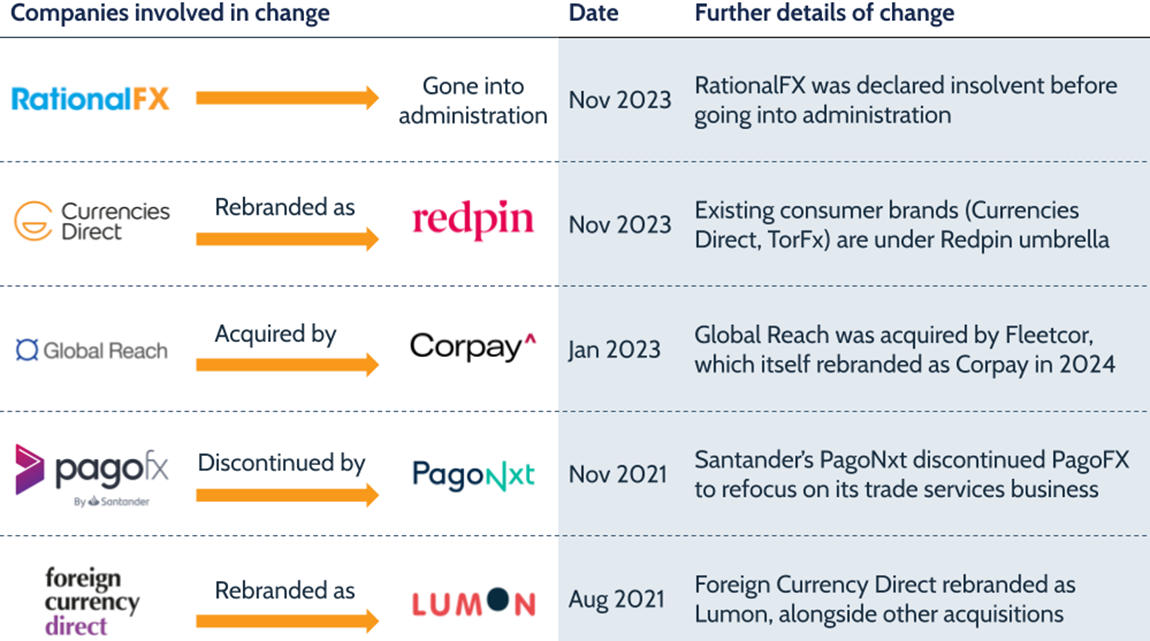

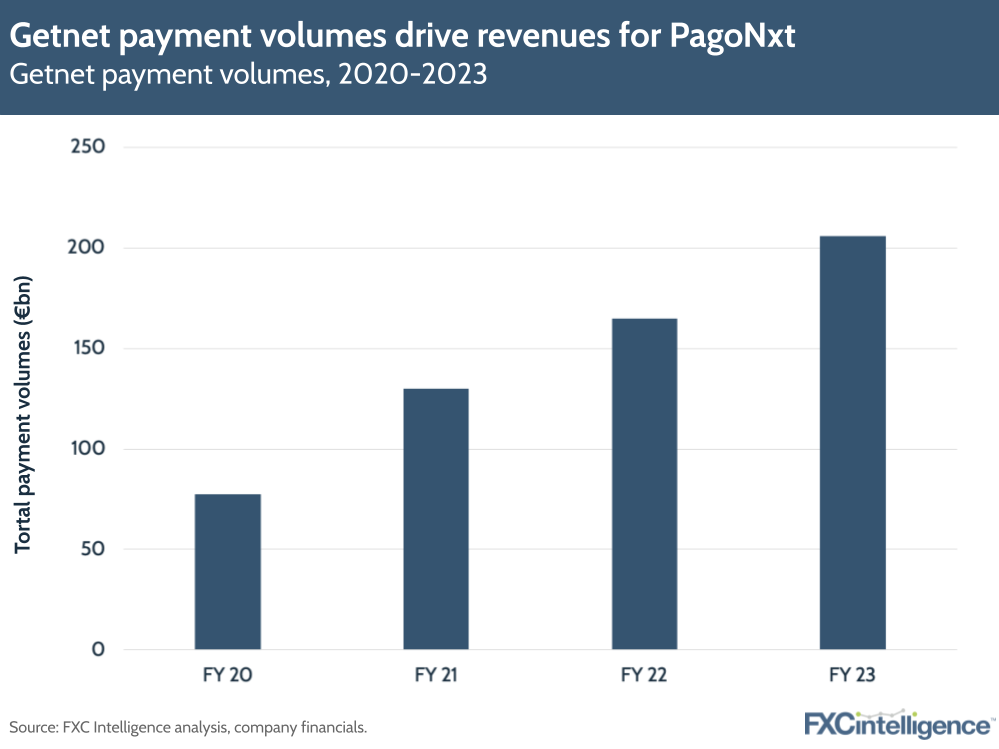

Santander’s payments arm, PagoNxt, saw its annual revenues surpass €1bn in 2023 on the back of growing payments activities and volumes across its merchant acquiring and B2B trade businesses (Getnet and Ebury, respectively).

Though revenue growth isn’t as high as last year (20% compared to 93%), the company is moving in a profitable direction; PagoNxt cut its pre-tax losses over the course of the year significantly from -€141m in 2022 to -€17m in 2023 and saw its second quarter in a row of pre-tax profit in Q4 23.

