Central bank digital currencies (CBDCs) are gaining growing attention for their potential in cross-border payments and beyond, but how much are central banks seriously considering them? The Bank for International Settlements (BIS) recently surveyed 50 central banks worldwide on the subject, and the subsequent report provides some key insights into the current state of affairs. We spoke to the BIS to get a sense of the current situation.

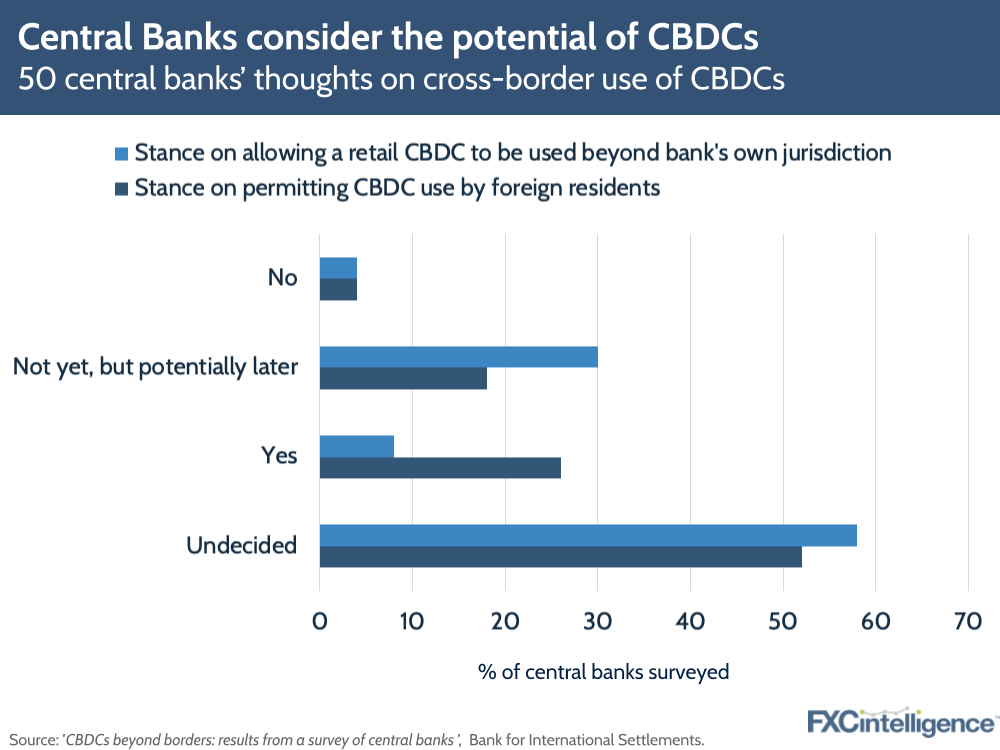

While many central banks are now engaged in CBDC pilot projects, CBDCs are still some way off meaningful use, and their arrival is likely to be in the form of incremental projects, beginning domestically before over time gaining cross-border capabilities. However, many of the central banks surveyed are being open-minded about CBDCs – more so than those at the BIS might expect.

Here are some interesting takeaways for those in cross-border payments:

- Exactly how cross-border transactions using CBDCs would work is still undecided. Because CBDCs will need to be pegged directly to the currency they represent, a transaction may need to be converted into fiat as part of a cross-border transaction, or an entirely different solution to enable transactions between CBDCs may be developed.

- When it comes to using CBDCs beyond the territory they are designed for, there may be restrictions for some. The usual fears around currency substitution that currently impact the international use of USD may also apply to CBDCs, although in nations that currently support multiple currencies, eg Switzerland, multiple CBDCs may be used.

- On the wholesale side, CBDCs may result in a cross-border system that looks very different to the current real-time gross settlement (RTGS) linked systems, which could see the underlying settlement layer of cross-border payment systems change significantly and so change the role for big banks that currently deal with clearing and settlement.

- Many central banks are exploring CBDCs to protect the sovereignty of their currencies against a globally dominant digital currency either from a single central bank or a third party organisation (such as Facebook’s Diem). One way to maintain this sovereignty while retaining the seamlessness of proposed CBDCs is through multi-CBDCs (mCBDCs), which are interoperable but distinct CDBCs that serve as individual digital currencies on a regional, national or even local level. These would see all such currencies work through one system, but would require significant international collaboration to develop.

- If CBDCs take off, they will present an enormous challenge for data handling, not only generating vast amounts of data in their use, but also data that is subject to myriad rules and regulations in different jurisdictions worldwide, which will be made more complex by the digital platforms and systems they are integrated into.

- Ultimately, the adoption of CBDCs will require a very strong, viable use case that adds notable improvements to the current systems, not just a minor advancement on what is already in place.

Sign up to our newsletter to stay up to date on cross-border payments