The world’s 100 top cross-border payment companies in 2025, according to FXC Intelligence.

2025 is shaping up to be another significant year for cross-border payments. This year has brought a new wave of consolidation and partnerships seeking to capitalise on an industry that continues to evolve and grow, and which we expect to be worth $65tn by 2032.

As money transfer operators and digital cross-border services grow in size, governments and central banks continue to promote solutions and policy to make cross-border payments less costly and more efficient. The performance of companies in the space also speaks to continued macroeconomic impacts, from conflict areas globally to the recent US tariffs.

Amid the developments so far this year, one of the best ways to understand an industry is to keep its biggest players front of mind. That’s why FXC Intelligence has released The 2025 Cross-Border Payments 100, a market map that recognises and celebrates the 100 most important players in the cross-border payments space. Now in its seventh year, The Cross-Border Payments 100 profiles the 100 players that truly matter in the sector.

This year’s list features companies spanning every segment of the market, from long-established remittances players and banks to neobanks, B2B platforms, stablecoin providers and regional specialists. Together, these companies move trillions of dollars across the globe every year, powering P2P and B2B transfers as well as ecommerce payments and disbursements globally.

This year, we’ve considered how the industry and the types of companies we’ve come to examine are broader than ever before. VC-backed companies continue to mature, businesses diversify and expand into new arenas and technology continues to change how some companies deliver services entirely. Trying to fit all the companies awarded a place on our map into narrow boxes does them a disservice, which is why we have not included distinct categories within the map itself this year.

That being said, as with every year, shifts in the market have prompted changes to who we’ve included. Several new additions to the map this year are in recognition of the growing significance that stablecoins and blockchain are having in the market: Paxos, BVNK and Fireblocks have been included on our map for the first time, while Stellar, Circle and Ripple have returned this year.

There are also other additions that reflect the increasingly global nature of the space, including Canada’s Shopify and Nuvei as well as Japan’s SBI Holdings and China’s XTransfer.

We’ve used the combined industry expertise of our team and our unique data to make this list the definitive guide to key players in the cross-border space. In addition to our market map, we’ve featured a bio for each company in alphabetical order below. Scroll down to view The 2025 Cross-Border Payments 100 market map or select from the links below to jump to the relevant section:

- The Top 100 Cross-Border Payment Companies for 2025: Market Map

- The 2025 Cross-Border Payments 100 in detail

The Top 100 Cross-Border Payment Companies for 2025: Market Map

Published every year, our market map recognises the leading companies in cross-border payments worldwide, including publicly traded companies, startups and private companies. It covers companies operating across consumer money transfers and remittances, B2B payments, ecommerce companies, payment processors, mobile payments players and beyond.

Here’s The 2025 Cross-Border Payments Top 100 in full:

To make our list, companies have to fulfill certain criteria:

- Be of a certain scale. This is not a startup or VC list (there are lots of those). This is also not a challengers list.

- Companies don’t have to have raised outside funds, but they must have an established customer base.

- Cross-border payments must either be the primary activity (many payment companies) or a substantial revenue line (certain banks, payment processors or card companies). With subsidiaries, we include them in the parent company, rather than listing them separately.

To produce a definitive overall list, every company considered for inclusion is assessed against four areas: their significance as a company globally, their significance in their given market or segment, to what extent cross-border payments is a key part of their business and to what extent they are growing. The combined scores determined which companies made the final 100.

Every player also met our sense check: if we removed the company, would it have a meaningful impact on the sector? We track over 15,000 players in the space, making this 100 the cream of the crop.

The 2025 Cross-Border Payments 100 in detail

Below, we’ve included key information about every company in FXC Intelligence’s 2025 cross-border payments top 100, with companies being split into alphabetical order in accordance with the main map.

