provide banks with better control over the fees applied on cross-border and domestic payments, while removing the interchange and scheme/network fees applied to merchants.

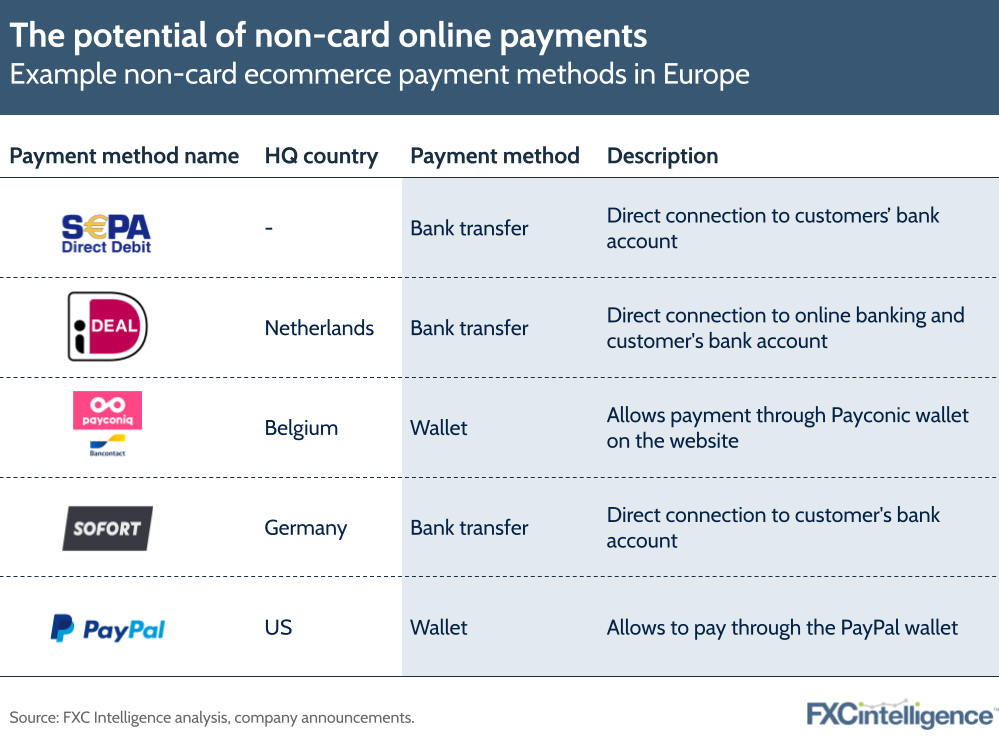

There is real potential for adoption of such a payment method is Europe. Consumers in the region are very open to using alternatives to cards for online purchases, as the presence of several non-card payment methods for ecommerce across the region shows. According to the ECB payment statistics, non-card payment methods are as popular as card payment methods both in physical and the online environment.

Such a solution could see customers benefit from a reduction in the overall price of cross-border payments. According to FXC Intelligence card pricing data, the price of cross-border card payments can be as high as 5% across European banks. Providing customers with a reliable and fast method of payment at a lower cost will therefore provide an advantage over existing card payments.

For banks, meanwhile, using their own rails to provide online payment options will provide significant margin opportunities, bypassing the need for card networks’ intermediation.