Following Argentex’s recent trading update, we speak to CEO Harry Adams about how current market conditions are driving revenue growth for the foreign exchange specialist, as well as its tech focus and expansion to new markets.

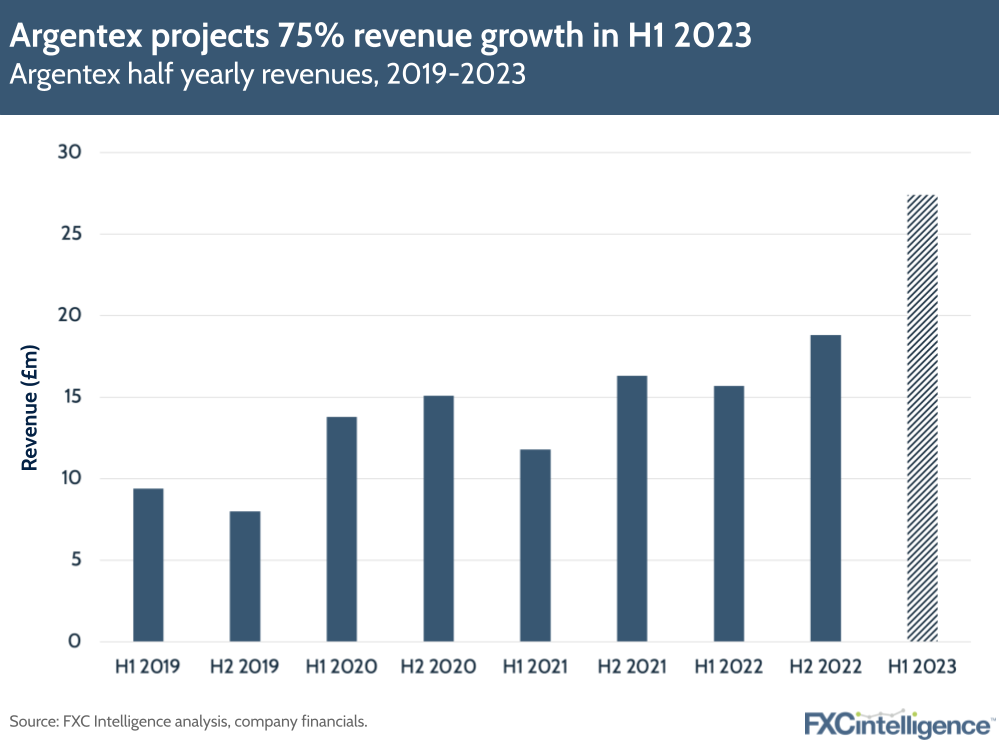

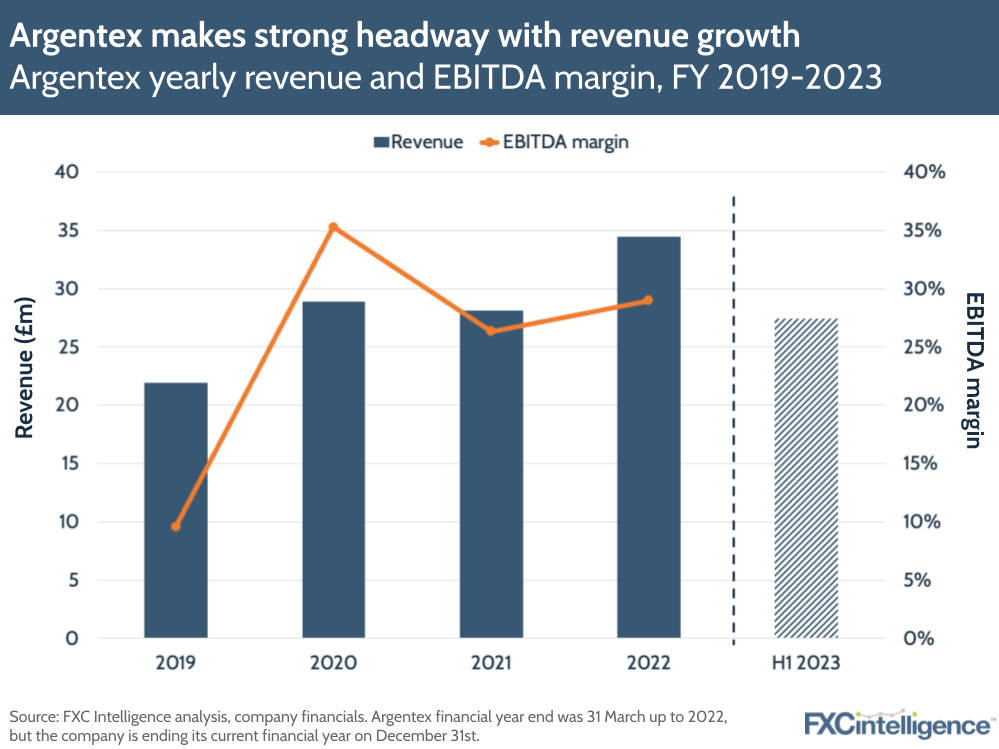

Argentex is expecting its growth run to continue, having projected a 75% YoY revenue increase (to £27.4m) in the six month period ending 30 September 2022 (which we refer to as H1 2023 in the graphic below).