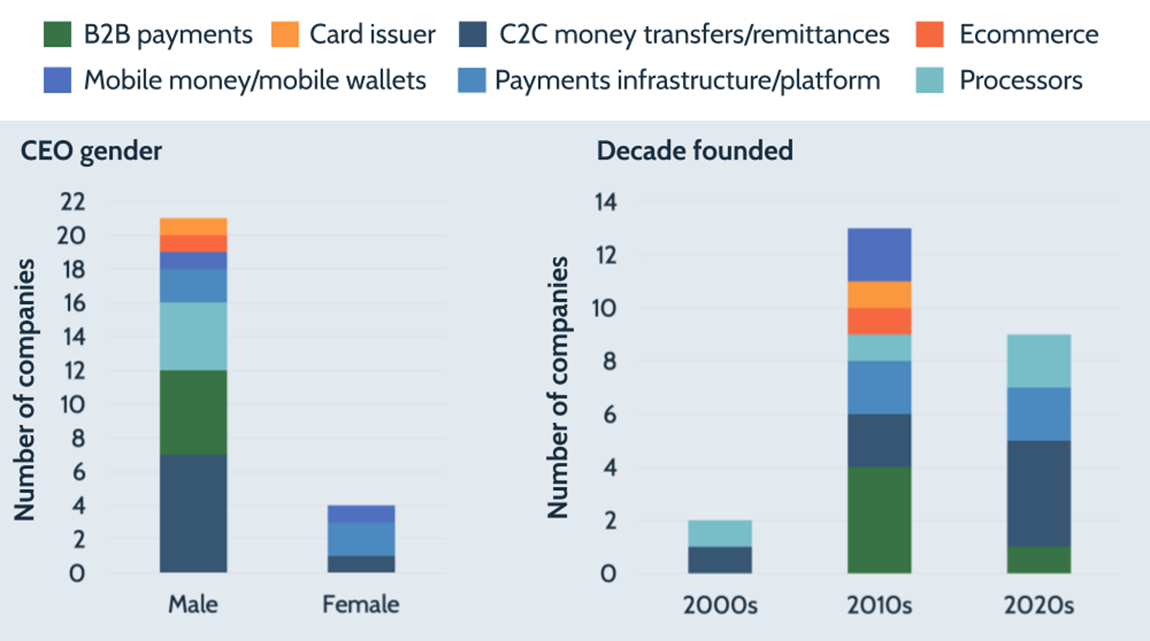

This year we’ve also added icons to indicate some of the main business areas each company focuses on. While by no means exhaustive, this provides a quick sense of the areas of the market each company caters to, and can be interpreted using the following key:

A-B

Adyen

Founded: 2006

CEO: Pieter van der Does, Ingo Uytdehaage (Co-CEOs)

Customer focus: Merchants

Focus region: Europe, US

Years on Top 100 Map: 7

Adyen was founded to help create more efficient payment technologies and infrastructure, and provide shopping day insights to merchants. The company has more than 4,300 employees in 28 offices worldwide, and has served clients including Uber, Adobe, Ebay and Microsoft. The core focus for Adyen is processing payments in the biggest developed markets globally, in particular Europe and North America – though its APAC business has been growing.

In the company’s recent full year results, it reported it had processed a total of €1.3tn ($1.4tn) in 2024, with revenues rising 23% to just under €2bn ($2.2bn). The company has increasingly moved towards PoS systems, but its Digital segment – which likely contains its highest cross-border volumes – makes up the majority of its revenues. The company has expanded its European operations recently, partnering with global BNPL firms such as Klarna and Affirm and introducing a new AI-powered payment optimisation product, Adyen Uplift.

Airtel Money

Founded: 1995

CEO: Gopal Vittal (Shashwat Sharma from January 2026)

Customer focus: Remittances, Consumers, SMEs, Large Enterprises

Focus region: India

Years on Top 100 Map: 5

Airtel Money is a mobile commerce service that allows users to send and receive money across Airtel’s network using their mobile phone numbers. It is part of Airtel, a leading telecommunications company based in India that offers wireless connectivity, prepaid and postpaid mobile and broadband services to consumers and businesses. Overall, Airtel serves 550 million customers across 15 countries. It has collaborated with leading money transfer operating companies (most notably Western Union) to enable real-time payments across millions of bank accounts in India and Africa.

Airtel’s consolidated revenues rose by 8% in its FY 2024 results (ending in March 2024) to ₹1.5tn ($18.1bn, based on March 2024 exchange rates) and 19% revenue growth in its Q3 FY 2025 results (October-December 2024). In March 2025, Airtel Money partnered with Network International to roll out a suite of digital payment solutions across a number of key African markets, including Uganda. Also in March, dLocal enabled Airtel Money as a payment method for Google Play in Kenya, where the company reportedly has over 31.5 million mobile money accounts (nearly 80% of the adult population).

