- FXC Intelligence has published a report mapping Singapore’s payments players using data from the Monetary Authority of Singapore (MAS).

- The MAS currently lists 15 companies with SPI (Standard Payment Institution) licences and 207 with MPI (Major Payment Institution) licences, although only 201 of these appear to be active.

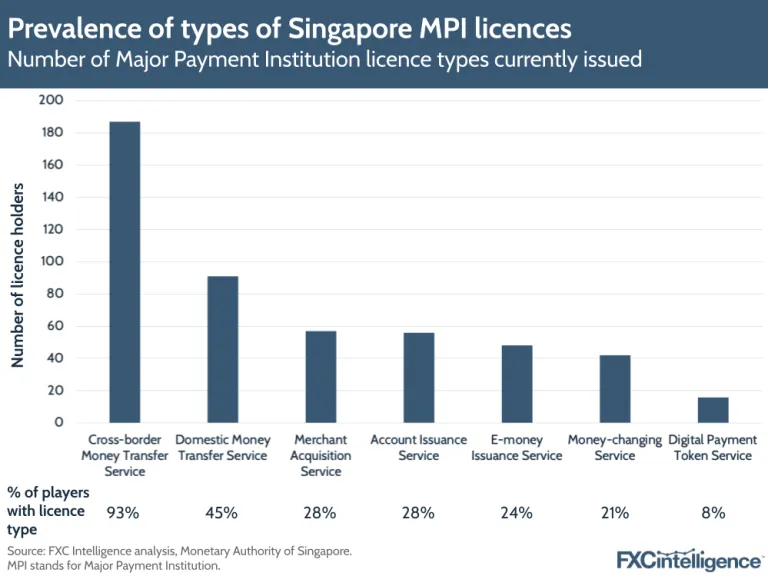

- 93% of MPI licence holders have a cross-border money transfer licence, demonstrating the importance of the city to the cross-border payments industry as a hub of innovation, highly skilled workers and a gateway to the emerging Southeast Asian market.

FXC Intelligence published a deep dive report mapping Singapore’s payments players by analysing the licences obtained by companies from the Monetary Authority of Singapore (MAS).

At the time of writing the report, FXC Intelligence found that the MAS currently lists 15 companies with SPI (Standard Payment Institution) licences and 207 with MPI (Major Payment Institution) licences, although only 201 of these appear to be active.

93% of MPI licence holders have a cross-border money transfer licence, while just 40% of SPI licence holders do. This is largely because SPI licences are more popular with smaller, domestic-only companies.

The report found that 90 of the larger international cross-border players now hold MPI or SPI licences to operate in Singapore. The majority of these companies are MPI holders, with only 3 holding an SPI licence, including remittances major MoneyGram.

Lucy Ingham, Head of Content and Editor-in-Chief at FXC Intelligence said:

“Looking at these findings, it is clear that Singapore has really grown as a major global city for the cross-border payments industry.

“Singapore’s popularity with 90 of the world’s key cross-border payments players underpins its importance as a gateway to serve the rapidly emerging Southeast Asia market, as well as its position as a hub for a highly skilled international workforce with a drive for innovation.

“Over the next few years, we expect to see companies of all shapes and sizes looking to secure a cross-border payments licence in Singapore whilst more and more international players are attracted to the city. ”

Less than half of licence holders in Singapore also hold a domestic money transfer licence, while just under a third hold merchant acquisition service or account issuance licences. Less than a quarter hold e-money issuance service or money-changing service licences. Digital payment token service licences, which are required for cryptocurrency-related activities, are the least common type held by MPI licence holders.

To read more about the companies operating in Singapore click here.