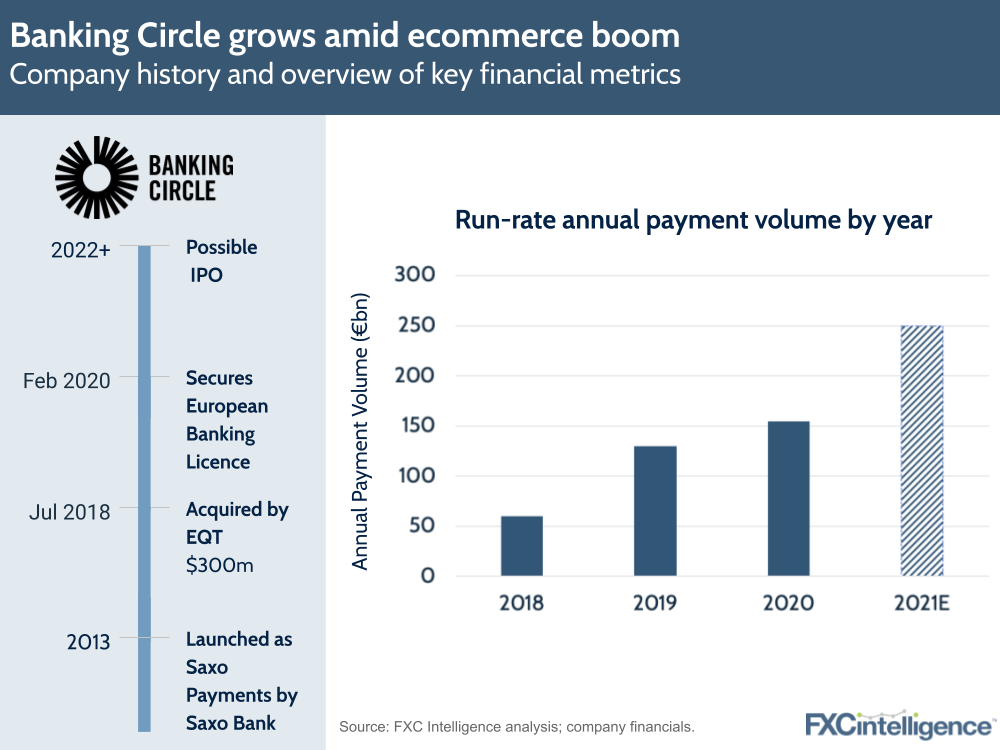

Earlier this year, private equity-backed Banking Circle celebrated 12 months of having its European banking licence, announcing that it is now processing 6% of European B2C ecommerce payments (c.$150bn of flow). I caught up with CEO Anders La Cour to find out what’s next.

With the pandemic moving the world online, almost everyone in ecommerce has seen a strong year, but Banking Circle has had particular success, and Anders sees it continuing. Some key takeaways from our conversation:

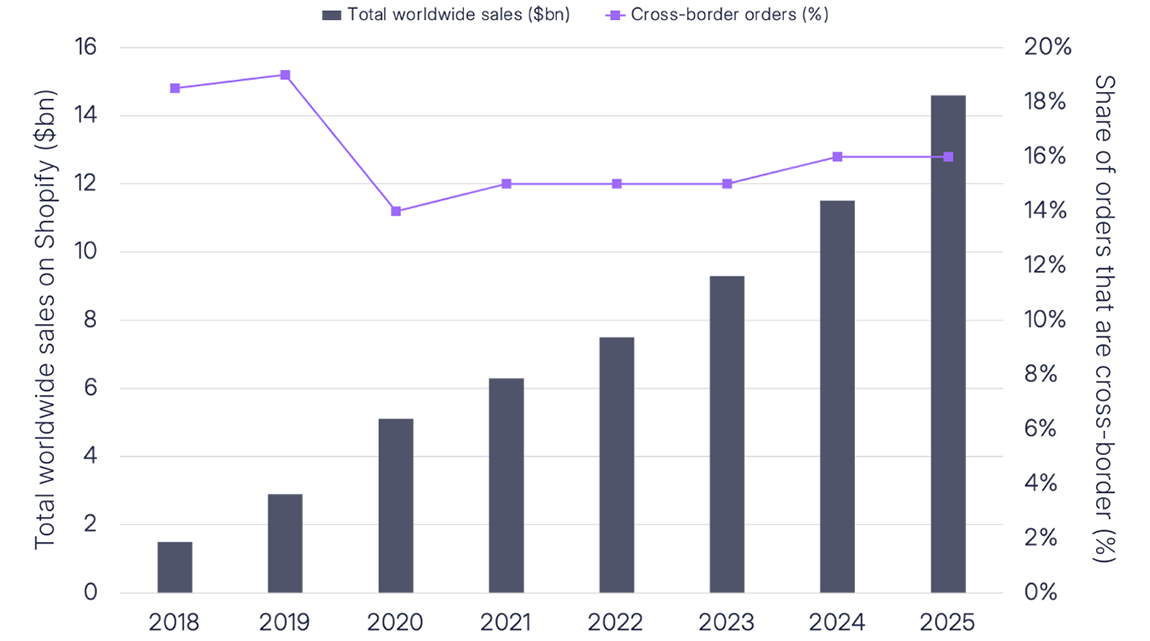

- During the pandemic, Banking Circle saw its previously 50/50 split between point of sale and ecommerce shift to almost completely ecommerce, with flow doubling over the year. Anders says there is “always some kind of FX component” to the transactions it processes, with the vast majority taking the form of settlements from Visa, Mastercard or Amex in the Eurozone, UK, Denmark, Norway, Sweden and Switzerland.

- While the pandemic is beginning to lessen, Anders believes the ecommerce boom will continue, saying that it has just accelerated inevitable shifts by around five to seven years. He cites buy now pay later services as one example of an ecommerce trend that is here to stay, and expects the company to significantly increase its 6% European ecommerce share in 2021.

- Anders sees Banking Circle as a “hybrid between a bank and a banking as a service provider”, augmented by its sister company YouLend, which provides loans and working capital. Anders counts Citi and JP Morgan among its competitors.

- The company plans to expand its range of services in the future. Some potential options include providing issuing to corporate managers and the launch of a white label buy now pay later scheme, which Anders describes as “low-hanging fruit”.

- However, don’t expect a Banking Circle IPO soon, even though the market is hot. The company is owned by private equity firm EQT, which acquired it in 2018 and typically holds for five to seven years. However, Anders did say the company was in a “very favourable position” for an IPO, as and when EQT make the call.