Airwallex

Founded: 2015

CEO: Jack Zhang

Customer focus: Marketplace Sellers, SMEs

Focus region: APAC

Years on Top 100 Map: 7

Airwallex was founded in Melbourne, Australia, and has since grown to over 1,700 people in 27 offices worldwide. The company has raised over $900m (as of April 2025) and is one of the payment sector’s unicorns. It initially focused on cross-border payouts, but its offering has since expanded into an end-to-end financial platform for companies to manage their business in multiple markets and currencies, including online checkout, expense management, bill payment and more. Airwallex’s payment network allows businesses to get paid, manage funds and payout more efficiently across over 150 countries and more than 60 currencies.

Airwallex is expanding its focus in the APAC region, having recently secured an online payment licence in China after acquiring Guangzhou Shang Wu Tong Network Technology. The company announced it had surpassed $100bn in annual processing volume in August 2024, and has recently seen expanded partnerships and launches across a variety of markets, including Brazil, Mexico, the UK and New Zealand.

Al Ansari Exchange

Founded: 1966

CEO: Rashed Al Ansari

Customer focus: Consumer money transfers/Remittances, SMEs

Focus region: Middle East

Years on Top 100 Map: 4

Al Ansari Exchange is an established provider of foreign exchange, remittance, bill payment and corporate services. With more than 260 branches across the UAE, the company serves around three million customers each month.

In April 2025, Al Ansari Exchange renewed its strategic partnership with Visa to bolster services, while its parent company, Al Ansari Financial Services, completed its $200m acquisition of BFC Group Holdings. In April 2023, Al Ansari took the company public through an IPO that valued it at about $2bn – part of its strategy to grow its consumer remittances and B2B offerings, as well as expand to new markets in the Gulf.

Al Fardan Exchange

Founded: 1971

CEO: Hasan Fardan Al Fardan

Customer focus: Remittances, SMES, Enterprises

Focus region: Middle East, Europe, APAC, LatAm

Years on Top 100 Map: 5

UAE-based Al Fardan Exchange is a leading foreign exchange and money transfer business, offering cross-border payments and forex solutions, with over 80 branches across the UAE and partnerships with 150 financial services organisations worldwide.

In February 2025, Al Fardan Exchange announced that it has rolled out a new cross-border remittance service with Visa Direct, enhancing its remittances services by enabling transfers to Visa Direct cards in more than 30 countries across MENA, Europe, North America and Southeast Asia.

Alpha Group

Founded: 2009

CEO: Clive Kahn

Customer focus: Mid-Size and Large Corporates, Institutional

Focus region: UK, Global

Years on Top 100 Map: 7

Alpha Group (previously Alpha FX) is a London-based payments and hedging company focused on mid-size and large corporates. It offers a range of banking solution products as part of its payments business, and its team of over 500 employees across 11 international offices serves customers across more than 50 countries.

In 2024, Alpha’s revenues rose 23% to £135.6m ($173.3m), driven primarily by rises in its Private Markets and Corporate revenues, which themselves contain margins on spot, forwards and options contracts. In June 2024, Alpha was included in the FTSE 250 Index, having moved from the AIM market to the Premium Segment of the London Stock Exchange in May 2024.

Amazon

Founded: 1994

CEO: Andy Jassy

Customer focus: Consumers, Merchants, Ecommerce Businesses

Focus region: US, Global

Years on Top 100 Map: 3

Starting out as an online marketplace for books, Amazon has since grown to become the world’s biggest ecommerce company, serving customers worldwide. As of late April 2025, the US-based company has a market capitalisation of $1.99tn, making it one of the world’s most valuable companies. It also contains Amazon Pay, an online payment service that allows customers to use their Amazon account to make payments on external merchant websites.

Amazon’s net sales revenue rose by 11% to $638bn in 2024, of which North America contributed $387.5bn (61%), international segment sales contributed $142.9bn (22%) and Amazon Web Services contributed $107.6bn (17%). The company has also partnered with Stripe to enable cross-border payments.

American Express

Founded: 1850

CEO: Stephen Squeri

Customer focus: Consumers, SMEs, Enterprises

Focus region: US

Years on Top 100 Map: 7

One of the 30 components of the Dow Jones Industrial Average, American Express (Amex) has grown to become one of the world’s largest providers of card payment services. The company’s total revenues net of interest expense rose by 9% to $65.9bn in 2024, backed by total billed business volumes (which spans transaction volumes across Amex’s payment products) of $1.6tn. Total revenues net of interest expense for international card services rose by 10% to $11.5bn.

