Advances in payment technologies have raised expectations of money transfer speeds, but how long do transfers typically take between different parts of the world?

As technology increases the rate at which economies move, customers expect greater speeds in their transfers. This is not just for digital methods but for cash as well – technology has enabled cash transfers to speed up, meaning money transfers using cash typically take just minutes in some corridors. In countries where transfers were traditionally slow due to infrastructure limitations, we have also seen mobile wallets unlock new speeds.

Transfer speeds often vary by the payment channel but also by the type of provider, with banks often offering slower speeds than payment companies. In general we find that most payment companies offer transfers within 24 hours or less for the corridors they support. There is also regional variation though due to limitations in payment channels and infrastructure in different regions.

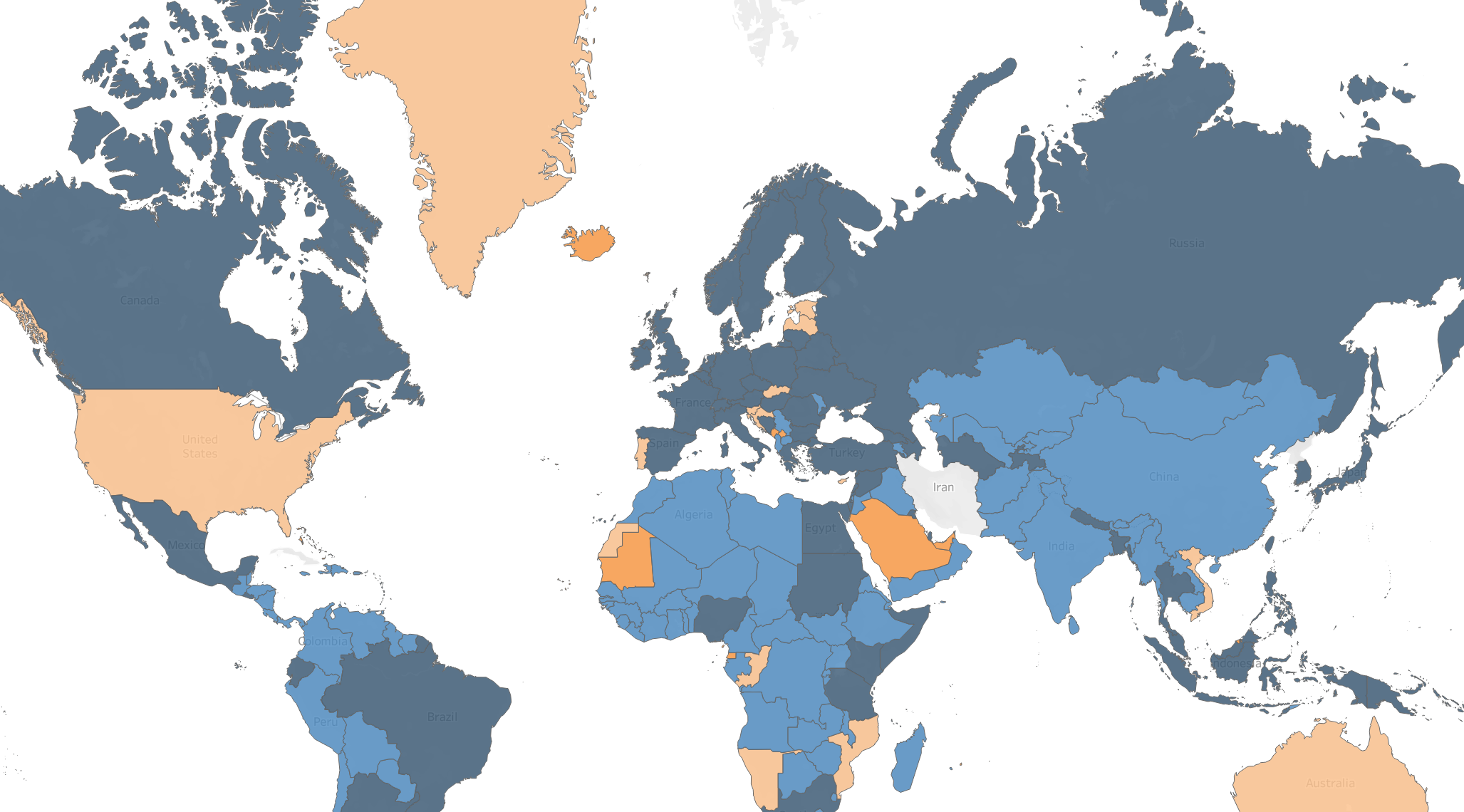

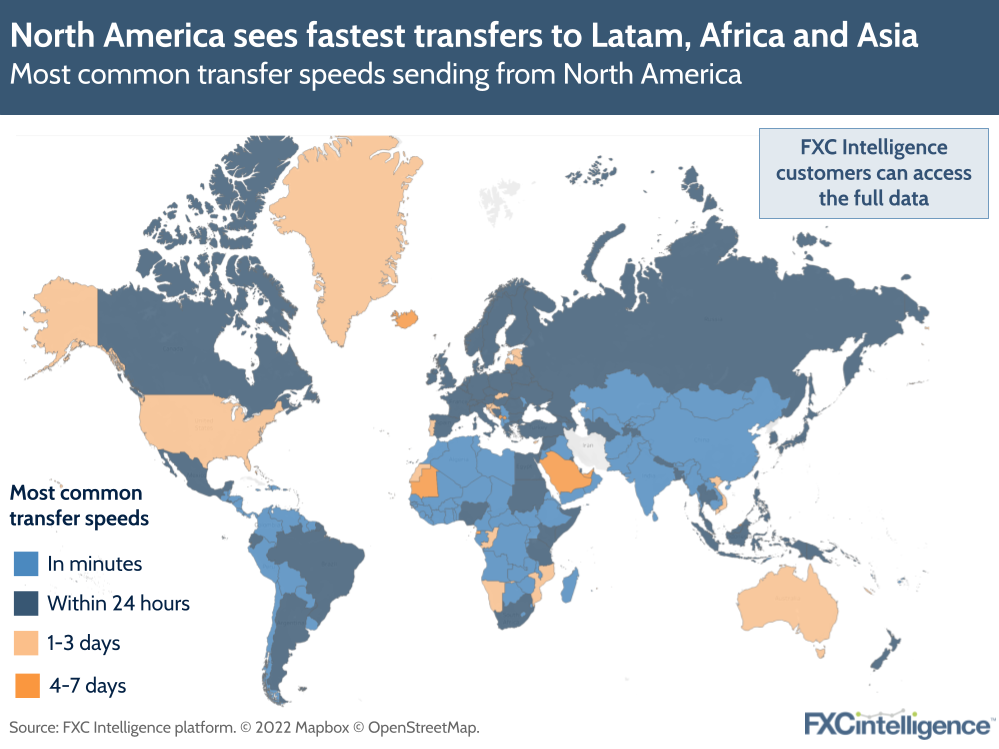

Money transfer speeds sending from North America

Perhaps surprisingly, in North America transfers to the US can be slower than expected due to many providers offering bank account-based transfer methods. While these transfers can often be quite quick, the providers give a large variance on the rate of delivery, for example advertising speeds of between 0-3 business days. By contrast, making money transfers via debit card is typically instant.

As a result, money transfers to the US from North America most commonly have advertised speeds that are notably slower than much more geographically distant parts of the world, including India, China and many parts of Africa.

