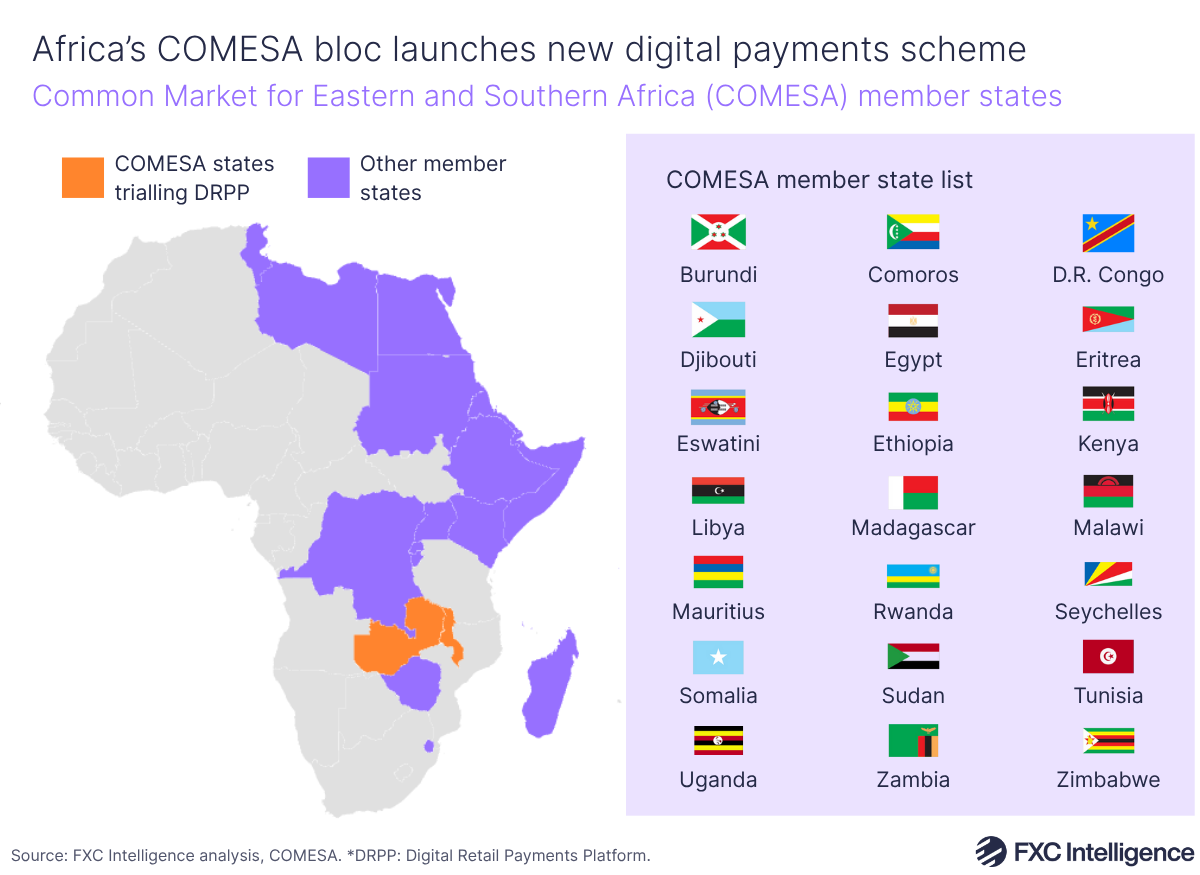

Last week, the Common Market for Eastern and Southern Africa (COMESA) – an economic organisation spanning 21 African states – launched a new digital payment system allowing businesses to settle transactions in local currencies. It’s one of several moves indicating demand from Africa to move away from the dollar, as cross-border transaction costs remain high.

For many years, much of Africa has been particularly dependent on the US dollar for cross-border trades as a hedge against political instability and currency volatility – including for trades between African countries. Most African exports and imports occur through offshore intermediaries operating in dollar-based systems such as Swift, meaning that African banks often have to convert local currencies to USD, send funds through a correspondent bank in the US and finally convert to the recipient currency, adding costs and delays. The situation is similar in many countries worldwide, prompting the development of intergovernmental orgs (such as BRICS) that aim to try and spur movement away from the dollar.

Now, COMESA Clearing House (the bloc’s payments-focused division) has launched its Digital Retail Payments Platform (DRPP). Initially beginning with user trials in Malawi and Zambia supported by digital financial service providers and an unnamed foreign exchange provider, the platform is set to see a staged rollout across other countries within the bloc, although the precise timeline is not yet clear.

The DRPP is intended to remove the need for businesses to use intermediary foreign currencies for cross-border payments between African nations. In a post on X commenting on the announcement, Kenya’s Trade Minister Lee Kinyanjui described the system as a “game-changer for regional trade” that “keeps costs under 3%” of the transaction value.

COMESA’s initiative joins a wave of other projects across Africa designed to enhance cross-border payments. The Pan-African Payment and Settlement System (PAPSS), launched by Afreximbank and the African Union, continues to make traction with more than 100 commercial banks connected as of this year. Various countries on the continent, including Egypt, Nigeria, South Africa and Ethiopia, have made bilateral currency agreements with other countries to enable trade directly in other currencies.

Elsewhere, some African orgs also collaborated with non-Western payments systems, such as Afreximbank joining China’s Cross-Border Interbank Payment System to enable faster and less costly trade between African and Chinese businesses.

Initiatives such as COMESA’s DRPP show the demand for dedollarisation, but combatting the dollar’s influence is challenging. According to Afreximbank’s African Trade Report for 2025, intra-African trade accounts for 14% of the region’s formal trade, showcasing the region’s dependence on external countries. African currencies aren’t as frequently traded as other currencies and have lower liquidity across African nations, making them harder to buy or sell abroad.

For payments providers, significant opportunities remain to support cross-border payments and local settlements into African countries. Moves to dedollarise are very much initial steps in that direction, but they highlight the ongoing demand for solutions in the region that make cross-border payments faster, less costly and more transparent.