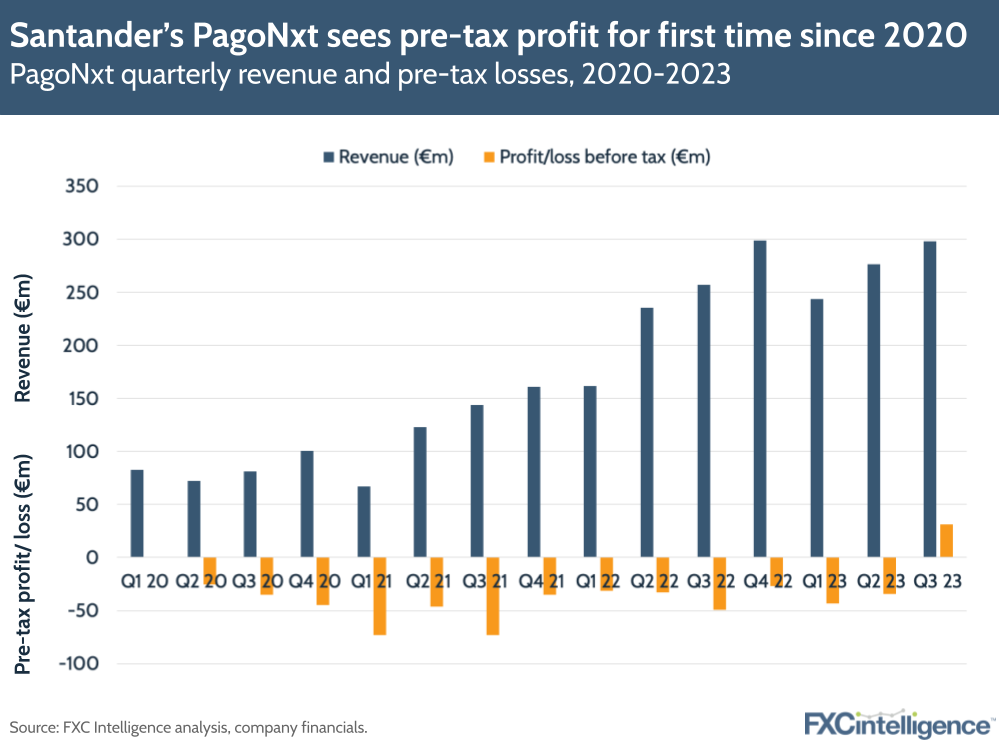

Santander has reported its Q3 23 results, including an update on its cross-border payments-focused division PagoNxt, which has made a pre-tax profit for the first time since 2020. Over the first nine months of the year, the company also reported a 24% growth in total payments volume, as well as 32% growth in the total number of merchant transactions.

Pagonxt profit drivers in Q3

For Q3, Pagonxt saw 7% revenue growth for the quarter – to €298m – while over the first 9 months of 2023, total revenue grew by 23% to €820m. While growth remains solid, it notably hasn’t been as dramatic this year as in Q3 22, when quarterly growth was at 25% and 9-month growth was at 75% in constant euros.

But while revenue growth has been slower, the company’s net operating income has been positive this quarter at €48m (compared to -€24m in Q3 22), which has helped drive a positive profit result for the quarter. After tax, the underlying attributable profit for Pagonxt was at €3m, up from a €48m loss in Q2 23.

Over nine months, PagoNxt has still made a loss of €101m, but this is down from €172m over the same period last year, showing that the company is moving in the right direction.

Breaking down PagoNxt by segment

Revenues seem to have been driven by a rise in merchant volumes under the Getnet brand. In particular, total payments volumes grew by 24% over the 9-month period to €149bn. Growth was led by Getnet in Europe, which saw 33% TPV growth over the period, followed by Mexico (27%) and Brazil (15%).

So far this year, Getnet has benefited from positive commercial dynamics in Spain and Portugal, as well as new solutions serving both larger businesses and SMEs. These include new processing capabilities for airlines, as well as connections to the digital version of PIX – Brazil’s instant payment system. In Q3, the company has focused on expanding Getnet as a fully licensed acquirer across Europe and Latin America.

For OneTrade, which offers international payments and FX services, this has now been fully rolled out in Spain and has achieved 10,000 active customers since its June rollout. Ebury, PagoNxt’s main B2B cross-border platform, didn’t see a numbers breakdown, but the company says it will continue to break into new regions following its acquisition of Bexs in Brazil and Prime Financial Markets in South Africa.

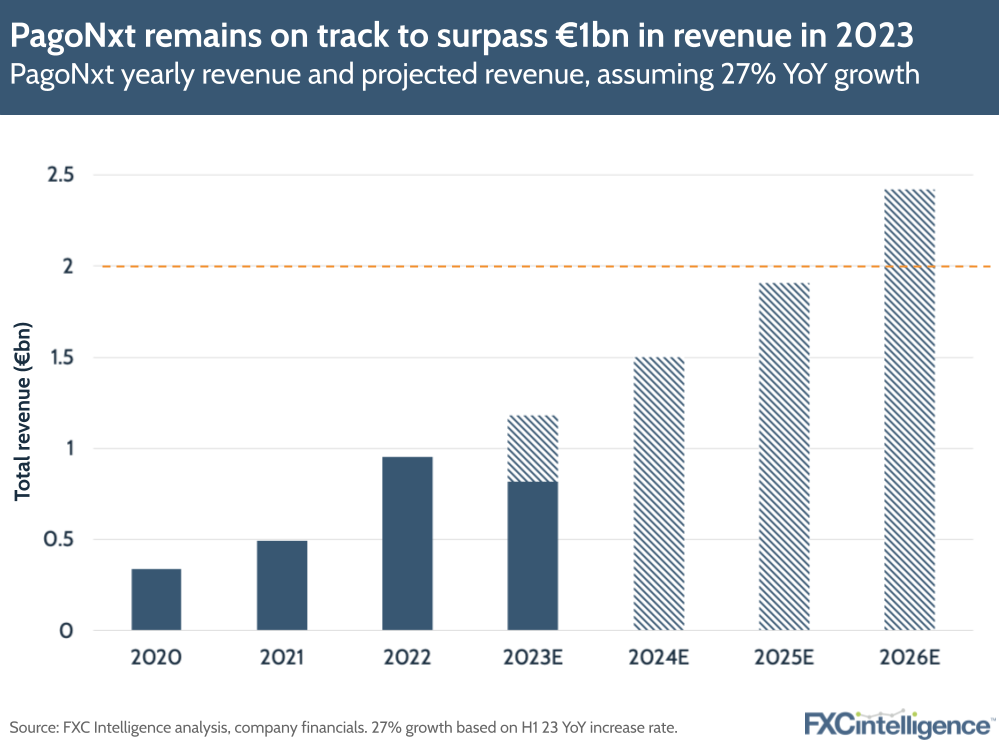

PagoNxt on track to pass €1bn in revenue in 2023

Following on from PagoNxt’s H1 23 results earlier this year, we projected how PagoNxt’s revenues would look if the company continued to achieve growth at the same rate to this half (27%). Updating our own projection with the most recent Q3 revenues, it is clear that the company remains on track to pass €1bn in revenue this year, particularly as the company tends to see its strongest quarterly revenues in Q4.

New product launches appear to have pushed the company back into profit, but PagoNxt still remains a very small part of Santander’s attributable profit overall (over €8bn). Moving forward, the company has said it will continue to scale up its global technology platform, accelerate growth and pursue open market opportunities through new partnerships.