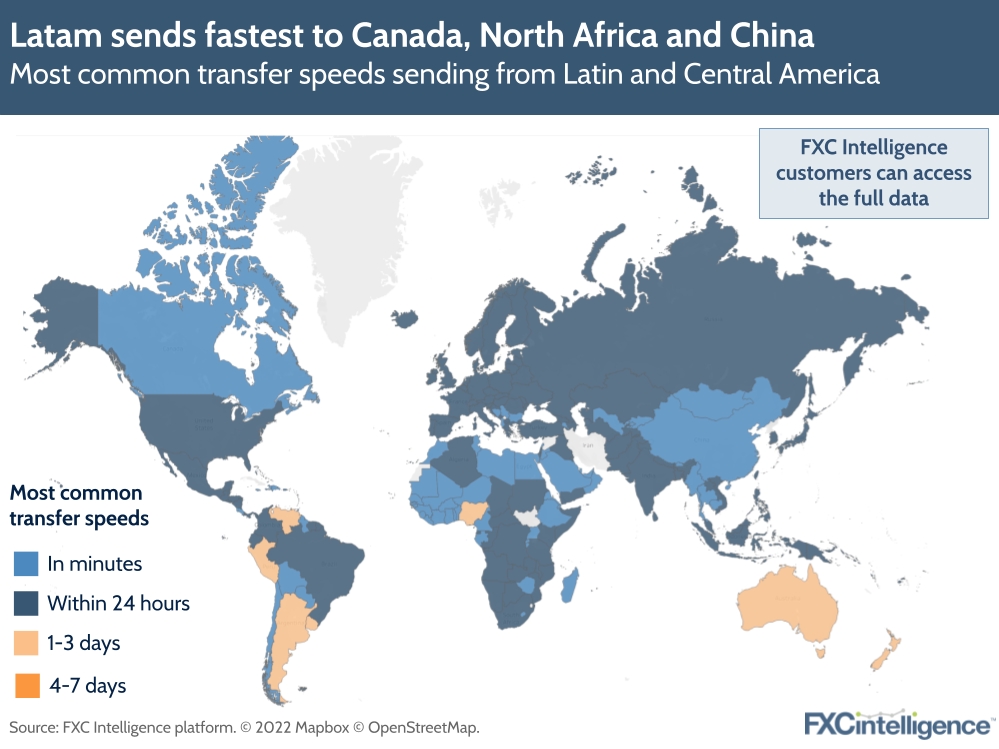

Money transfer speeds for Latin and Central America

For Latin and Central America, much of the world has common transfer speeds of less than a day. However for some countries, including Australia and New Zealand, the most common advertised speeds are higher, potentially reflecting less popular corridors for money transfers. Notably, the region has particularly fast speeds to Canada, parts of North Africa and China, where instant transfers are common.

