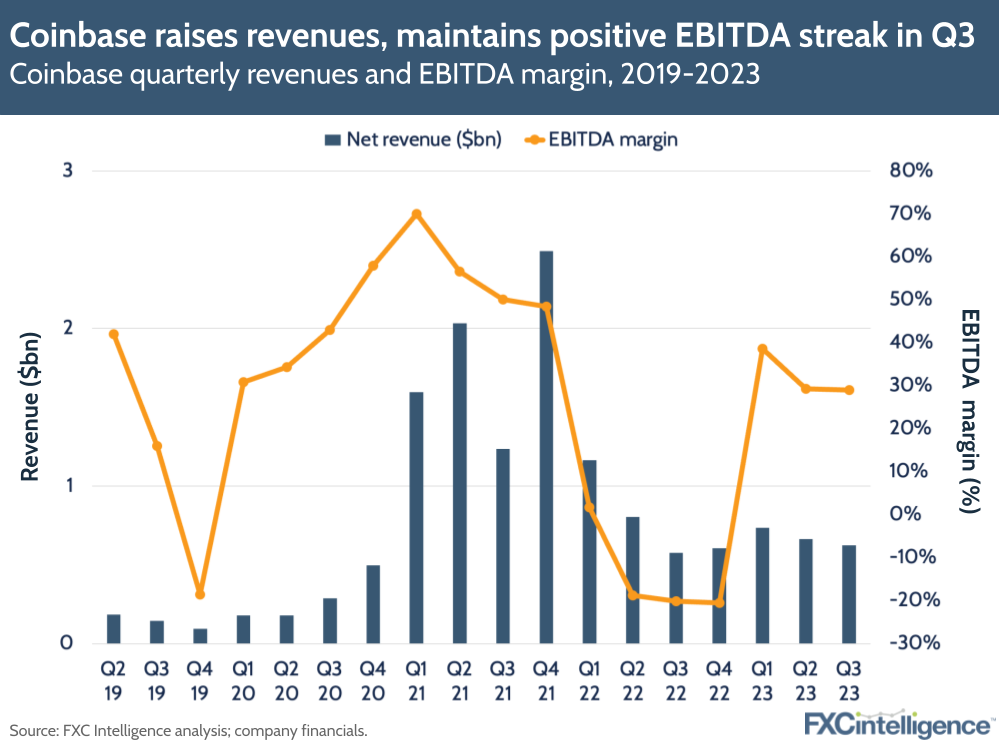

Crypto exchange Coinbase has reported its first YoY rise in net revenue since 2021. Revenues rose 8% YoY to $623m in Q3 23 (though this was down 6% from last quarter), while the company also reported a positive EBITDA of $181m, driving an EBITDA margin of around 29%. The company also spoke more about the potential of Base – its newly launched Layer 2 solution built on the Ethereum blockchain – for global payments.

