Worldline’s continuing push towards digital payments (which started with its acquisition of major rival Ingenico 18 months ago) appears to be paying off. In its H1 2022 figures announced this week, the French payments company said it had seen revenue growth of 12.6% YoY.

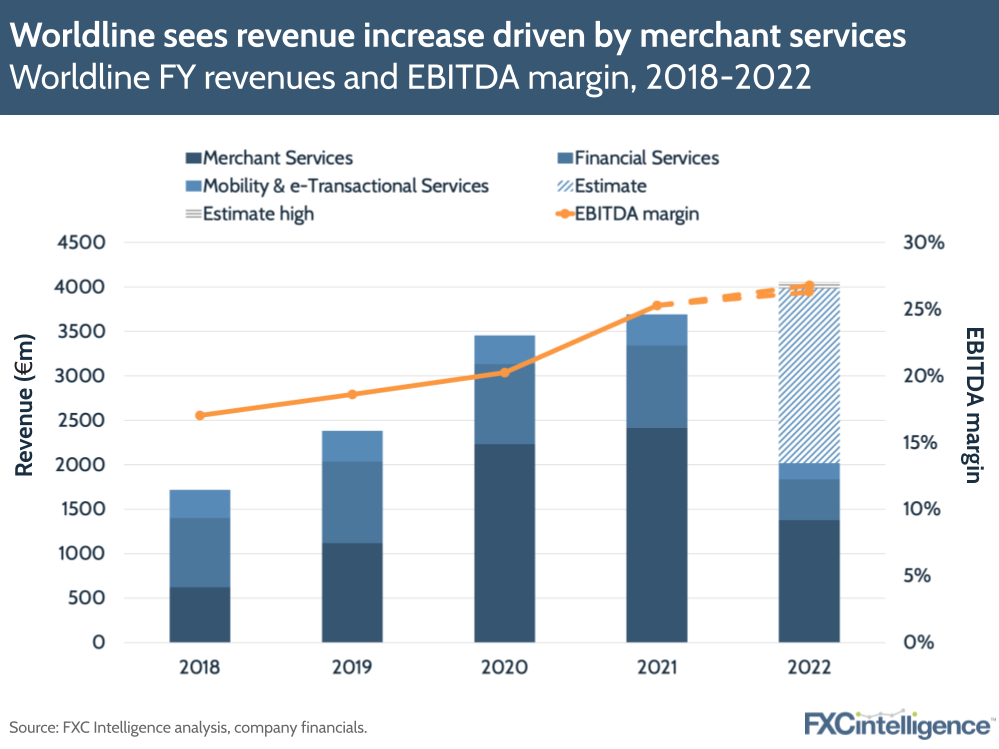

Revenue growth was largely driven by merchant services, which saw growth of 16.8% in the first half of the year, as well as gains in its mobility and e-transactional services (9.4%) and financial services segments (2.8%).

The company said that key contributors to its merchant segment have been the strength of commercial acquiring, payment acceptance and digital services. Commercial acquiring saw growth approaching 30% across all geographies and market segments. Meanwhile, payment acceptance was driven primarily by SMBs and large retailers. Worldline noted a positive impact from the return of travel, but did say it had “faced a more difficult situation” as a result of ceasing activities in Russia.

Worldline wants to bolster its merchant operations even further after acquiring Axepta Italy; ANZ’s commercial acquiring business in Australia and Eurobank Merchant Acquiring in Greece. It confirmed the sale of its terminals segment was on track, with closing set for H2 2022, and expects the resulting funds to give more “financial flexibility” for further consolidation activity in the future.

The company has restated its FY22 objective of achieving 8-10% revenue growth and a 100-150+ bp rise in EBITDA. Worldline wants this margin to be trending towards 30% of revenue by 2024 which, as our analysis of Worldline’s FY2021 result shows, is in reach if the company can keep up its momentum.

How does Worldline’s pricing compare to its competitors in ecommerce?