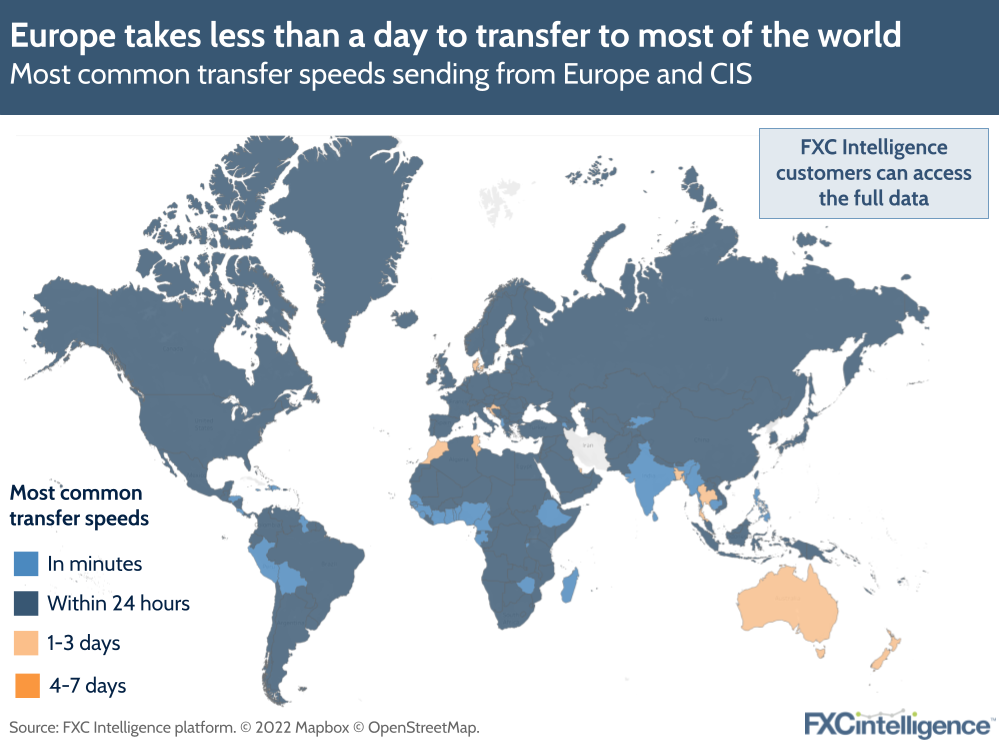

Money transfer speeds sending from Europe

For Europe, which covers Europe and the Commonwealth of Independent States (CIS), we find that transfer speeds are consistently under 24 hours for much of the world. Notably some popular receiving markets have near-instant speeds – these regions correlate with the origin countries of some of Europe’s largest migrant populations, making them popular destinations for remittances.

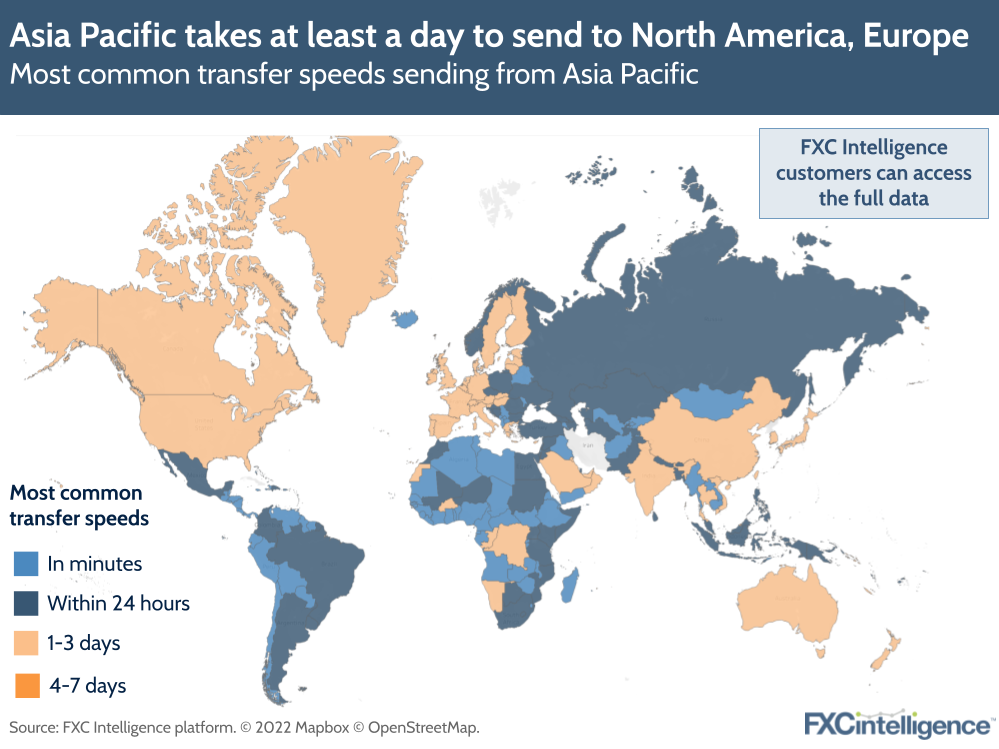

Money transfer speeds sending from Asia Pacific

Asia Pacific has quite a mixed range of speeds globally, with transfers to North America, Europe and some parts of Asia Pacific commonly seeing transfers of over a day. However, transfers to the CIS, Latin and Central America and the Middle East, Africa and South Asia are typically far faster.

