- FXC Intelligence has published its predictions for the B2B cross-border payments industry in 2024, combining its insights with input from industry experts.

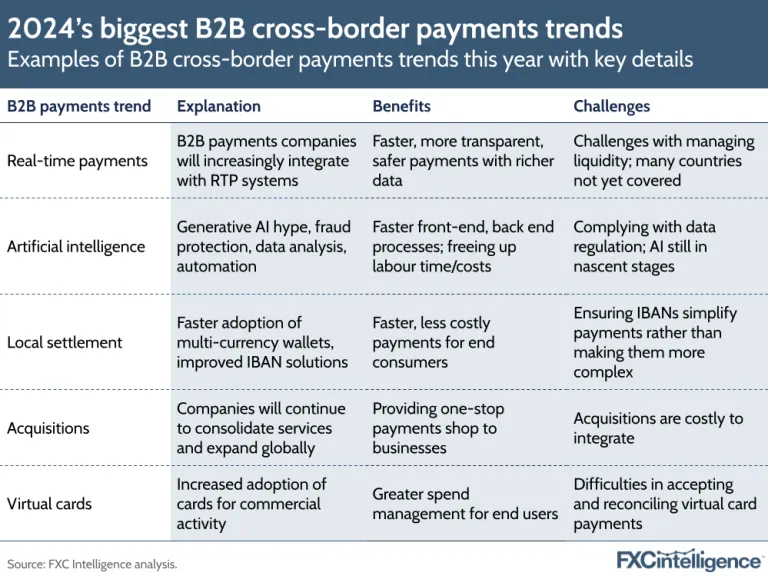

- B2B cross-border payments is set to see continued consolidation this year, as well as trends around real-time payments, AI and local currency settlements.

- Although B2B payments is a less mature industry than consumer money transfers, the segment is quickly growing and is expected to reach a market size of $56.1tn by 2030.

FXC Intelligence has published a report detailing its predictions for the B2B cross-border payments industry in 2024. Companies in the space will continue to provide platforms that enable fast, less costly and more transparent payments flows between businesses. Here we detail three of the most exciting trends we expect to see throughout 2024.

Real-time payments and interoperability ramp up

The industry is increasingly being driven to establish real-time payment networks worldwide to aid improvements in speed, cost and transparency. Although real-time payments are not new, there will be a concerted effort by companies in the B2B payments space to continue to integrate fast local payment rails to speed up the movement of money within countries to reduce delays. This will happen concurrently with global regulation changes that could make B2B payments faster and more secure.

Settling cross-border payments in local currencies

A lot of cross-border payment infrastructure is not yet good enough to support increased global interconnectivity, so we expect to see companies focusing on improving and integrating with local payment rails. This will drive the faster adoption of multi-currency wallets and improved IBAN solutions.

AI to boost fraud prevention and analytics

Like every industry, companies in the cross-border space will be looking to leverage the benefits of AI. We expect companies to focus on using generative AI to analyse large datasets to help inform business decisions, predict cash flows and replace burdensome manual processes involved with payments. Another big use case for AI will be fraud detection, which is especially relevant after a year in which the wider financial industry came under increased scrutiny.

Lucy Ingham, Head of Content and Editor-in-Chief at FXC Intelligence said:

“FXC intelligence has used its own rich data and deep insights, as well as the opinions of other industry experts, to make these predictions for the B2B cross-border payments space.

“Established payment players are reporting increased contributions to their overall revenue from B2B activity and we’re seeing a wave of investments in B2B cross-border startups. It’s clear from our research that the B2B segment of the market is becoming increasingly important to the industry – our own data forecasts that the global payments market will grow to $56.1tn by 2030.”

“The B2B space is ripe for transformation and innovation, which is driving forward progress across these key trends that we are predicting for the year.”

In total, FXC intelligence explored 9 trends that are expected to progress throughout the next year. To read more about these trends, and to see input from a wide range of industry experts, click here.