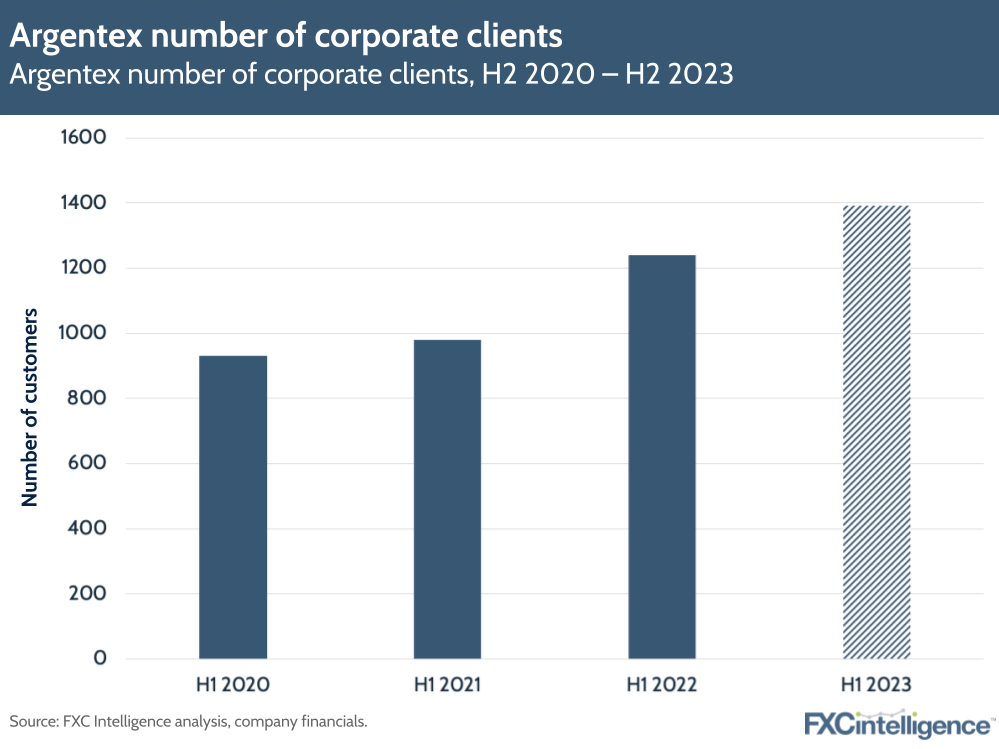

Also in its interim results – set to be released in full on 8 November – the company expects to report strong client demand, with its number of corporate clients growing to 1,393 (a 12% increase).

Argentex says that it is seeing growth as a result of its core UK proposition and disciplined approach to costs, while the historic drop in the pound has presented ‘exceptional’ short-term trading conditions. Now the company aims to build on revenue rise by adding and retaining talent, building its international presence and creating a ‘more technology-enabled platform’.

Ahead of its full Q3 results, I spoke to Argentex to delve deeper into what’s driving the company’s revenue growth and the potential impact of market conditions moving forward.

Argentex key growth drivers in H1 2023

Daniel Webber: You are projecting a 75% year-on-year revenue increase. What’s driving this?

Harry Adams:

The main drivers are that the business is exceeding its expectations on every single business unit. When I took over as sole CEO in June last year, the first thing I did was overhaul the strategy. With that, we focused on people, products and overseas expansion (product comes under technology). We invested in every part of those areas, and we’re very pleased to report that each one has paid back and exceeded expectations.

We had a decent tailwind towards the end of our reporting period. That last week in September was something that I’ve probably only experienced once before, and that was over the Brexit referendum. We were already having a great half before that week, but really that was the cherry on the top.

The impact of favourable market dynamics

Daniel Webber: Have you seen any change in the mix of business types you’ve been servicing? (SME, enterprise, corporates, institutions)? Will that change going forward?

