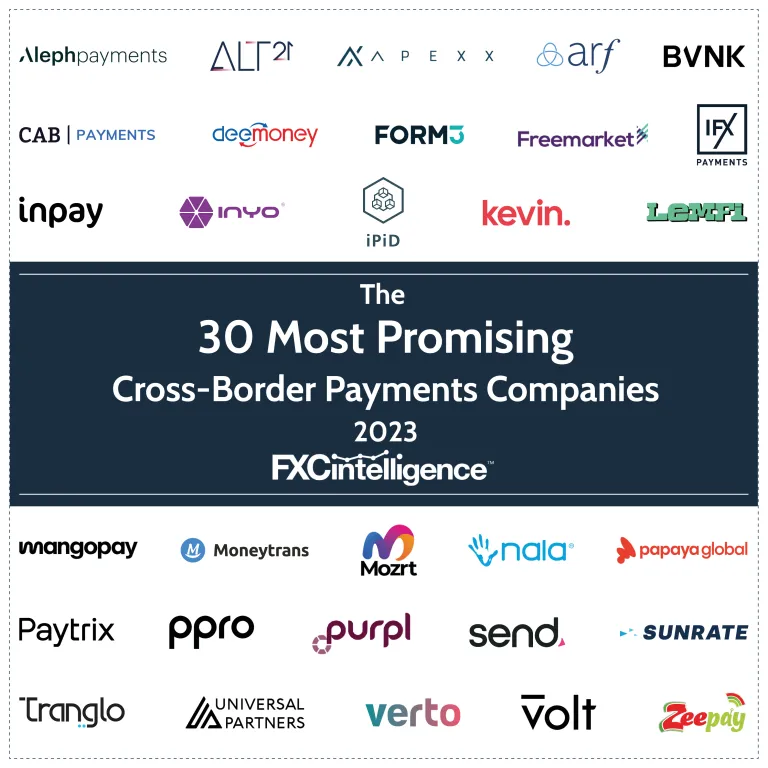

- Today, FXC Intelligence has published The Most Promising Cross-Border Payments Companies 2023.

- This is a brand new, annual market map recognising 30 of the best newer market entrants that are showing great promise for the future.

- To be included on the list, companies must have shown significant growth over the past couple of years.

Today, FXC Intelligence published The Most Promising Cross-Border Payments Companies for 2023.

This is a brand new, annual market map that will recognise 30 companies that are building a name and presence for themselves within the industry, through the pursuit of innovative new technologies, untapped markets or effective growth strategies.

FXC Intelligence has used its industry expertise and data to create a guide to companies that are worth watching this year, spanning remittances, payment processors, B2B and more, which you can read here.

Daniel Webber, CEO and Founder of FXC Intelligence said:

“Every year, FXC Intelligence recognises the top 100 companies in the cross-border payments space; inclusion on the list is sought after and is widely recognised as the definitive benchmark of the biggest players in the industry.

“To make the top 100 list, companies have to fulfil a strict criteria and be of a certain scale, which means we have to exclude a lot of fantastic younger and smaller companies. That’s why FXC Intelligence is launching the brand new annual market map, the Most Promising Cross-Border Payments Companies, so that we can celebrate the 30 companies that are truly on the rise within the industry and deserve recognition.”

The list here is not meant to be a hierarchical top 30. Rather, it’s an unordered list of companies from the cross-border space that have shown significant growth in recent years, whether that’s particularly strong financial results; successful fundraising rounds backed by private equity firms or other major payments players; or significant changes in executive leadership in pursuit of a new growth strategy.

To make the list, companies have to fulfil certain criteria:

- Be primarily or largely focused on cross-border payments. For some companies, this will be part of a wider range of services, but it will always need to be a substantial revenue line for an organisation to be considered for inclusion.

- Be consistently growing. This may be demonstrated by increased product offerings, a rise in clients or additional hires at the business, but companies need to be demonstrating growth to be considered for inclusion.

- Companies don’t have to have raised outside funds, but they should have a reasonably or fully established customer base – we are unlikely to consider a company that has only just started, unless it is a spin-out from another established player.