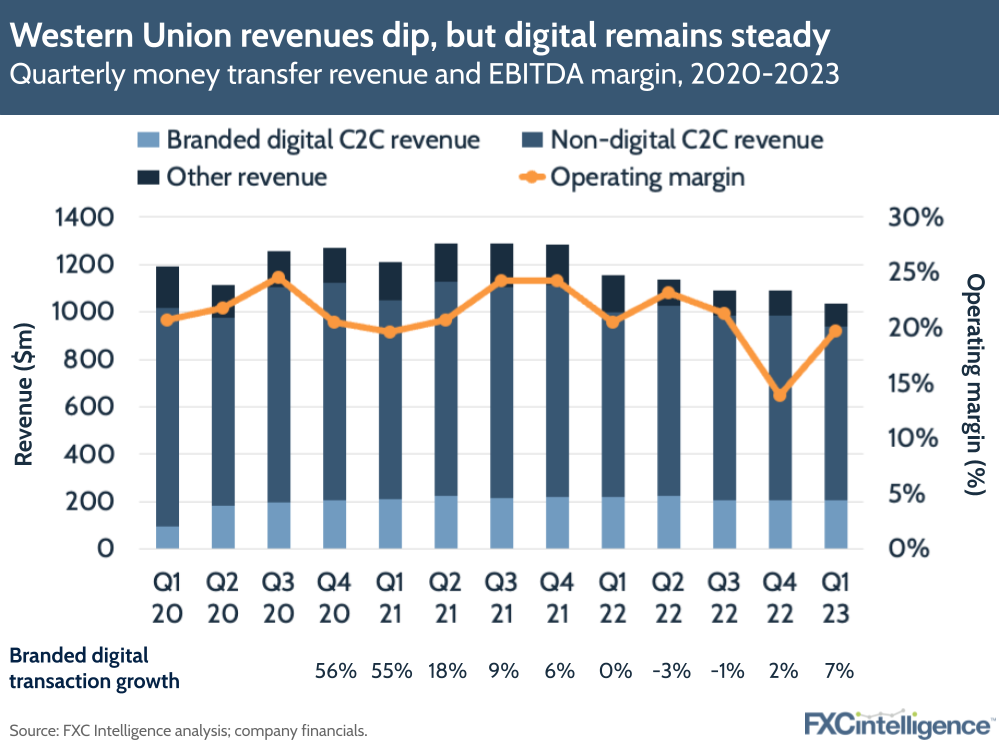

Western Union’s Q1 23 results saw it report the fifth quarter in a row with a year-on-year drop in both total and consumer-to-consumer (C2C) revenue, with total revenue dropping 10% YoY to $1.04bn while C2C reduced 6% to $938.3m. Branded digital revenues reduced 7% for the quarter; however, branded digital transactions saw the highest growth since Q3 21, climbing by 7% YoY. This was ahead of expectations, prompting share prices to rise following the results.

Western Union attributes its drop in revenues in part to the suspension of operations in Belarus and Russia, which impacted C2C revenues by three and six percentage points respectively. Elsewhere, North America also saw an 8% YoY drop in revenue, despite a 1% rise in transactions, while APAC saw revenues decline 5%. However, Latin America and the Caribbean performed well, with a 17% rise in revenue and a 9% increase in transactions.

High inflation continues to be a significant headwind, although Western Union did highlight the resilience of remittances, which is reflected by a 5% increase in principal per transaction on a constant currency basis.

The revenue hit to branded digital, which covers the company’s website and app-based offerings and is expected to be a key source of future growth, was largely attributed to a new go-to-market strategy, including significant promotional pricing. However, there are signs that it is paying off, with WU seeing a 14% rise in new branded digital customers globally and a 21% increase in the US. The US has also seen an 11% rise in transactions. This is in line with the company’s digital strategy, but it acknowledges that it will need to increase the customer lifetime value in order to translate this into revenue benefits – and it has lowered customer acquisition costs in North America by 20% in pursuit of this.

This approach forms part of the company’s Evolve 2025 strategy, which is seeing it make continued investment as it attempts to stabilise the business and reinvent itself as a digital-led accessible financial services provider. So far, this has included the launch of a digital bank in Italy, Poland, Germany and Romania; initial testing of a digital wallet product in Brazil and the US; the expansion of its bill pay product in Latin America; and the re-launch of several products in the US.

These additional products are intended to help create a broader ecosystem for customers, and WU reports that its digital bank product is already showing the benefits of this. It has already enabled it to re-engage over 20,000 lapsed customers, and digital bank customers are now doing more than twice the number of transactions. However, WU did cite continued investment in pursuit of its Evolve 2025 strategy as the reason for its drop in operating margin.

Looking to FY 2023, WU now expects revenue to drop between -7% and -9% YoY, and is projecting a FY operating margin of 18-20%.