French payment processor Worldline has had a solid start to the year, with Q1 revenue growing 9.2% organically (i.e. excluding exchange rate impacts) to €1.07bn. It also discussed its recently announced partnership with Credit Agricole – one of France’s biggest banks – to create a new payments player focused specifically on French merchants.

As per the deal announced last week, Worldline wants to pair its payment technology with Credit Agricole’s distribution network to build the next major payments player in France, offering merchants new ‘state-of-the-art’ commercial and tech offerings. Powered by an €80m joint investment, the new venture is expected to be majority-owned by Worldline and bolster its position in France – continental Europe’s largest payment market, with merchant sale values around €700bn.

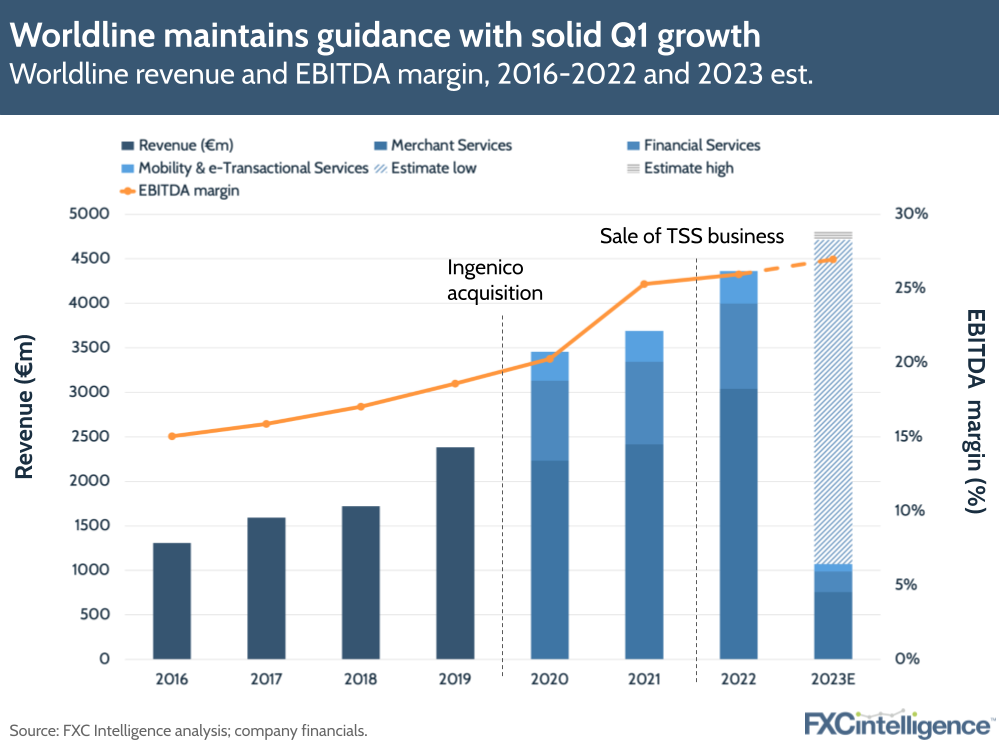

On the company’s recent performance, Worldline’s revenues have once again been driven by merchant services, which grew by 12.6% to €758m. Commercial acquiring activities saw double digit growth across all geographies, while payment volumes increased instore and online – backed by a return to travel. However, suspended services due to the Russia/Ukraine war continued to be a headwind to merchant growth in Q1.

Revenue growth was slower in other areas. Financial services grew 2.3% to €228m, while Worldline’s mobility and e-transactional services segment was around the same as Q1 22 at €84m. Having said this, the company has some other big banking projects in the pipeline that could spur growth in this area, including its extended partnership with ING and a new contract with another of France’s biggest banks, BNP Paribas.

Looking forward, the company reconfirmed its 2023 outlook, which would see profitability continuing to climb. Specifically, Worldline expects 8-10% organic revenue growth and above 100 bps in its OMDA (EBITDA) margin for 2023, with this margin expected to trend towards 30% of revenue by 2024.