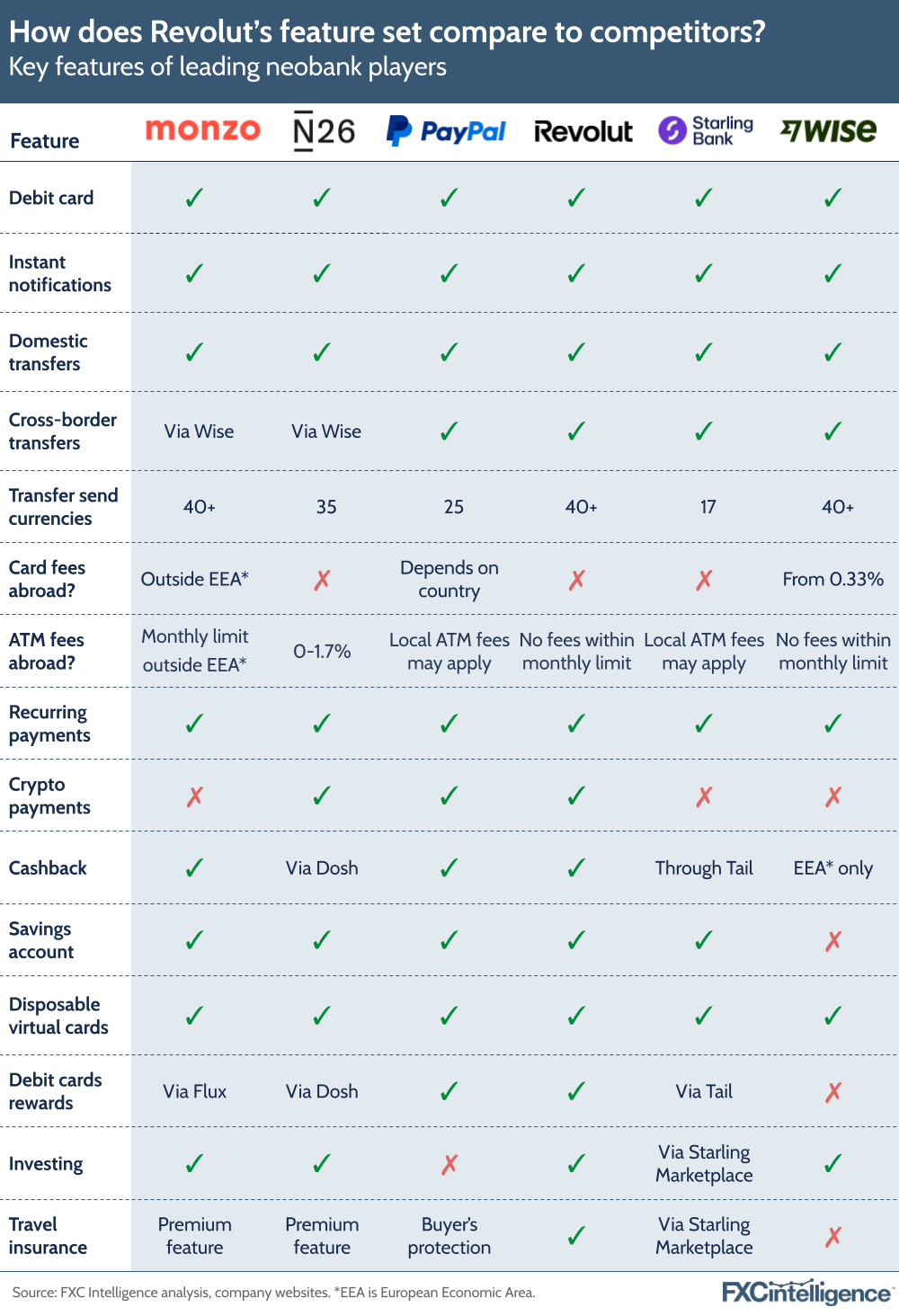

Prior to recent news that it was seeking an updated, $40bn valuation, Revolut added a number of new features to its app – namely the ability to invest in bonds, as well as a pan-European debit loyalty card programme in the UK. We’ve taken a look at the company’s key features, alongside other neobank competitors, to see the lay of the land in 2024.

Revolut – alongside Starling, Wise, PayPal, N26 and Monzo – offers extensive features for users. Wise is best known for being a remittance service and PayPal a processor, but both of them have come to offer features in their apps that put them in competition with Revolut and other players in the space, such as debit cards, investing service and savings accounts (in PayPal’s case).

Notably, these companies offer a variety of similar services, with all of them offering international transfers; in the case of Monzo and N26, these services are powered by Wise. There has also been a focus on providing services supporting overseas travel, such as fee-free card transactions within the European Economic Area (EEA) for Monzo and Revolut, as well as fee-free ATM withdrawals within limits while abroad (not including local ATM provider fees).

Monzo and N26 have also opted to offer travel insurance as a feature for their higher-tier customers, while for Starling this feature is accessible but only through a third-party company featured on its marketplace. Notably, there has been a shift in the way some apps are approaching crypto payments. For example, although Monzo doesn’t work with crypto directly, users can purchase crypto with Monzo as their chosen banking provider.

Neobanks have also partnered with other companies – such as Dosh, Flux and Tail – to enable cashback and rewards programmes for their customers, while Revolut, Monzo, Wise and N26 all enable investing in some form.

Overall, the picture of neobanks appears to be a continued drive to unify financial services in one place and incentivise users, but also one-up legacy banks with less costly services for travelling and sending money abroad. However, expanded banking license acquisitions (particularly for Wise and Revolut) will continue to help them enhance their services and offerings further.