Key revenue drivers for PagoNxt in 2023

Rising volumes and transactions spurred PagoNxt’s revenue to rise 20% (17% in constant euros) to €1.1bn in 2023, backed by 7% revenue growth in Q4 to €320m. In particular, the company saw 15% growth in monthly transactions, to three billion, as well as a 16% decline in costs per transaction.

This translated to growing profitability, with the company noting its EBITDA margin had risen from 9.1% in 2022 to 24.8% in 2023. In addition to the pre-tax loss figures given above, PagoNxt also noted that, overall, attributable losses were €77m in 2023, against losses of €215m in 2022. Having said this, overall costs grew 6% due to inflation as well as ongoing tech investments.

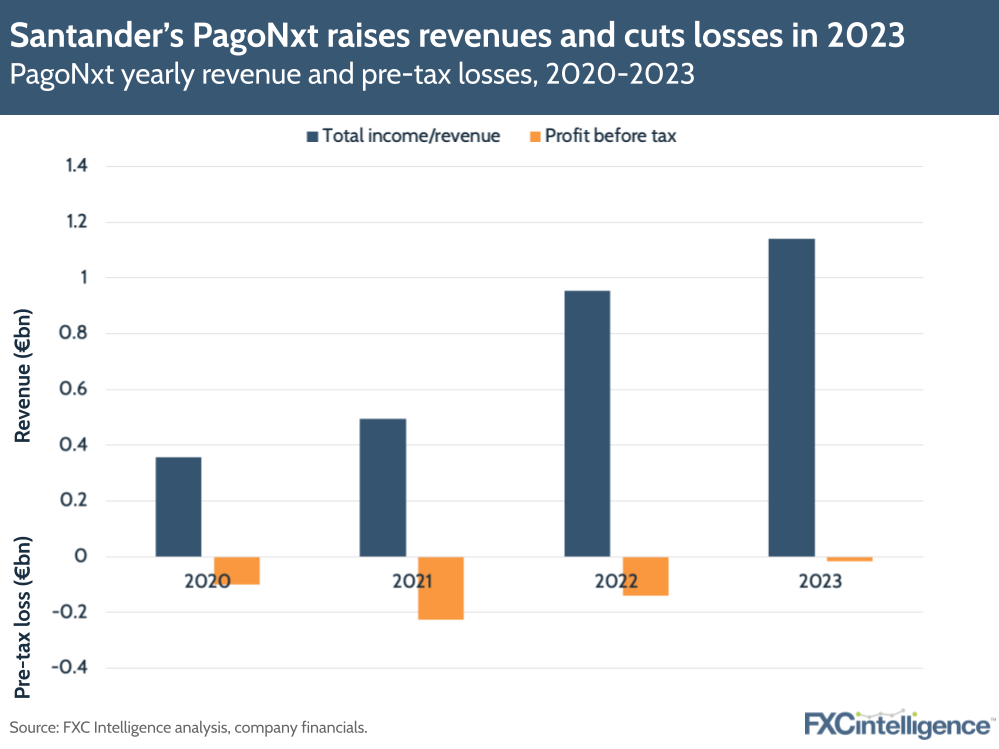

A key driver for PagoNxt was merchant acquiring business Getnet, which saw its total payments volume (TPV) growing 25% against 2022. This figure was driven by TPV rises across its core markets – including 31% growth in Europe, 23% growth in Mexico and 14% growth in Brazil – as well as more recently entered markets such as Chile, which saw 80% TPV growth.

PagoNxt also gave an update on OneTrade, its platform that offers digital FX services targeted at corporates and SMEs. The company has deployed OneTrade FX across Spain, Mexico and Chile and now wants to scale up its correspondent banking offerings for financial institutions and other businesses.

On Ebury, the company mentioned double-digit growth in total income, expected to be bolstered further through its recent acquisition of Brazilian cross-border payments specialist Bexs. As noted in FXC’s recent report on B2B payments trends for 2024, this space is likely to see more acquisitions and consolidation this year as the demand for better cross-border solutions grows.

PagoNxt’s future revenue and profit projections

Santander’s results came with a host of projections for 2025 (notably, not 2024), with the bank expecting PagoNxt to see more than 30% revenue growth in this year, driving a more than 30% EBITDA margin, against 24.8% in 2023. The new mention of EBITDA margin in Santander’s financial report this year suggests its confidence in profitability going forward.

PagoNxt had said in H1 21 that it would aim to surpass €2bn in revenues in the next two to three years. Revenues have risen every year since the company made this projection, but growth was slower than last year (20% in 2023, compared to 93% in 2022).

Assuming that PagoNxt sees the same revenue growth in 2024 that it saw in 2023, and in 2025 it sees growth of 30% (the figure the company believes it will exceed), PagoNxt’s annual figure would be at around €1.8bn – still a few million euros shy of €2bn, but on track to surpassing it in 2026. This scenario would align with our previous analysis of the company.

Against Santander’s total income of €58bn for 2023, payments remains a fraction of the bank’s core revenues. Having said this, PagoNxt continues to see solid growth, driven by Getnet’s penetration of the SME market in Latin America, as well as its scaling up of international trade and wholesale payment solutions.