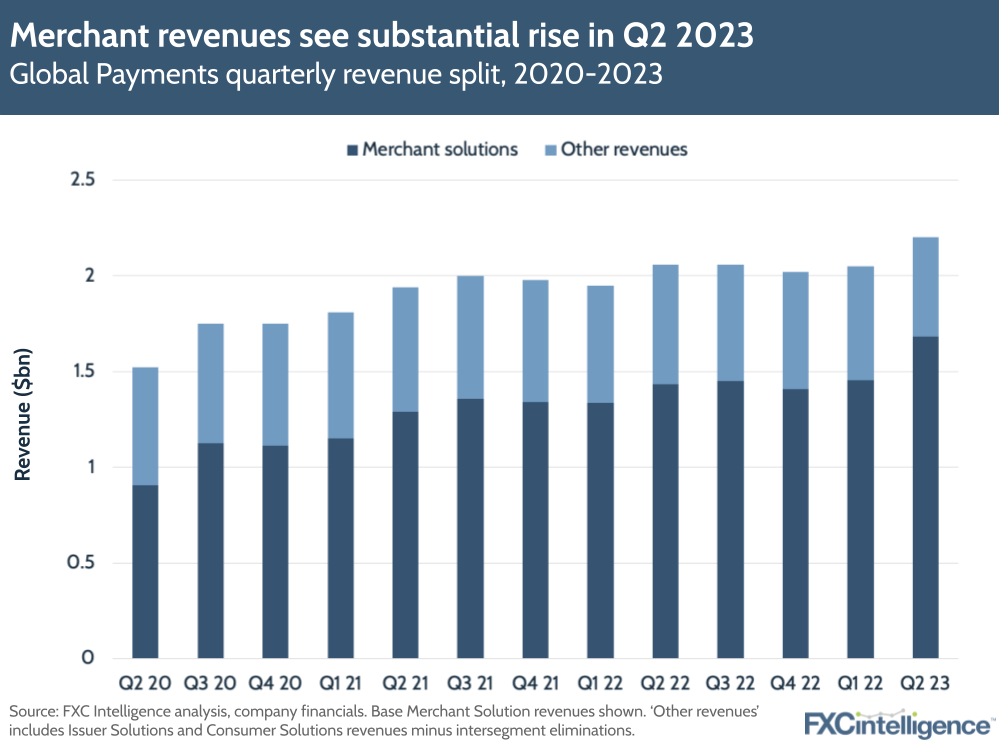

Payment tech provider Global Payments has raised its guidance after adjusted revenues rose 7% to $2.2bn in Q2 23, driven by particularly strong growth in its Merchant Solutions segment. The company’s adjusted operating margin also rose 100 basis points to 44.8%, despite rising costs resulting from the company’s continued integration of payments rival EVO.

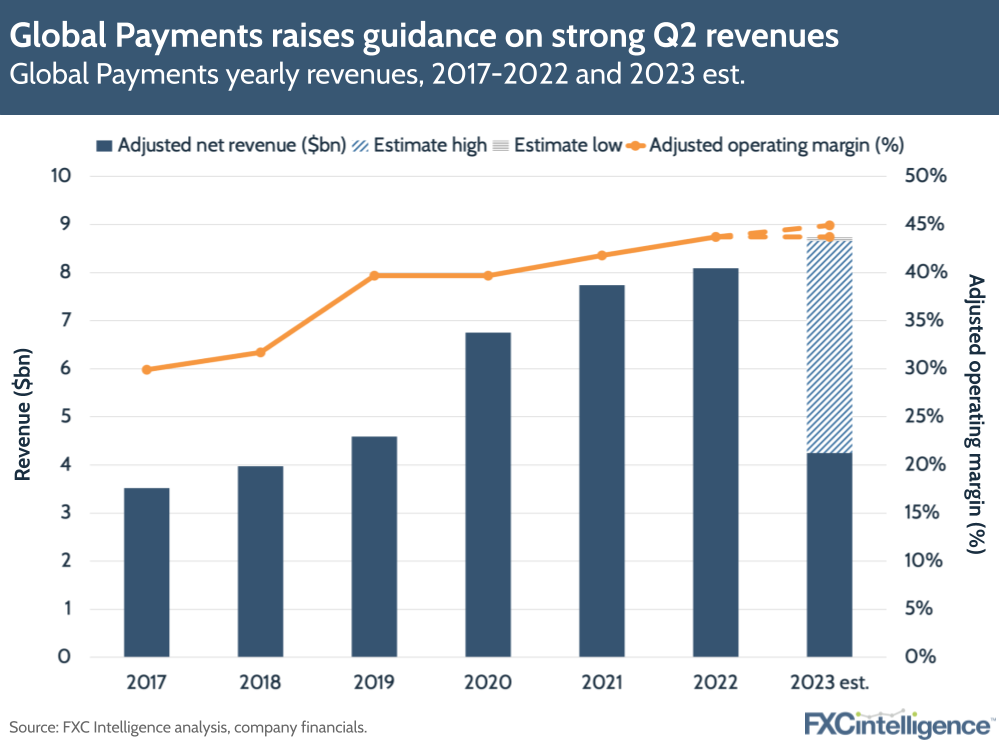

Global Payments now expects its adjusted net revenue to be in the range of $8.66bn to $8.74bn for 2023, a 7-8% growth, and its adjusted operating margin to expand 120 basis points. Though executives said the guidance reflected the potential for a “more tempered macroeconomic environment” this year, they remain confident in the company’s diverse verticals and momentum.

Merchant solutions drive Global Payments revenue in Q2

Merchant solutions continued to drive growth for Global Payments in Q2, with a 17% rise in revenues to $1.68bn – the biggest YoY increase since Q4 2021.

Excluding the impact of EVO and dispositions, adjusted net revenue growth was 9%, while volume growth was 20%. The segment’s adjusted operating margin was down by 170 basis points to 48.5%, again driven by EVO-related costs, but the company expects this margin to rise 120 bps over 2023, with revenue expected to rise by around 16%.

In the earnings call, Global Payments executives said volume growth was driven by Central Europe and APAC, double-digit growth across vertical markets and a 20% rise in PoS revenues – a strong showing against some of the other payments companies we track in the PoS space. The company’s limited exposure to travel meant it didn’t see a post-pandemic upside, but it also didn’t have the same difficult comparison to Q2 2022 (see Visa and Mastercard’s results).

Having said this, volumes were offset by rising interest rates and inflation in the UK, which is affecting consumer spending. Global Payments was also one of several companies to mention the impact of reduced fuel prices on merchants this quarter, which has had a trickledown effect for processors.

For Global Payments’ Issuer Solutions segment, adjusted revenue rose 5% to $505m, while adjusted operating margin rose 300bps to 46.7%. The company expects a 5-6% revenue increase in this area, with adjusted operating margin up 120 bps. Global Payments saw its consumer solutions segment decline 79% to $34m, reflecting the company’s changing revenue mix and its shift away from consumers following its sale of Netspend’s consumer business last year.

Despite considering macro impacts in its guidance, Global Payments is expecting a relatively stable economic backdrop in the back half of the year. The company now has a 100-day plan for its EVO acquisition, which is projected to deliver at least $125m within two years by eliminating various costs while growing ecommerce, PoS and B2B opportunities across a number of markets. Executives also hinted at the possibility of more acquisitions in the B2B space, though the company needs to decide on its focus for this.

How does Global Payments’ pricing compare to other merchant payment providers?