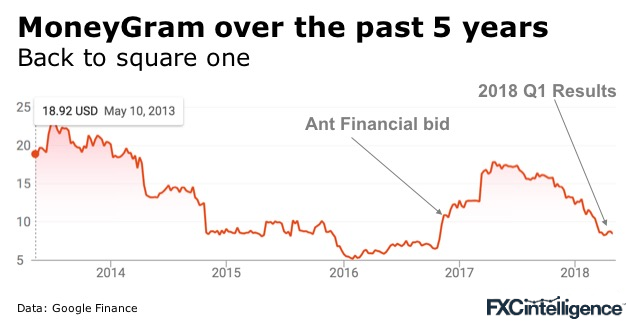

Moneygram released their 2018 Q1 results earlier this week and it doesn’t make for kind reading. Since the failed bid from Ant Financial, MoneyGram has lost much of its value and in the past three days, the stock fell another 25% taking it back to where it was pre-bid. What’s going on and what can we learn for the sector more broadly?

Some observations:

- MoneyGram’s underlying money transfer business is shrinking. Digital (whilst growing) is still only 16% of the overall business. This is against the background of CEO W. Alexander Holmes stating in the earnings call on Tuesday: “Make no mistake, we believe our cash network is an extremely valuable asset and one that we will leverage to win.” He continued later that the “…cash presence as sort of the value add side of the equation for both sends and receives and so we will be positioning ourselves that way and kind of pivoting the marketing a little bit”. 84% of the business is about to pivot. That’s a big pivot. On the plus side, there are some parts where the investment has at least caught up with the competition such as in digital onboarding.

- Margins are declining and whilst MoneyGram is certainly happy it did not lose the Walmart white-label contract, initial numbers from MoneyGram are that 85% of the customers using the new white-label service were already MoneyGram customers and with lower pricing in the new deal, they are cannibalising their base.

- The value of goodwill (intangible assets such as brand) on MoneyGram’s balance sheet is $442m and is now higher than the value of the whole company ($415m). The market is either saying the underlying business is worth nothing or goodwill on the balance sheet isn’t worth what it’s marked at – but it can’t be both.

Which leaves the obvious question – what’s next for MoneyGram? Can the business turn itself around and compete? Its digital revenue is only around $50m making it smaller than many of the new fintechs in the space. Since Western Union has shown no appetite for MoneyGram does that leave only Ria?

Stay up to date on the International Payments Industry – Subscribe to FXC Intelligence’s Newsletter

The broader takeways

12 years ago, MoneyGram was at its peak. It cost $286 to buy a share (it now costs $6.5/share). Revenue back in Q1 2006 wasn’t far off what it is now but the business was worth 35 times more. In 2006, MoneyGram had the potential to be any of the digital players we see today. A few lessons can be learned from this week’s comments from MoneyGram’s CEO:

Data should have been at the centre of the business

Making data an asset in your business is not a cost free exercise. Just talk to your compliance department and anyone on an internal GDPR committee. But most businesses know that truly understanding your customer can pay big rewards.

“The more I [MoneyGram] can collect about consumers, the more information they are willing to give us, the easier it is to authenticate, easier it is to communicate with them and easier it is to effectuate our business from a risk reward perspective over the long-term.” – W. Alexander Holmes, MoneyGram CEO

Maintaining a long-tail of physical agents is an expensive way to build your brand ‘

Two weeks ago, Nick Day, CEO of Small World Financial Services shared with us the value of having a smaller network of physical locations for brand building. MoneyGram accepted this week that maybe this benefit for them has now been exhausted.

“I think probably 10 years ago I think my view was a little bit different, right. It was a marketing opportunity being assigned to promote your brand and get out there in the market. But I think the world has changed quite a bit.” – W. Alexander Holmes, MoneyGram CEO

Pricing pressure will continue

Clearly this is not news to anyone. But how much of a premium can MoneyGram’s brand sustain if any at all?

The Blockbuster & Netflix story reminds us of one truth for business. When you are out in front and one the leaders in the market, you still can’t rest on your laurels. Fintechs take note, someone out there is trying to disrupt the very business you just disrupted.

[fxci_space class=”tailor-633163ce211g0″][/fxci_space]