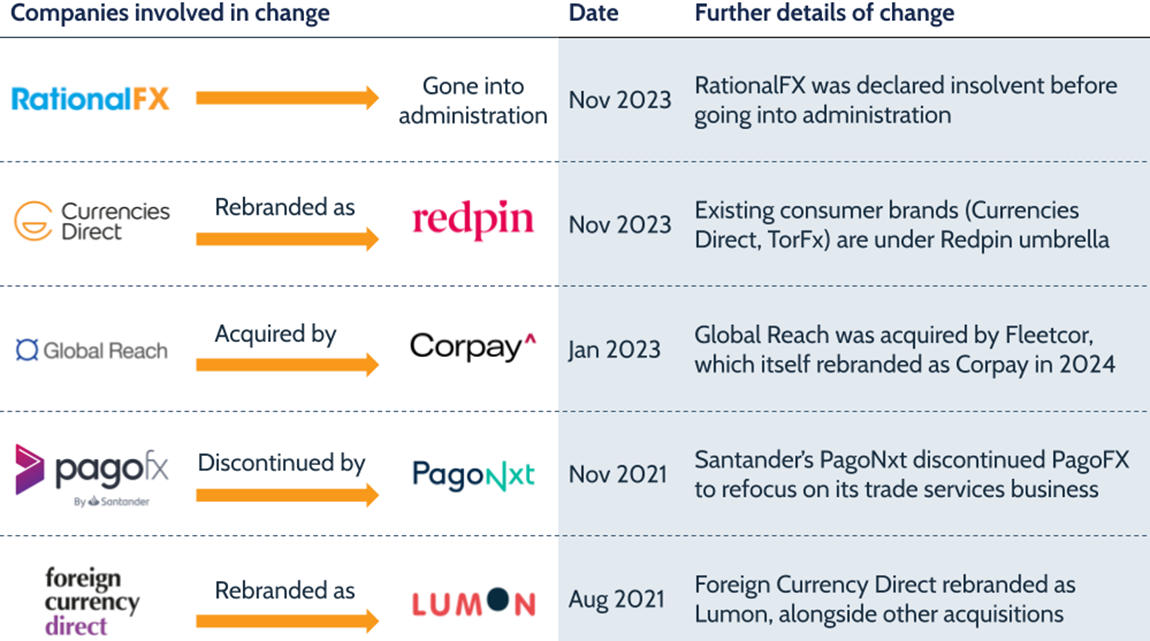

Over the past couple of years, Santander has embarked on a digital transformation journey, most recently with the creation of PagoNxt. Designed to bring Santander’s cross-border-focused businesses under one umbrella, PagoNxt is intended to be a “global payments company”.

Though not all details have been revealed, recent job postings highlight that the company will focus on three business verticals: Merchant Solutions, Trade Solutions and Consumer Solutions. These units are currently grouped under Santander Global Platform (SGP), illustrated in the table above. The digital bank Openbank and money transfer app PagoFX also fall in the SGP segment, though not specifically under ‘Consumer Solutions’.

Over the first nine months of 2020, Santander Global Platform reported $910m in revenue, servicing over 1 million active businesses. Profit in the same period was $74m, with most of the costs attributed to building and developing these digital platforms.

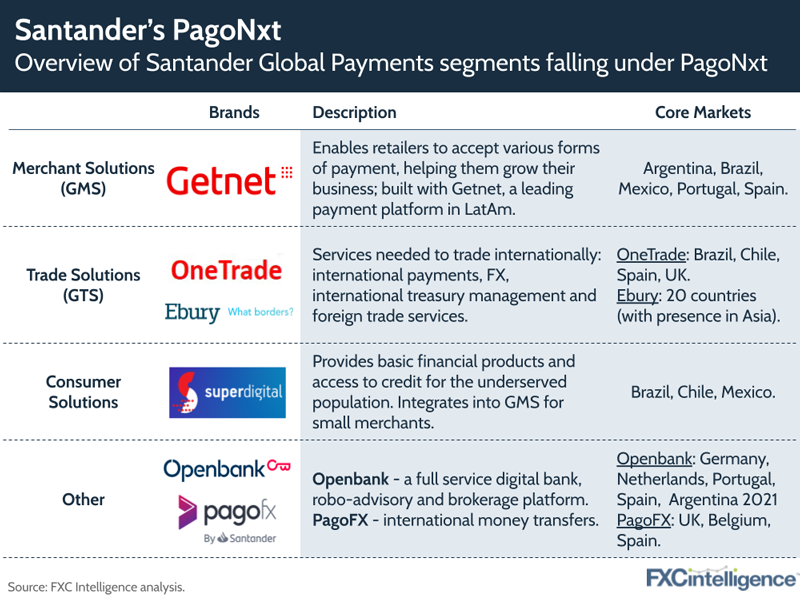

Santander makes acquisitions ahead of PagoNxt global payments challenge

In anticipation of the launch of PagoNxt, Santander has been expanding its presence in the payments space by actively investing in and acquiring companies. Amongst others, the bank has acquired Getnet, one of the largest card processors in Brazil; invested in a 50.1% stake in the payments platform Ebury and acquired Elavon’s Mexican business, which focuses on merchant payment solutions.

By acquiring companies, technologies and human resources, Santander has access to European, Latin American and Asian markets and is in a strong position to compete in the payments industry. But how will it capitalise on this position as the year progresses? Will it continue to cement PagoNxt’s position as a separate group? Will other banks follow building out standalone global payments divisions (and potentially spinning them out)?

Sign up to our newsletter to stay up to date on industry developments