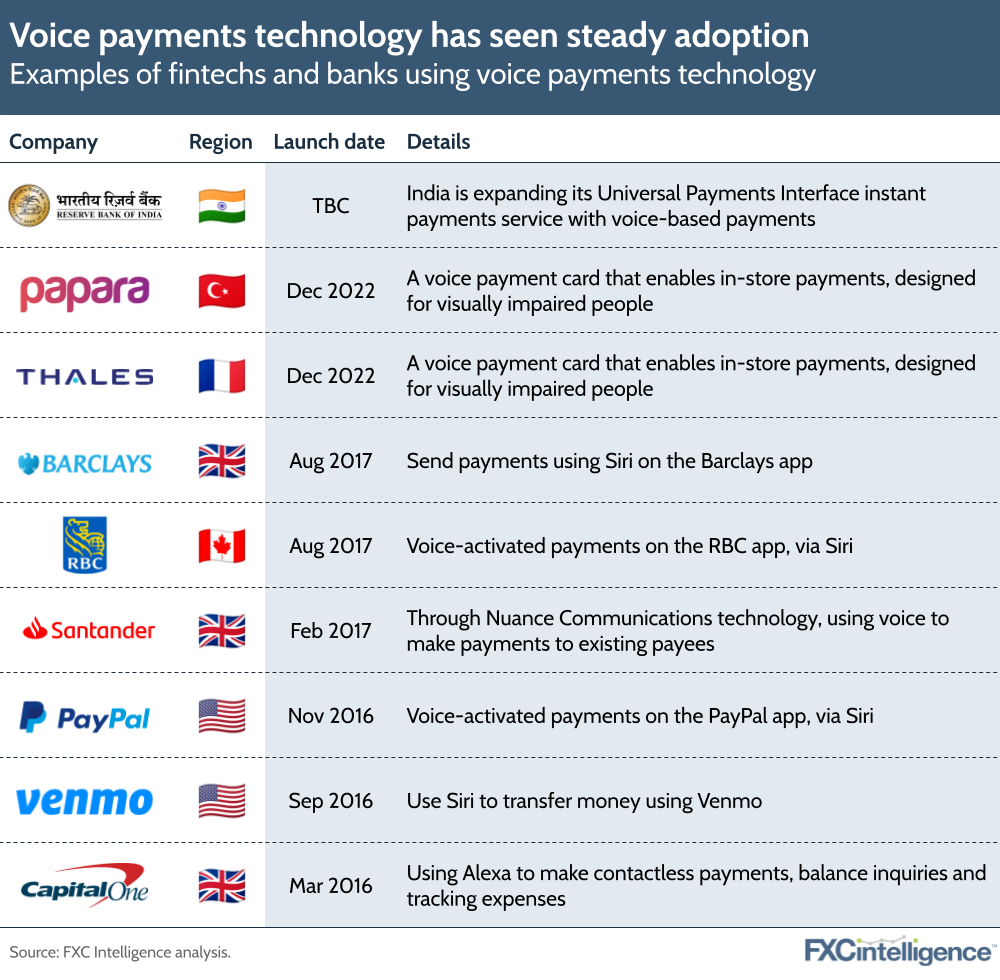

The Reserve Bank of India (RBI) is adding voice payment technology to the Unified Payments Interface (UPI) – India’s instant payments system, used to make payments by over 350 million people. Users will be able to speak payment instructions into their mobile device, which then uses AI-based speech recognition technology to process the instruction and start a transaction.

Voice-activated payments aren’t new, but this alternative payment method has arguably become more relevant in light of recent payment trends, such as the need for more secure payments, financial inclusion, accessibility and the adoption of AI.

Voice payments rely on natural language processing (NLP), a field of computer science focused on teaching computers to replicate how humans speak. The success of voice assistants using NLP has led banks to incorporate the tech for several tasks, from authentication to money transfers.

Voice payments technology offers improved accessibility for people with visual or motor disabilities. It can also recognise unique voice signatures to authenticate payments, thereby improving payment security. However, as with facial recognition, concerns remain about cloning technology, which uses recorded speech samples to create synthetic voices and has already led to some high-profile cases of payments fraud.

Tying voice payments in with another biometric check, such as fingerprint recognition, could help overcome this difficulty, but many consumers are still worried about data privacy. Also, to be truly inclusive, voice payments tech also needs to understand as many accents and languages as possible (at the moment, Siri speaks about 21 languages).

India’s move will no doubt make payments more accessible for users across the country, but when it comes to the wider penetration of voice payments, there are still familiar challenges to overcome – some technological, and some to do with trust.