After revealing FXC Intelligence’s 2022 Cross-Border Payments 100, we break down key data about the companies included to give insights into how the industry is shaping up.

Last week, we unveiled our 2022 Cross-Border Payments 100, which recognised the most important companies making moves in the cross-border payments space this year (view our full report here).

In this piece, we’re taking a closer look at the companies in our top 100 – breaking down where they are from, how long they’ve been around, who’s leading them and how big they are – to highlight key trends and give a detailed snapshot of the industry in 2022.

As we explained previously, companies on our Top 100 list have to fulfill several criteria. They need to be of a certain scale, have an established customer base and feature cross-border payments as a primary activity or substantial revenue. Most importantly, if they were removed from the sector, it would have a meaningful impact. That means that the trends gleaned from this data subset provide insights into the industry as a whole.

First, here’s another look at our market map for 2022, which splits cross-border payments companies into seven categories: VC-backed (growth stage), independently owned, banks, private equity-backed, mobile, crypto, and public companies (non-banks).

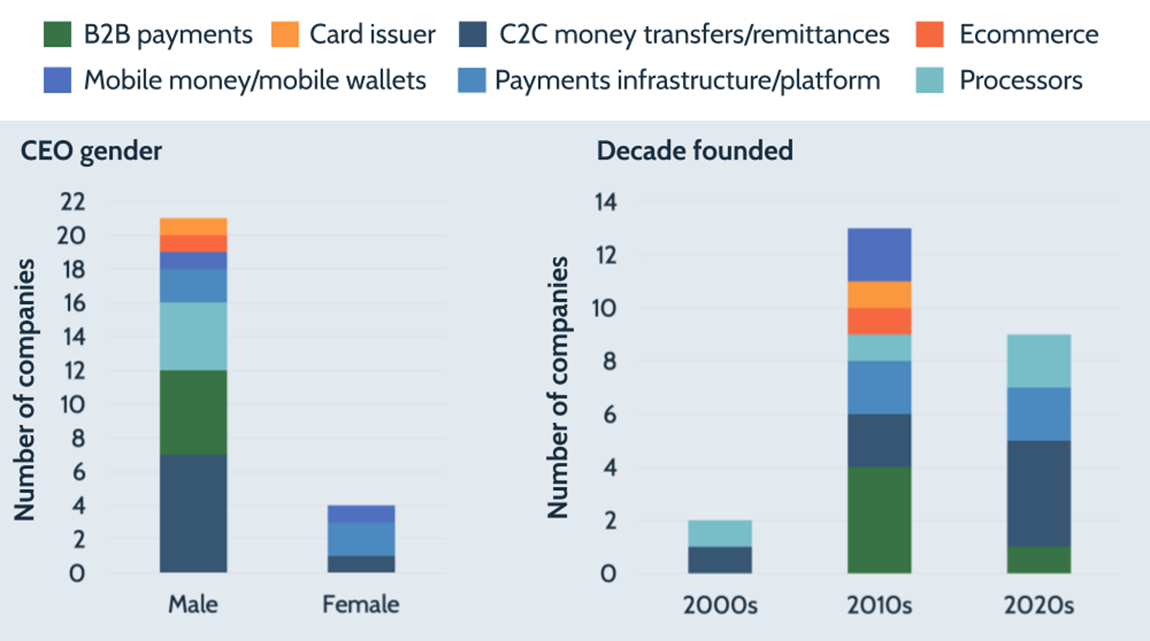

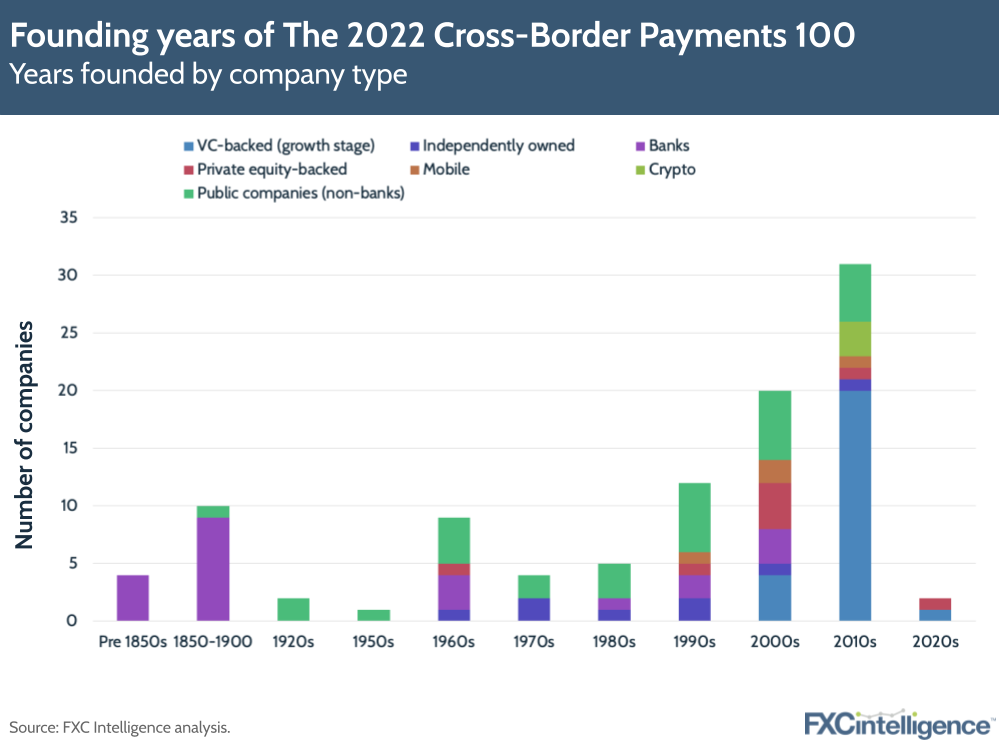

2010 is a major decade for industry scale-ups

In this graph, we’ve broken down the decades in which our 2022 Cross-Border Payments 100 were founded. We can see how the majority of the top 100 (i.e. the cross-border payments companies making the biggest impact in the world today) were founded in the last three decades, with the 2010s standing out as the biggest year for foundings.

VC-backed companies appear in the 2000s and see a spike in the 2010s, which points to a growth in support from investors and the speed at which payments companies have been growing in the last decade. It will be interesting to see how this graph develops across the decade to come – similar to the jump VC-backed companies took from 2000s to the 2010s, will we see a leap in the number of crypto companies founded this decade?

