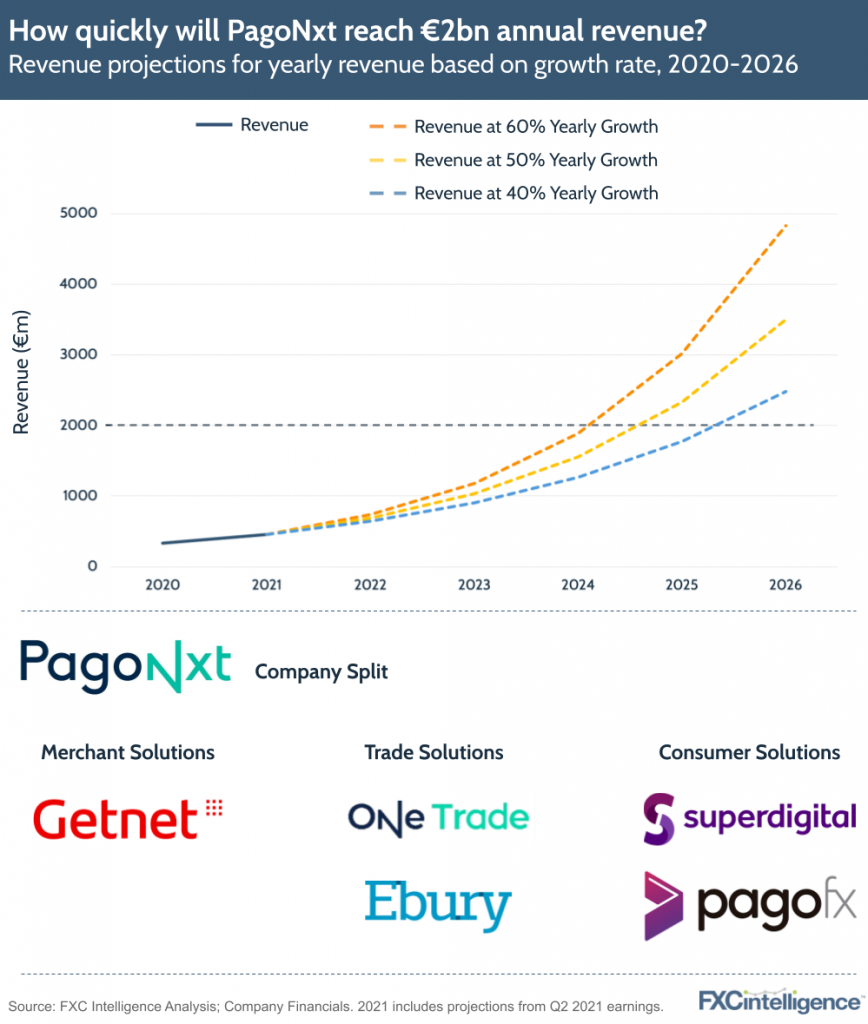

Santander’s PagoNxt is designed to be the bank’s global digital payments company, bringing together all its cross-border focused businesses under one umbrella and in doing so helping to boost customer loyalty. And in its Q2 2021 earnings, Santander made it clear that it expects big things from PagoNxt over the next few years, including reaching EUR2bn annual revenue within two to three years.

Some key takeaways on PagoNxt from Santander’s Q2 2021 earnings:

- PagoNxt saw its H1 revenue growth 23% year-on-year, with Q2 2021 seeing 72% growth, and anticipates 50% revenue growth in H2 2021.

- While PagoNxt is not yet profitable, Santander expects it to break even with a year to a year and a half, including its recent acquisition of a range of Wirecard assets.

- Getnet, PagoNxt’s merchant solutions arm, is now well beyond pre-pandemic levels of active merchants, with 1.2 million, a 24% increase. It also has seen total payment volumes grow by 53% to €50bn, and is now one of the top three acquirers in the Latam region.

- Trade Solutions, its B2B arm, is seeing growth in active customers, with One Trade reaching over 6,000 (a 50% yoy increase). This number is expected to “increase exponentially” as new services are added. However, Ebury is still being impacted by the pandemic.

- The company is also expanding its Consumer Solutions segment, which includes PagoFX and its Superdigital brand, with the rollout of a single global IT platform launching in Argentina, Peru and Colombia later this year. However, it still needs to deploy its network in some European countries, including the UK and Poland, which is not likely to occur for several years.

The potential value of PagoNxt

Overall the impression is that Santander is building PagoNxt as a standalone global digital payments company, running as independently as possible with its own line in the accounts. It wants PagoNxt to be seen as a fintech payment processor with the associated valuation, incubated within Santander and possibly spun out in the future.

What would those numbers mean at a high level? Santander’s global annual revenue is around $50bn with a market cap of around $70bn. Not much of a revenue multiple, and slow-growth banks aren’t valued on revenue multiples.

But digital payment companies are highly valued and if PagoNxt can achieve rates of >20% annual growth, just $2.5bn of revenue would be worth c.$20bn using an industry average 8x revenue multiple (a much higher multiple could be used if we treat it as an emerging markets business). That would mean a division accounting for only 5% of revenue could be worth nearly 30% of the value of the entire bank, maybe more.