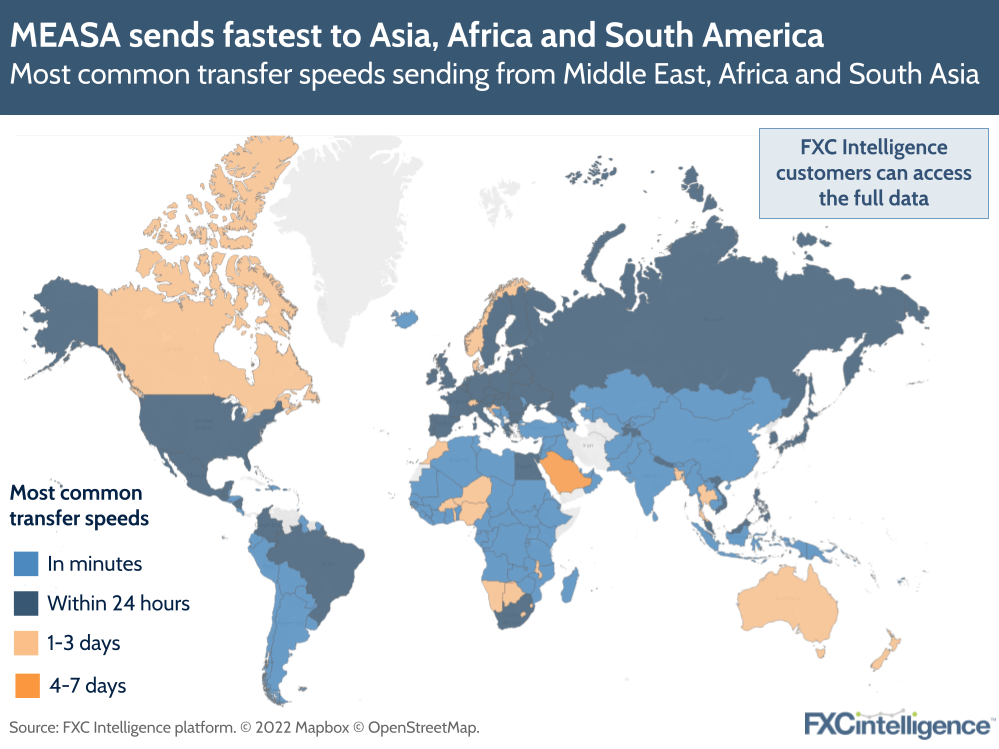

Money transfer speeds for Middle East, Africa and South Asia

The Middle East, Africa and South Asia generally has fast transfers within its region and in surrounding countries, with places such as China able to receive fast transactions through Alipay mobile wallets. However, there are certain countries in which transfers are significantly slower than the rest of the region and which providers give limited corridors for.

Why send speeds vary in different parts of the world

Some of the reasons for these differences in regions can be due to preferences in payment methods, such as bank transfers in Europe or mobile wallets in Africa. In the case of bank transfers, often legacy systems have to be used, leading to longer transfers times. While this is beginning to change, many bank transfers still need to be settled the next working day at best.

In countries such as Africa where a large amount of the population has been unbanked, alternative modern solutions have popped up to facilitate transfers, such as mobile wallets. These provide both accessible payment methods and faster speeds, without requiring traditional bank infrastructure.

Perhaps surprisingly to some, cash often isn’t a slow option for money transfers. One reason for this is that remittance providers often transfers cash payments through their own systems, which they are able to maintain and update to support increased consumer expectations and integrate current technologies. This therefore has meant that cash has become faster and ‘digitised’, allowing pay-outs to be provided instantly by many providers in many corridors.

Get in touch to find out how our transfer speeds data and other datasets can help your business