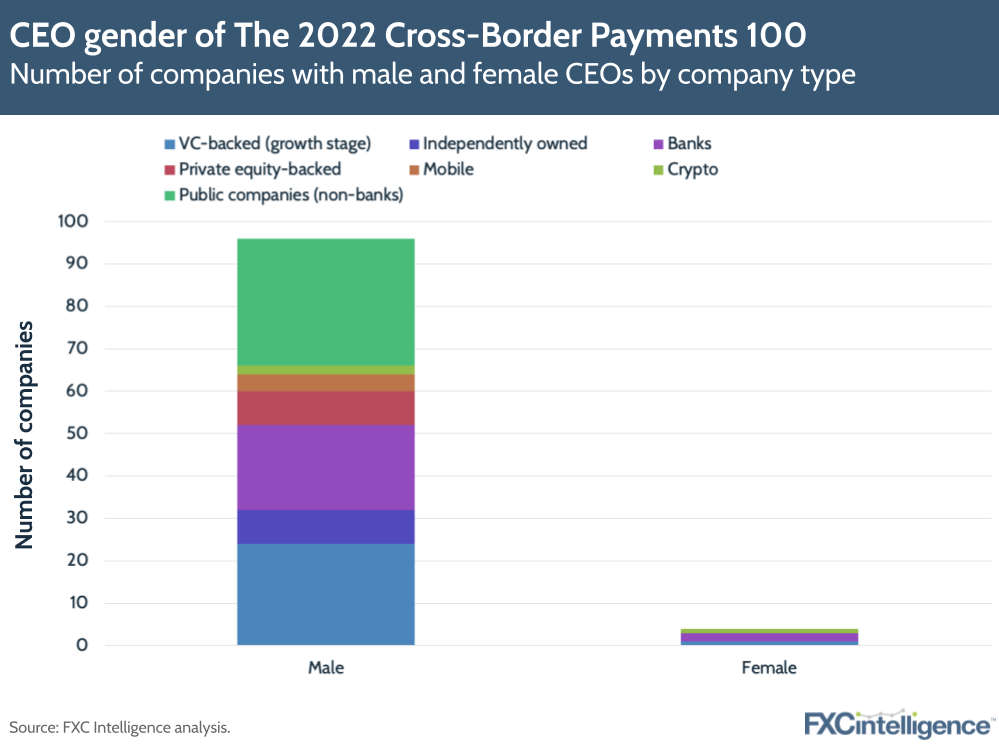

Male CEOs dominate 2022 Cross-Border Payments 100

It’s clear to see which gender is dominating our list from this graph, with 96 of the top 100 companies currently having male CEOs while four have female CEOs. Within those four female CEO-led companies, two are banks, one is crypto-focused and one is VC-backed. There is no female CEO representation across the private-equity backed, public (non-bank) company and mobile categories.

Thinking back to the last graph, we can see that across the slew of new cross-border payments companies since the millennium, men still hold the highest number of CEO positions by a significant margin. While the numbers don’t reflect the entire payments industry or diversity strategies across any of the companies in our list, this does give an indication of the gender makeup of some of the space’s largest players (and some food for thought).

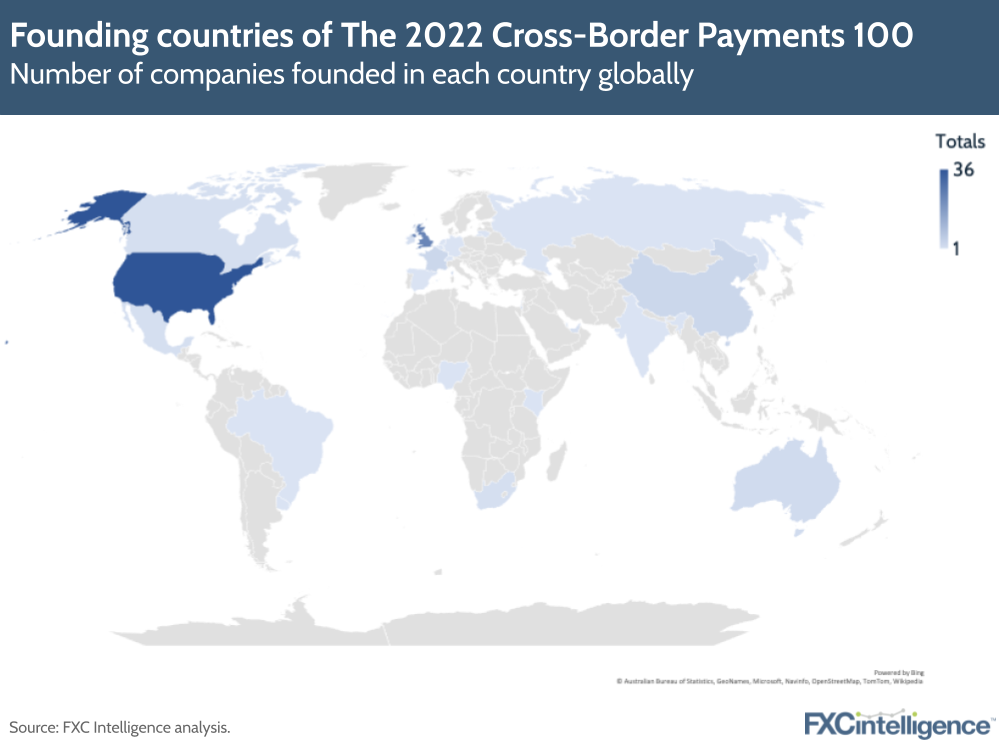

North America, Europe still leading hubs for cross-border payments

The overwhelming majority of our top 100 companies were founded in the US, with 36 being founded in the country across all segments – a figure that is perhaps not surprising given the volume of remittances to and from the US and the fact it is home to the biggest remittance corridor in terms of flow (Mexico/US). The highest number of banks (8) and public non-bank companies (19) in the list were also founded in the US.

