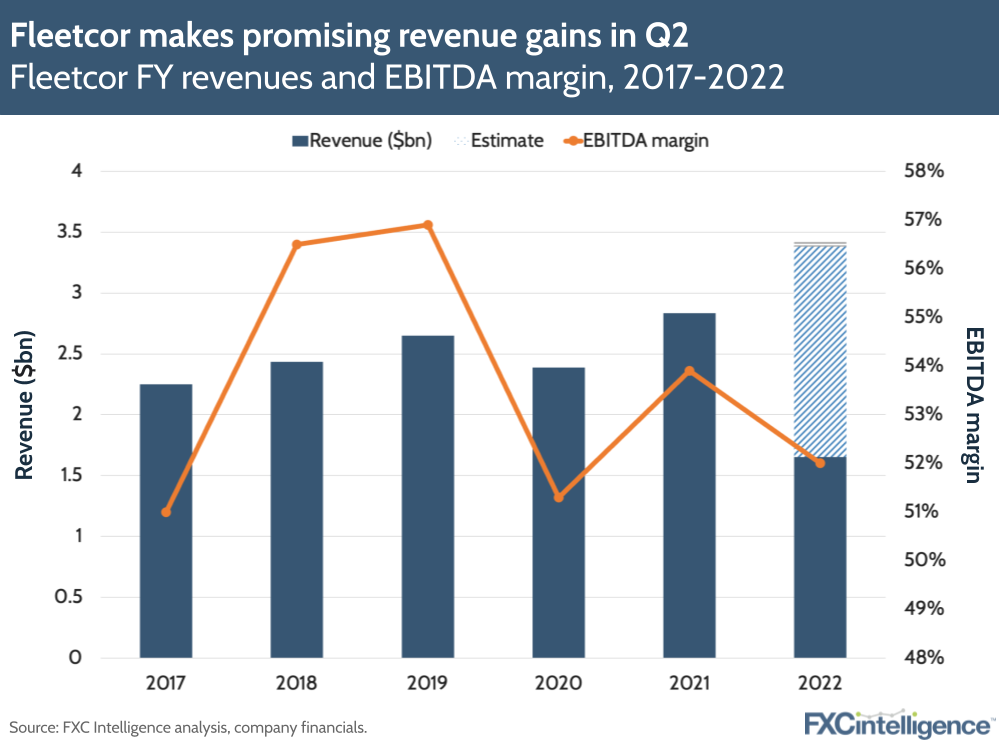

B2B global payments provider Fleetcor has once again beaten revenue expectations for the quarter, with revenues increasing 29% to $861.3m in Q2 22.

In the earnings call, executives reported that 7% of revenue growth had been driven by acquisitions, such as 2017-acquired Cambridge Global Payments and 2021-acquired Afex, now driving Fleetcor’s Corpay solution. Rising fuel prices worldwide contributed around $33m of additional revenues and cross-border payments were up 22%, with sales remaining strong and activity robust across nearly all geographies.

EBITDA margin for the margin was 52.1%, 2% higher than the first quarter but down from 55% in Q2 21. This was due to a combination of higher stock compensation expense and bad debt, the company said.

Fleetcor saw notable growth across its lodging (42%), tolls (19%) corporate payments (18%) and fuel segments (7%). The company is further expanding its Corporate Payments offering through its acquisition of Accrualify, a cloud-based accounts payable platform, with more acquisitions to come.

Fleetcor raises guidance on Q2 22 results

Fleetcor currently expects third quarter revenues between $870m and $890m. On the back of the strong performance, it raised its GAAP revenue guidance to between $$3.38bn and $3.42bn (20% YoY growth).

According to CEO Ron Clarke, the company is not recession-proof but is resilient, particularly given the necessity of some of its product segments such as fuel. Having said this, the company has forecasted that macroeconomic impacts (e.g. changing fuel prices and interest rates) could aid performance in Q3 but slow growth in Q4.