Currencies Direct published their annual results this past week. As one of the best performing companies in their segment, I talked with their CEO Keith Hatton to discuss what has been driving this.

Currencies Direct’s solid performance

Currencies Direct is one of the few private equity-owned players in the space. The company focuses on the higher-end consumer space (expats, overseas property purchases), corporates and marketplace sellers.

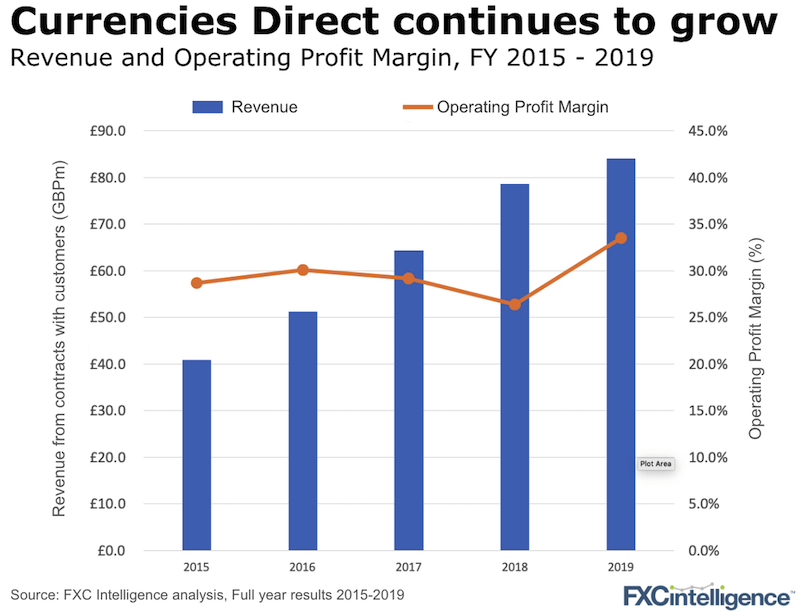

Whilst many of its peers in these segments have struggled for growth, in the four-plus years under private equity ownership, Currencies Direct’s growth and profit has been consistent. What’s been underpinning this?

Speaking to CEO Keith Hatton this past week, he highlighted four key areas:

- Their core differentiator, in Keith’s words, is their route to market. As opposed to relying on paid marketing and pay-per-click like many other groups do, Currencies Direct Group has built up a large number of partnerships across the media, financial, property and expat world. These partnerships are relatively sticky and also provide stability as they are gained one by one and lost one by one.

- Currencies Direct (like Moneycorp) is a proven consolidator in the industry, having made four acquisitions (Tor FX, Exchange4Free, Foremost Currency and Currencies UK). This build-and-buy strategy is common under private equity ownership: buy a smaller company at a lower valuation multiple, remove some costs (i.e. find synergies) and the value of that smaller company rises in its new bigger home.

- The group has invested in technology to deliver what Keith believes is one of the most modern technology stacks in the industry.

- The group’s operations are not just in London but they also have a significant presence in the lower-cost (but talented) regions of Penzance in the south of England and Mumbai in India.

Interestingly as well, in a period like last year, when the UK has seen slower growth for many players, the country grew by around 15% for Currencies Direct, while the rest of the world was flat for them.

Currencies Direct has patient private equity owners. We would not be surprised to see more acquisitions added to the underlying organic growth over the next few years.

[fxci_space class=”tailor-633312f456a0e”][/fxci_space]