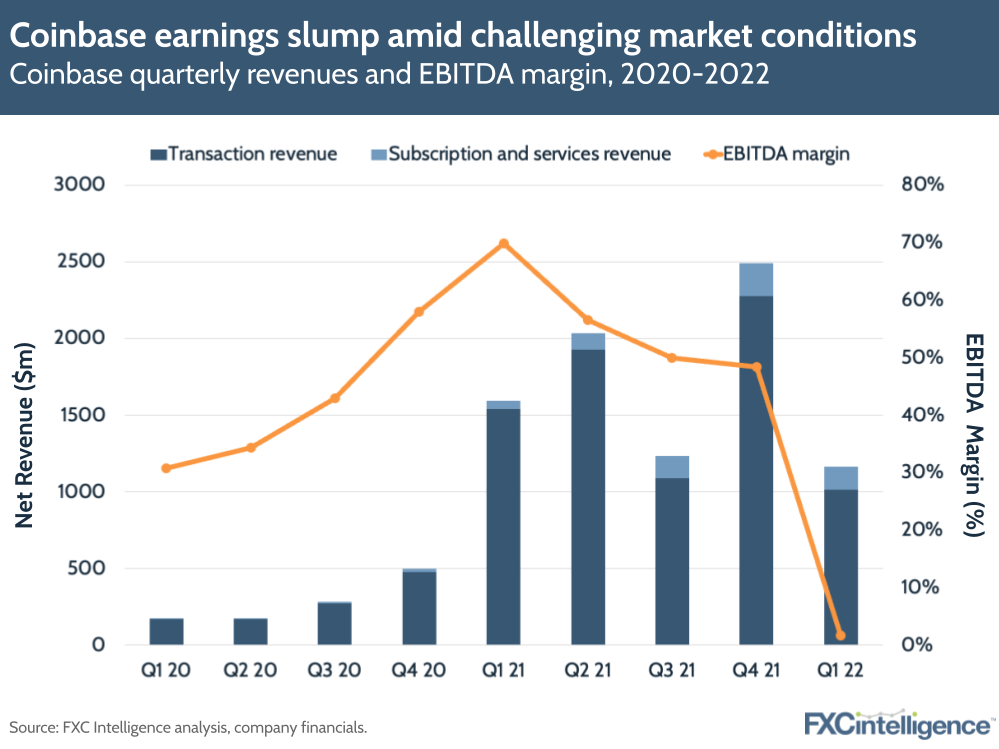

It has not been a good quarter for several companies, least of all Coinbase. The cryptocurrency exchange was hit by the decline of digital currencies and the wider stock market downturn in Q1 2022, seeing its revenues drop 27% YoY while adjusted EBITDA declined 98% compared to Q1 2021.

The leading cryptocurrency exchange saw its share price decrease by 27% after its earnings call for Q1, which saw its worst performance in terms of profitability since it went public in April 2021. However, Coinbase executives said that continued product investment and the success of the company’s diversification venture will aid its long-term objectives in 2022.

Coinbase Q1 2022 earnings

Key takeaways for Coinbase in Q1 2022:

- Revenues dropped by 27% YoY to $1.2bn amid declining market conditions and the drop of crypto assets. This includes bitcoin, which makes up 24% of Coinbase’s total trading volume and has nearly halved in value since its peak in November 2021.

- Adjusted EBITDA margin saw a seismic YoY drop to 1.69%, compared to 69.94% in Q1 2021. Coinbase put its EBITDA decline down to lower transaction revenues and heavy investment in new products and employees.

- Coinbase is expanding its payment rails, having enabled payouts to Visa Debits cards via Checkout.com in dozens of countries, and added Citi to its global banking partners. It also launched Coinbase Pay (which allows any crypto wallet to connect to fiat rails) for its Coinbase Wallet Chrome extension and recently launched NFT marketplace.

- There was no update on Coinbase’s recently launched remittance programme to Mexico, but there was talk about the role of crypto in the global economy. Brian Armstrong sees crypto economy eventually representing a large portion of global GDP (“15% or so”), similar to the rise of ecommerce since the 90s.

- Coinbase believes its diversification strategy is working as the majority of customers (54%) use the platform for services other than just trading, such as payments, payroll or its NFT marketplace. The company saw a higher share of subscription and services revenue (13% vs 3.5% in Q1 21).

- The company has not changed its FY2022 projections much, but does project lower transaction volume as well as a decline in subscription and services revenue and monthly transacting users (MTUs) in Q2 22.