Worldline, one of the leading payments processing and travel-related payments providers focused on Western Europe and Scandinavia, has posted its Q4 and FY 2021 results. It reported a successful year that saw the company reposition to increasingly focus on digital payments.

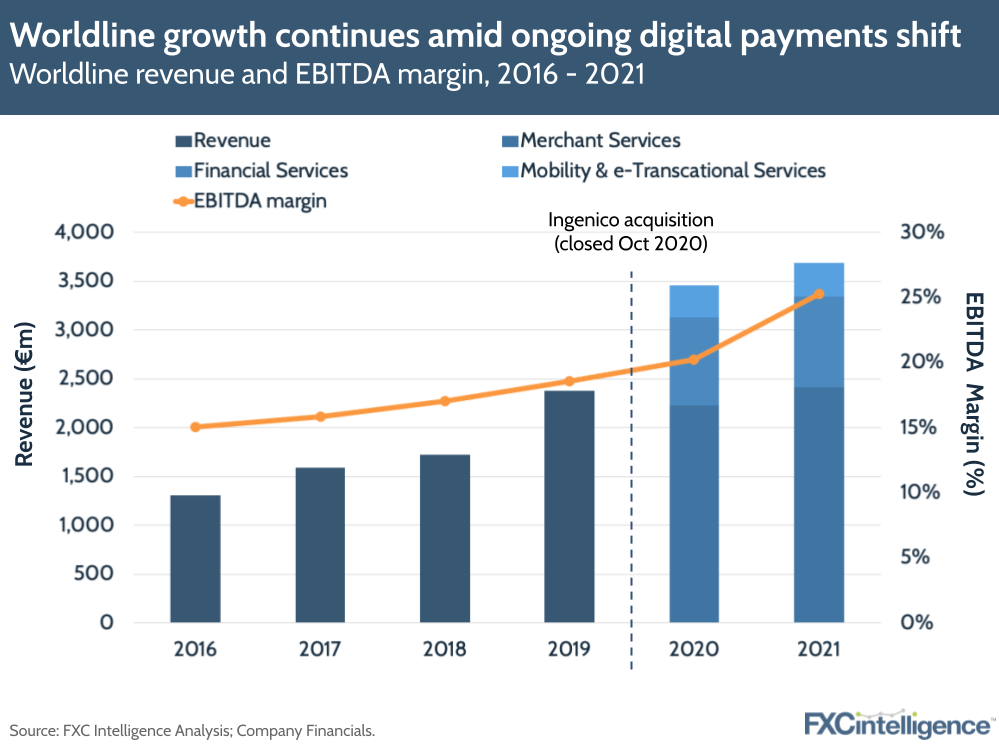

Worldline saw revenue climb by about 7% year-on-year, while EBITDA increased 220 basis points, with growth in all of its divisions. Some of the key takeaways:

- Worldline’s Merchant Services division was a key driver of growth, with a 15% increase year-on-year that was aided by a strong Q4 that included a number of ecommerce and omnichannel client wins. The company saw particularly strong growth in commercial acquiring, while payment acceptance saw “high single digit growth” that was muted by ongoing travel restrictions. The company has also expanded its efforts across a number of key geographies, including Russia where it has become the first marketplace to give European merchants access to the country.

- Although it is providing omnichannel services to many clients, Worldline is increasingly focused on digital payments, aided by its acquisition of payment software provider Ingenico, which it fully integrated this year.

- Worldline announced the divestment of its terminal business to global investment firm Apollo during the earnings call, in a deal worth up to €2.3bn. It says this will simplify the group structure while increasing its focus on its main business goals.

- In 2022 Worldline plans to begin a three-year effort to establish the company as a globally recognised paytech that is “at the heart of the European payments system”. It projects 8-10% revenue growth and a 100-150 bp increase in EBITDA margin in 2022.