From our top 100 list, 24 companies were founded in the UK, giving it the second-highest number across all categories. The UK also saw the highest number of VC-backed (growth-stage) enterprises and private-equity backed enterprises in our list, propping up its status as an ongoing powerhouse for fintech growth.

North America and Europe appear to house the bulk of cross-border payments companies on our list, although Asia and Australia are also represented. We’re also seeing cross-border payments companies being founded in several African countries, namely Kenya, Nigeria and South Africa.

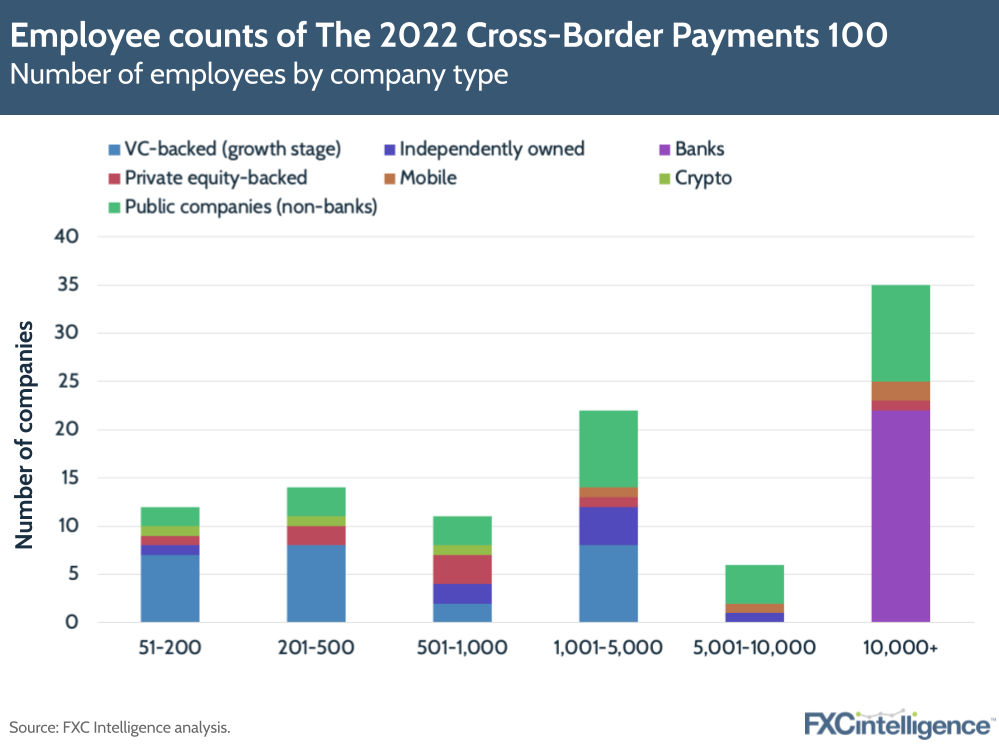

Banks dominate employee counts; Employee numbers spread across remaining categories

As part of criteria for our Top 100, each company needed to be of a certain scale and already have a customer base, which explains why the majority have 50+ employees. That said, it’s interesting to see how each of the categories stacks up in terms of scale.

Banks heavily tip the balance at the upper end of this graph, with all of them having more than 10,000 employees. We also see that public non-bank companies are spread across every band, but the majority in our list are at the larger end of the scale, with the highest number in the 10,000+ category.

There are a similar number of VC-backed companies across the 51-200, 201-500 and 1,001-5,000 categories. Meanwhile, our three crypto picks – Circle, Ripple and Stellar – are represented across three bands from low to mid-tier (501-1,000), while private-equity backed companies are split across five bands.

Companies with a mobile payments focus are represented in the higher bands (1,001-5,000, 5,001-10,000 and 10,000+). This partially indicates the scale at which these companies are able to deliver mobile remittances services worldwide – a particular boon for developing countries, where mobile remittances are proving extremely convenient for non-banked customers.

We look forward to seeing how trends and incoming players will shape our market map for 2023. For more insights into the cross-border payments industry, you can view more of our exclusive research and analysis.