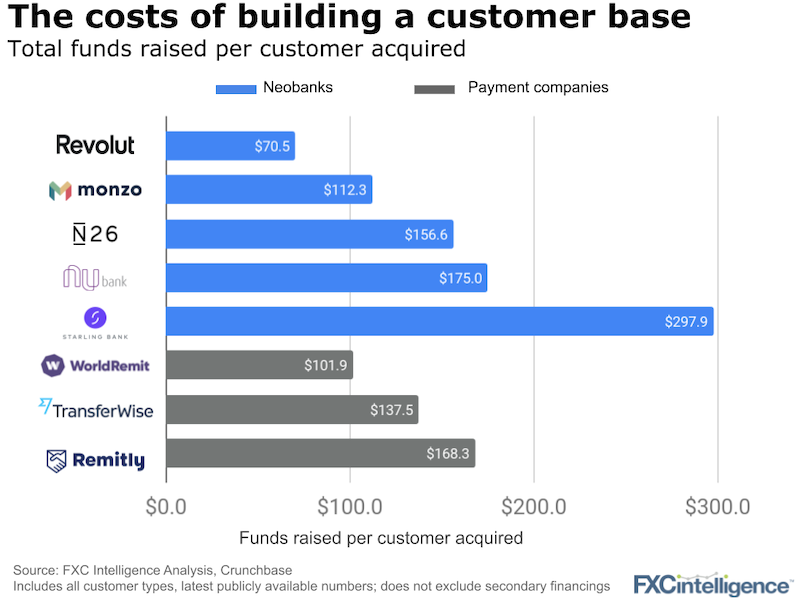

To build a leading consumer focused fintech, you need to raise a lot of money. If your goal is millions of customers, you’ll need hundreds of millions, maybe even billions to build and market your product.

We have simplified the analysis to allow comparisons to be made. Although some of these players have brought on business customers too, their numbers are tiny fractions of the consumer counts and skew to very small businesses.

The headlines:

- Customers are not cheap

Is the life-time value of your customer more than $100? More than $200? Would you build a business where it costs this much to build the product to serve this value of customer? On the flip side, some businesses are investing more per customer to build their businesses – it goes both ways. - Build versus buy versus partner

Banks such as Starling have stated they want to build a banking platform, not just a digital user experience. This, and their targeting of business customers skews them to the top of the range.

Revolut, perhaps one of the most viral products (amongst a group of viral competitors), has been the most efficient even though it has raised some of the largest sums across the board – over $900m to date. - These are massive bets on scale

All of the businesses above are making a bet that scale improves their economics. Annual revenue per customer for many of these businesses is still at $20-$50 (our analysis here). Stickiness of the customer can depend on how much you had spent to entice them in the first place.

Will everyone in the group above make it? We hope so but not necessarily. Those with the weakest revenue models are likely to struggle the most and the higher the valuation, the less obvious the (bail-out) purchaser.

Be wary of the promise of eternal growth

Argentex, the publicly listed B2B-focused FX hedging player had been on an excellent growth run. When we looked at its comparative growth and revenue metrics versus its peers back in August, it was a positive outlier.

On Monday this week, Argentex had to put out a trading update that revenue was nearly 15% down in the six months to September 2020 year on year. In a heartbeat, that wiped 25% off its share price, the largest single day decline in its history. Argentex stated that it expects business to pick up in the next six months but clearly some investors were not convinced.