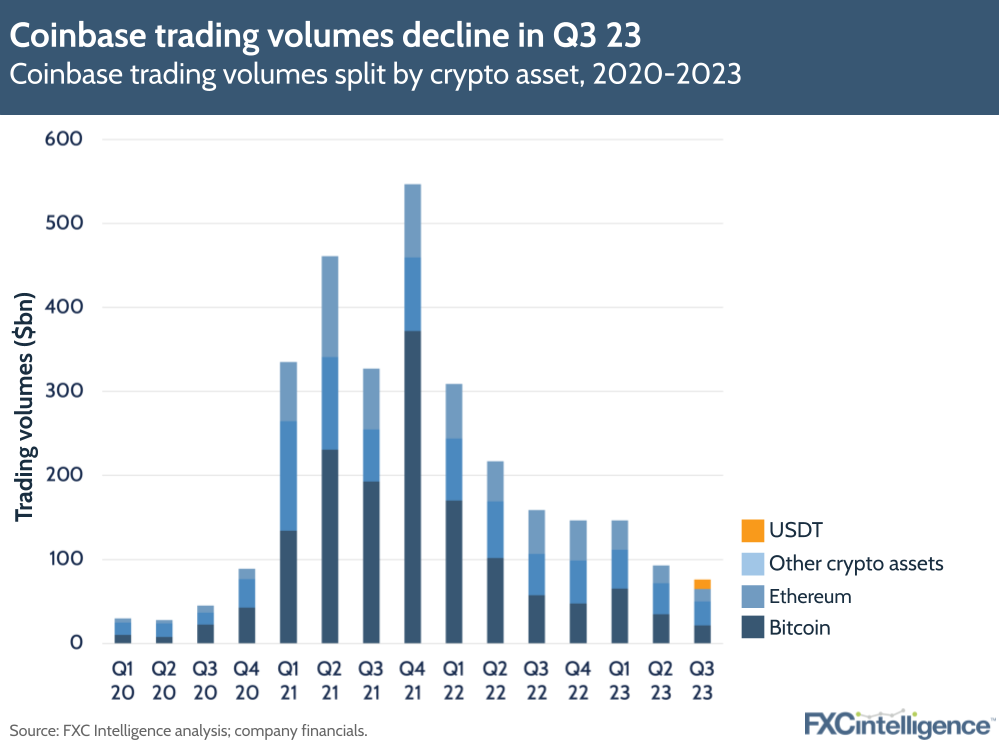

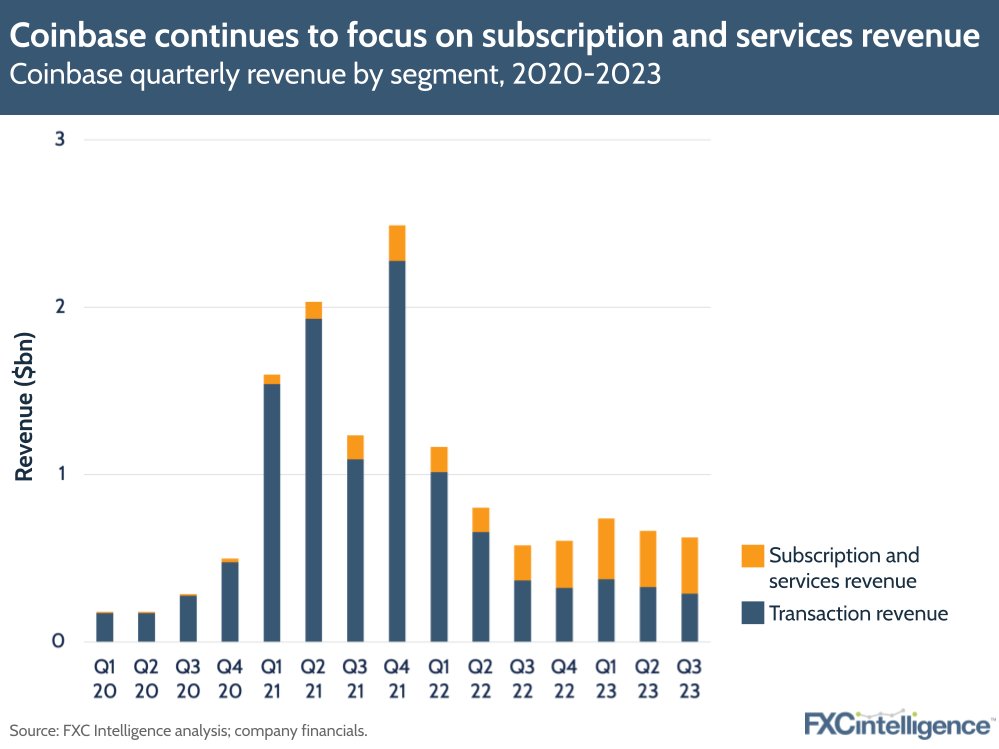

However, Coinbase once again saw saw trading volumes fall by 52% to $76m, driving a 21% YoY decline in transaction revenue to $288.6m. Monthly transacting users (MTU) fell by 21% to 6.7 million, marking the seventh consecutive quarter this number has fallen.