Harry Adams:

I suspect that the split of corporate to institutional will remain as in prior years, which is, broadly speaking, 40% institutional and 60% corporate. This is all going to come out in a few weeks, but I suspect that clients are willing to commit more for a longer period. When we saw that volatility over Brexit or Covid, that does make clients hedge forward; but of course, in those two circumstances, there wasn’t a huge amount of certainty.

A lot of these corporates didn’t even know if their businesses were going to be around six months after Covid so they were willing to dip their toe in the water and take advantage of the drop in sterling, but they didn’t want to commit too far.

On the other hand, in the last two months you’ve had that dip in sterling, but also there is that level of certainty, so clients are far more sure about booking further out. The tenure will no doubt be longer than what we’ve experienced in the past.

Daniel Webber: How does that help you as a business?

Harry Adams:

It helps us for a couple of reasons. The market dynamics really are what we’re talking about. First of all, interest rates have been flat across the sterling, euro and dollar for the last four years or so, meaning the cost of carrying between those two currencies has been pretty much non-existent.

With central banks starting to jostle position and raise rates, you’re starting to see that yield curve open up a bit on sterling-dollar, as an example, and sterling-euro. That allows us to take more on the spread for the forward contracts because there could be a slight improvement in the price, but equally, we do action a lot of swaps as well. From now back to three or four years ago, we weren’t making any revenue off swaps, but now we are starting to make a little bit, so market dynamics are very favourable.

As we continue to go through that period of an inflationary backdrop, even if the Federal Reserve does halt their rate hikes, then Europe and the UK have got to catch up. If the US is nine to 12 months ahead of us, they might start cutting sooner than us. It has taken a long time to get to this point, but certainly it is helpful for businesses like us.

Figure 2

Expanding Argentex’s reach through tech investment

Daniel Webber: You’ve been investing in your technology platform. How’s that paying off? And what does it mean for your clients?

Harry Adams:

We’ve always focused on the more sophisticated clients, such as larger SMEs and institutional/financial services businesses, so not many of them actually require the online platform.

We’ve decided to invest in the online platform and revamp the client journey, and that allows us to go slowly down the food chain. With more technology investment, we’ll be able to onboard these clients seamlessly. That allows us to take on those smaller clients, which makes the revenue part a lot deeper, casting a much wider net over these clients rather than just focusing on the more sophisticated end of the market.

A lot of clients would expect us to have an execution platform, which we’ve always had, but we haven’t driven a huge amount of traffic to that platform, and that’s what we’re starting to do.

Growth opportunities in Australia and Europe

Daniel Webber: You’ve also opened up some interesting markets, including Australia. How do you see Australia and other geographic markets playing out at the moment?

Harry Adams:

We’ve opened two offices in Australia: one in Sydney, one in Melbourne. We’re currently going through the process of obtaining our Australian Financial Services Licence, which we are expecting soon. That will allow us to give our clients greater accessibility, which certainly would complement the online platform that we’ve invested heavily into.

There’s a huge opportunity across Europe. There are a few firms out there that have made some really good headway in Europe but, quite frankly, I don’t think they’ve even scratched the surface. The UK is quite saturated. We’ll start driving more of our resources over to Europe rather than trying to compete in an incredibly saturated market in the UK.

The only concern about Europe – or opportunity, depending on how you look at it – is that it tends to be a bit more derivative-based. Of course, with the volatility that we’ve experienced recently, I know of a few firms that have become unstuck with a couple of their very leveraged products that they’re pushing out. We’ve taken a decision internally not to offer any target redemption forwards or targeted accrual redemption notes.

Market dynamics in the UK vs Europe

Daniel Webber: As you mentioned, the UK is very competitive. The barrier to entry there is lower. What’s different about market dynamics in Europe?

Harry Adams:

In Europe, they tend to trade or execute online a lot more. The platform is incredibly important to them, and it needs to be slick. However, they’ll also use the dealer to speak about other potential hedging strategies they can put in place.

The corporates are a lot more sophisticated in Europe than they are in the UK, so that’s really the difference between the two markets.

Differentiating from competitors in the FX space

Daniel Webber: Finally, FX is a competitive space. How are you working to differentiate yourselves from others in the market?

Harry Adams:

We have evolved in the last 11 years or so from a very high-touch, private bank-style foreign exchange broker to more of a foreign exchange, treasury management and payment specialist. That’s where we’re starting to compete.

We’re not the most technologically advanced businesses out there, and we still believe that there is a place for the right tech and the right touch, rather than high tech, high touch. So we’re giving clients what they want rather than forcing them to do what we want them to do. In other words, we’re not forcing them to do what we want to offer.

Right tech, right touch is our mantra right now.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.