Accounts payable management – yawn. $200m raised recently by two of the leading companies – hello! Paying suppliers, especially in the US, is a major pain point for many corporates. Add in a cross-border element and it gets worse.

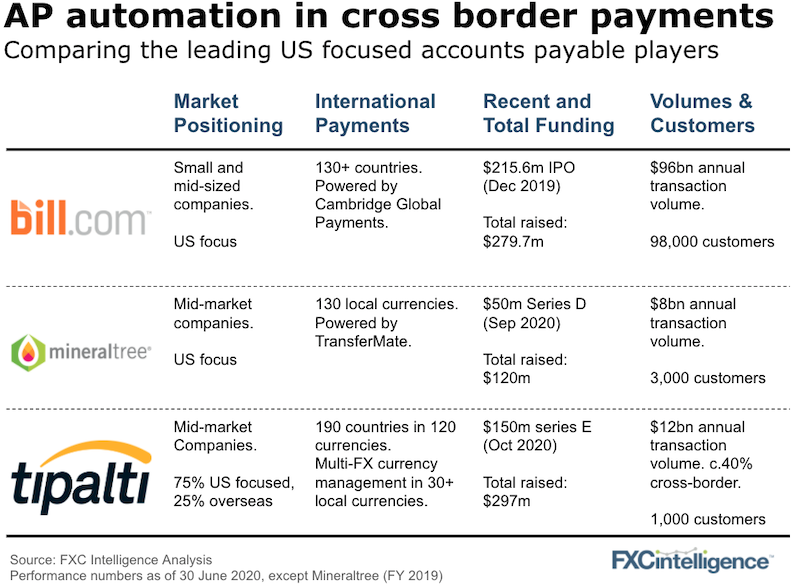

We talked with Chen Amit, Co-Founder & CEO of Tipalti (raised $150m), and Vijay Ramnathan, President of MineralTree (raised $50m), two of the leading companies looking to solve these problems. AvidXchange, the biggest player in the space doesn’t focus on cross-border.

Our takeaways:

- For many companies, the costs and time involved in managing payables is significant. This is the pain point to focus on to acquire new customers. The cross-border payments then becomes a value add (and higher-margin additional service).

- None of these high growth software companies have built their own cross-border platforms, nor have they needed to. Cambridge powers Bill.com, MineralTree is with TransferMate and Tipalti works with a small number of leading banks.

- There’s a lot at stake in the payables software market, and the stake rises as the corporates you service get larger and more internationally focused (which usually means overseas subsidiaries). Tipalti offers multiple ERP integrations, reconciliations, financial controls, cash management, cross-border tax, AML and payments compliance. Compare that to the small business offering of a Revolut or a TransferWise – it’s not even close.

Overall, this speaks to a segment of the market that is ripe for partnerships for banks and payment companies. The barriers that have to be overcome to solve all the customer pain points above are likely too high and prevent them from developing cross-border capabilities internally. This is a hot segment of the market. Expect more to come.