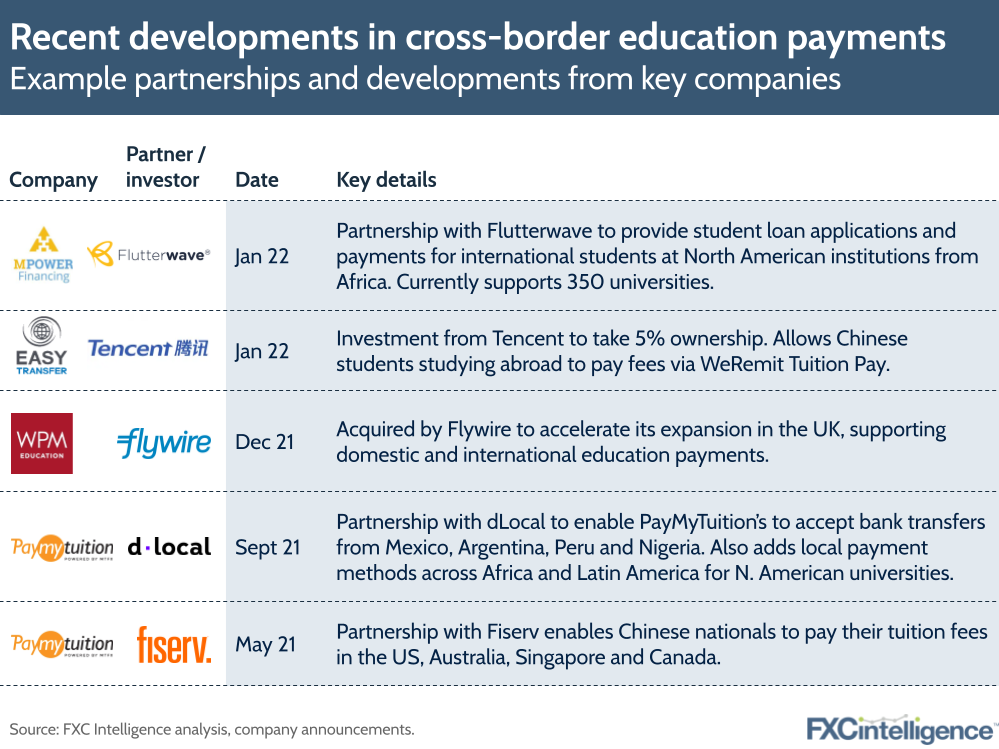

Cross-border payments for tuition fees has long been big business, but it’s traditionally been handled by bank transfers or major payments players such as Western Union Business Solutions and specialist Flywire. However, the market is increasingly diversifying, with new players partnering to access the space, particularly in light of the growing volume that is emerging as pandemic restrictions dissipate.

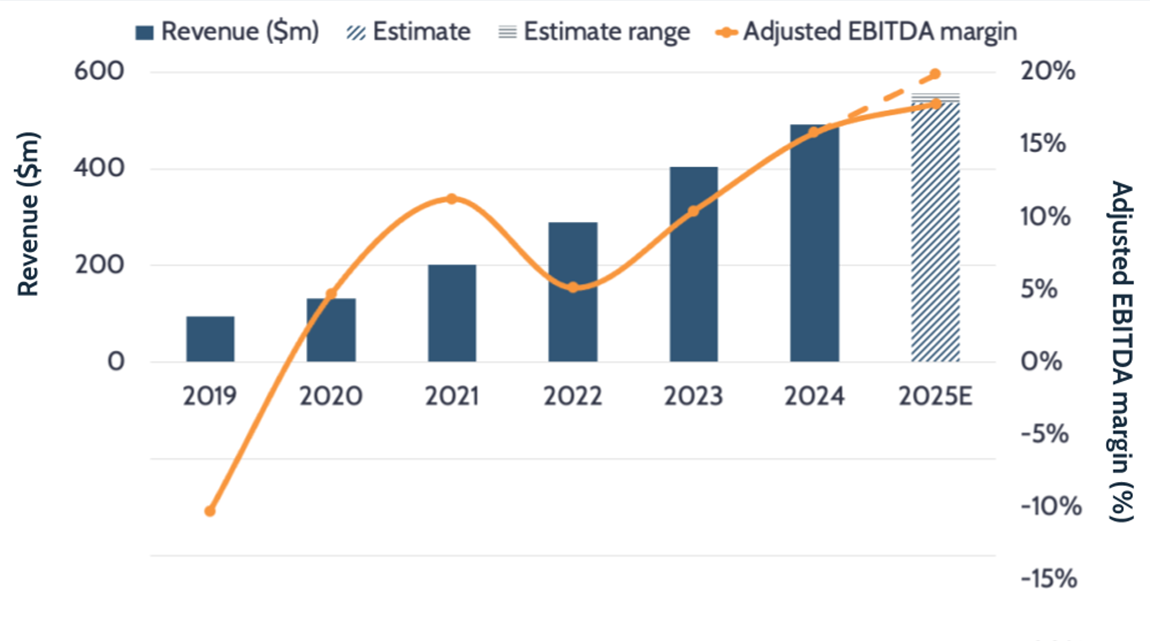

While growing numbers of companies are beginning to access this space, in part through partnerships, Flywire is now one of the more established players that has found considerable success focusing on education payments. Flywire itself entered the market to take share from Western Union Business Solutions, one of the original providers of educational payments.

Despite already operating in 240 countries, Flywire is also expanding its presence globally, most recently with the acquisition of WPM Education, which has enabled it to boost its presence in the UK – a market worth $30bn.

Meanwhile, African fintech Flutterwave became Africa’s highest valued startup earlier this month, with a $3bn valuation, and has increasingly begun to look for opportunities beyond the continent, including with a recent partnership with Mpower Financing to support international students studying in North America.

Some companies have also focused on supporting common payment methods in a student’s country of origin. In 2021 payment processor Fiserv partnered with PayMyTuition to enable local payment methods for overseas services. This enables Chinese students to use their preferred payment methods – such as Alipay, WeChat Pay and Express Pay – to pay their tuition at international institutions, with settlement made in the local currency.

Success in education payments typically requires a direct integration with an education institution and then the promotion of that payment service by the institution. We’ve heard from the industry multiple times about the need to offer a full set of software solutions and to cover both domestic and international payments. That sets the bar for a baseline offering in the space. This means that whilst there are a growing number of partnerships in the space, and expected growth in education payments as the pandemic recedes, making direct inroads into education payments will require significant efforts by new entrants.

Access the largest pool of research on cross-border payments globally