Understandably, a lot of company specific news, especially about trading and annual reporting, has fallen under the radar over the last few weeks. We’ve uncovered a few interesting items for two of the publicly quoted companies, Alpha FX and OFX.

Let’s start with Alpha, which released their full 2019 results late last week.

Alpha continues to be one of the leaders in the corporate FX space and its share price has held up much better than similar publicly listed competitors such as Argentex.

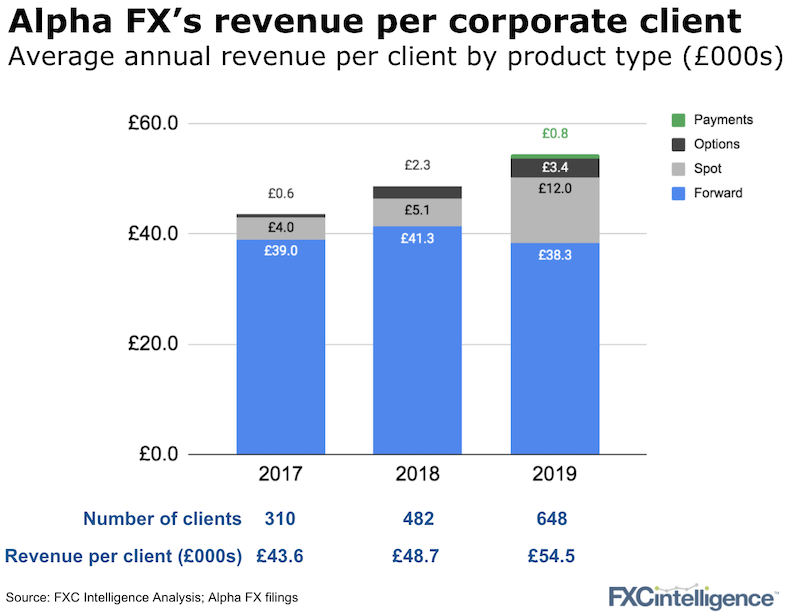

The most interesting trend is that whilst forwards drive Alpha’s revenue, it’s the expansion of the spot revenue per client that is most pronounced. The question is whether continued growth in the spot FX segment, which is much harder to differentiate, is sustainable.

Alpha FX affected by the market slowdown

Only two weeks after the company released its full 2019 results, it was hit by the slowdown in trade due to Covid-19. Notably, it announced that one of its major clients was unable to meet its margin call of over £30m in its forward contracts business. This saw Alpha’s its share price fall by 39% on March 30th. The company published a trading update that day announcing it would cancel dividends for now.

While the company forecasts revenue for 2020 to be close to those of 2019, its stock price continues to plunge and the real effect of Covid-19 is yet to be seen.

What’s happening at OFX?

Two interesting lowkey filings by OFX over the past week. The first was as part of a trading update. It was an acknowledgement that OFX had been the recipient of an unsolicited takeover bid but those talks had been shelved due to the recent market volatility.

The second was a purchase of shares by co-Founder Matthew Gilmour at what was a historic low share price to take his holding in the company above 5%. OFX has felt the brunt of the market downturn like many other companies in the space. So, it’s encouraging to see those who likely know the company very well picking up shares believing that company is undervalued at its current price.

[fxci_space class=”tailor-63344d8a5175f”][/fxci_space]