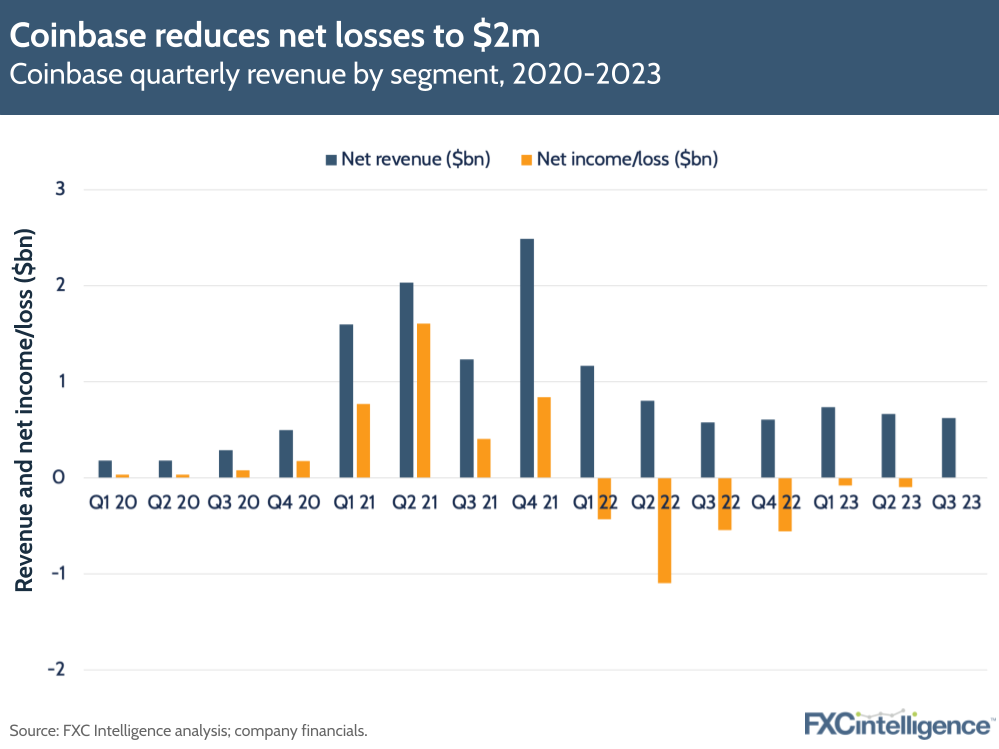

Despite this, the company’s continued cost-cutting and ROI has helped pull net losses back to $2m (this time last year net losses were $545m), and Coinbase now believes it is on track to deliver ‘meaningful positive adjusted EBITDA’ for 2023. Coinbase’s share price fell in the wake of its earnings, but has since risen and is up by around 150% compared to the start of the year.

Coinbase’s new layer 2 solution could power global payments

While there was no specific update on remittances/international money transfers from Coinbase, Co-Founder and CEO Brian Armstrong did mention the potential of Base – its newly launched Layer 2 solution built on the Ethereum blockchain – for payments, including remittances and B2B. According to Coinbase, Base has already had one million transacting wallets over the last month, with $500m worth of assets on the platform already.

In particular, Armstrong suggested that Base could help facilitate the creation of global payment networks with faster and cheaper payments, compared to existing Layer 1 blockchain solutions. He used the analogy of free WhatsApp messages replacing text messages costing $0.25, which saw a magnitude more messages being sent, and implied that the jump could be similar when it comes to blockchain payments.

It’s not the first allusion to the potential of payments recently – earlier this year, the company said that crypto international money transfers are significantly faster and over 96% cheaper than regular fiat transfers, while last year it successfully launched international transfers in Mexico.

Coinbase revenue drives for Q3 2023

Across the actual cryptocurrencies being traded on the platform, Coinbase continues to see a smaller share of volume from Ethereum in Q3 23 at 19%, while Bitcoin accounted for 38% of volumes. The company also opted to break out the share of USDT for the first time (15%), and noted that the industry had seen elevated use of USDT volume due to depegging events.

Coinbase noted that the overall crypto market cap had declined by 9% QoQ in Q3 23, while crypto asset volatility (which drives revenue) was also at the lowest level the company had measured since 2016, which ended up contributing to lower trading volumes. While the number of MTUs was down on last year, the value of assets on the platform did increase by 17% to $118bn.

Coinbase has therefore continued its shift from transaction revenue to subscription and services revenue, which rose 59% YoY. It now accounts for around 54% of overall revenues and Coinbase expects this trend to continue, with transaction expenses having a share in the mid-teens in its Q4 results.

Cutting losses to help drive profit

The crypto exchange has also continued to cut investment in certain business areas, with technology, development and general admin expenses dropping by around 36% in Q3 to $575m.

Driven by a decline in operating costs, an $82m debt repurchase and a $50m return on investments, Coinbase has weaned down its net losses to $2m. The graphic here shows the level of change that the company has gone through over the last years when it comes to income and losses, particularly compared to some of the other money transfer players we track.

Coinbase has taken some steps in the right direction for this quarter, with losses significantly down on last year, but it continues to face macroeconomic challenges. It is also currently locked in a legal battle with the SEC, and is anticipating arguments for a motion to dismiss in January.