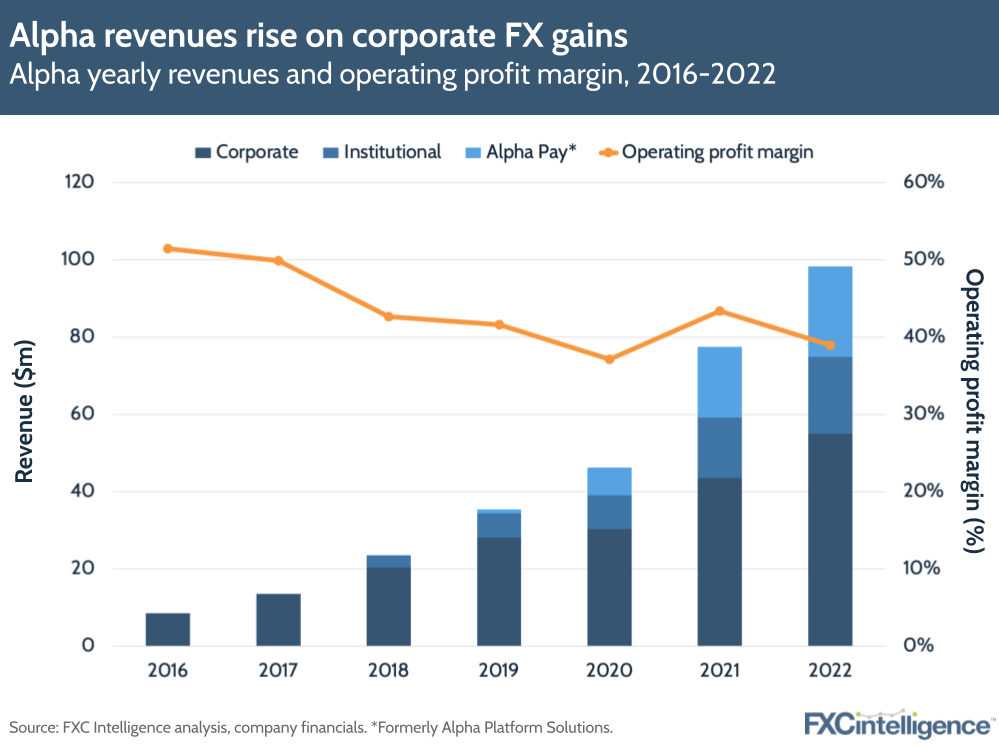

Alpha Group (previously Alpha FX) saw revenues rise 27% to £98.3m in FY 2022, driven primarily by 22% growth in its FX risk management (FXRM) segment to £69.5m. While revenue and profit growth were slower for the FX services provider than in 2021, growth continues to outpace rising investment costs.

The company’s FXRM clients increased by 19% to 1,047, with average revenue per customer rising to £66,380 – a very high per customer for this space (most competitors run perhaps 10-20x less). Meanwhile, revenues for Alternative Banking Solutions (ABS) – which launched in 2020 for private equity investors and hedge funds, amongst others – rose 41% to £28.8m, while accounts invoiced in this segment increased by 141% to 4,200.

Alpha invested heavily in 2022, increasing its headcount by 67% to 357 people and its number of global offices to eight, as well as launching a new FXRM platform. As a result of increased investments and deferred revenue costs, operating margins for FXRM (39%) and ABS (39%) were down on last year’s figures. Profits before tax rose 42% to £47.2m in 2022, as opposed to 94% growth in this figure in 2021.

On last year’s macroeconomic impact, the company said that inflation and rising interest have been a tailwind, with clients tending to trade higher volumes of currency to deal with rising prices. Alpha gained $9m in additional interest income, as reported in a January update. However, it did mention headwinds in Q4, partly due to a slowdown in investor trading.

Anticipating more growth in 2023, the company has brought forward investment plans for its ABS segment originally planned for 2024/25, and its strategy is to continue to grow wallet share with existing clients while also winning new ones. As Alpha grows in size, so too will its costs, but for now the company appears to be maintaining solid profits.