– In August, the BRICS bloc doubled with the addition of six new countries.

– FXC Intelligence data shows that with the new countries added, BRICS countries will see their share of global remittances grow by 193% to account for 16.2% of all remittances sent in 2023.

– This makes the BRICS bloc a significant player in the remittance space and could prove to be a powerful shaper of remittance trends over the next few years.

In August, the BRICS bloc made the historic step of more than doubling, with the addition of six new countries. The current BRICS countries – Brazil, Russia, India, China and South Africa – are joined by Argentia, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates.

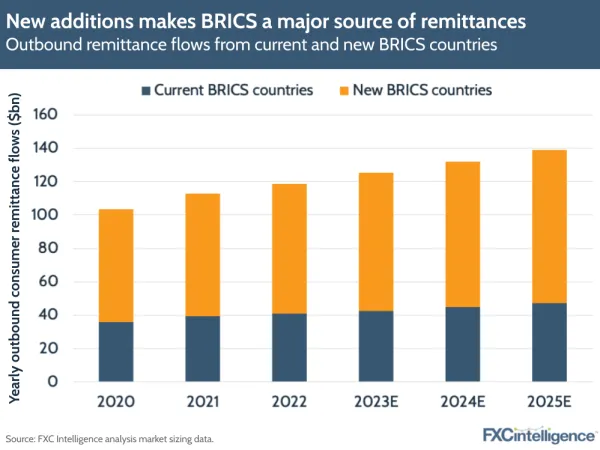

FXC Intelligence data shows that with the additional six countries, the BRICS bloc will send $125.2bn in remittances 2023, which we expect to rise to $138.9bn in 2025. This is compared to $42.7bn in 2023 for the current five BRICS countries, which will rise to $47.1bn in 2025.

In terms of share of global flows, this represents a significant increase, with the BRICS bloc’s send volume increasing by 193% in 2023 as a result of the new countries, and 195% in 2025.

In 2023, the core five BRICS countries are expected to account for 5.5% of all money sent as consumer remittances globally. However, with the new countries added this will increase to 16.2%. By contrast, the US, which is the world’s largest sending country for remittances, will account for around a quarter of all remittances sent in 2023.

The amount sent by the new BRICS countries is also expected to grow at a faster rate than that of the current BRICS countries. While the amount of consumer remittances sent from the current five countries is set to grow by 10.4% between 2023 and 2025, money sent from the new six countries is set to grow by 11.3% over the same period.

This comes as the broader global consumer-to-consumer payments market is set to grow at a significant pace over the next few years. FXC Intelligence market sizing data projects that the entire global C2C payments market will grow by 80% between 2023 and 2030, aided in part by ongoing growth in migration. According to the UN IOM World Migration Report, the percentage of people who are migrants globally has grown consistently over the last few decades, rising from 2.87% of the world’s population in 1990 to 3.9% in 2020.

Lucy Ingham, Head of Content and Editor-in-Chief said:

“Globally, the amount of money people are sending as consumer remittances continues to grow, and the BRICS bloc is becoming an increasingly important source. With BRICS countries now accounting for every one in six dollars sent in remittances, this makes the bloc an increasingly powerful contender in the remittance space and provides renewed economic clout for the group on multiple metrics.

“Amid the current geopolitical climate, there have been suggestions that the BRICS bloc will look to shift away from the US dollar for international trade. This could have powerful implications for remittance trends in future.”