In February 2025, Amex and Alipay launched a new feature enabling Amex users to link their cards to Alipay’s digital wallet, enabling visitors to China to make payments at thousands of merchants across the country. In March 2024, the company’s Global Business Travel segment acquired global business travel and meeting solution provider CWT for approximately $570m. According to the company, more than 800 service providers have certified their payments products and services for use on the Amex network.

Ant Group

Founded: 2004

CEO: Cyril Han

Customer focus: Consumers, Small Businesses

Focus region: China, Global

Years on Top 100 Map: 7

Formerly known as Ant Financial and Alipay, Ant Group is a fintech and affiliate of Chinese multinational tech company Alibaba. Ant Group owns Alipay, China’s largest digital payments platform, which serves over one billion users (as of 2020). It also connects to international e-wallet platforms through cross-border digital payments solution Alipay+, which connects tens of millions of merchants worldwide. Alipay+ has struck partnerships with mobile payment solutions and wallets to enable international payments at merchants globally, with major examples including bKash, GCash, Grab, AlipayHK, KakaoPay, TrueMoney and Touch ‘n Go.

As a result of a share buyback in July 2023, Ant Group was valued at $78.5bn. In March 2024, Ant Group underwent a major restructure, appointing former CFO Han Xinyi as its new president (he has since been appointed CEO) and also spinning out three of its businesses, including Ant International, OceanBase and Ant Digital Technologies, which will now operate independently. As of December 2024, Alipay+ had 35 international payment partners, connecting global travellers to more than 90 million merchants across 66 markets.

Apple

Founded: 1976

CEO: Tim Cook

Customer focus: Consumers, Businesses

Focus region: Global

Years on Top 100 Map: 2

One of the largest companies in the world by market cap (as of May 2025), Apple is a multinational provider of consumer electronics, software and online services. In total, the company recorded net sales of $391bn in FY 2024 (ending September 2024). The company launched its mobile payment service Apple Pay in 2014.

Payments on Apple Pay are supported by merchants in over 90 countries worldwide across North America, the Middle East, LatAm and the Caribbean, Europe, APAC and Africa (. As of October 2024 (Apple Pay’s 10th anniversary), it was supported by more than 11,000 bank and network partners. In May 2025, it was announced that Apple Pay would be integrated with the Mesh global crypto payments network to enable users to make stablecoin payments at merchants.

Bank of America

Founded: 1784

CEO: Brian Moynihan

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: US

Years on Top 100 Map: 7

Bank of America (BofA) is one of the largest banks in both the US and the world. The bank in its current iteration was formed after BankAmerica was acquired by NationsBank, nearly a century after the founding of its first iteration as the Bank of Italy in 1904 and more than two centuries after what is now the eastern portion of its business was chartered as Massachusetts Bank.

The bank now serves approximately 69 million consumer and SME clients across 35 countries via approximately 3,700 retail financial centres. It also offers payment, FX and banking services to other banks and fintechs in the sector. BofA’s cross-border solutions are largely represented by its Global Transaction Services segment, which grew 1% to $2.7bn in Q1 2025 and formed around 45% of the bank’s overall Global Banking revenue. In April 2025, BofA announced two key leadership changes to its payments team, including adding Phil Carmalt as Head of Asia Pacific Global Payments Solutions and Gabriel Andrade as Managing Director and Head of Global Payments Solutions for Mexico.

Banking Circle

Founded: 2013

CEO: Anders la Cour

Customer focus: Payment Businesses, Marketplaces, Banks

Focus region: Europe

Years on Top 100 Map: 7

Headquartered in Luxembourg, Banking Circle provides financial institutions with direct access to clearing and payment schemes in multiple countries, allowing them to provide cross-border payment services. The company facilitates payments for more than 530 financial institutions worldwide, and processes €700bn ($798bn as of April exchange rates) in payment volumes annually. The company also has offices across several other countries, including the UK, Germany and Denmark.

Last year, Banking Circle engaged in a number of strategic partnerships, including Chinese B2B payments provider XTransfer, and web3 money app Wirex. It also launched a new EUR-backed stablecoin, EURI, as well as becoming an early adopter of Sweden’s instant payments system RIX-INST. In March 2025, Banking Circle secured in-principle approval for a Major Payment Institution licence from the Monetary Authority of Singapore.

Banorte (UniTeller)

Founded: 1899

CEO: Jose Marcos Ramirez Miguel

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: Mexico

Years on Top 100 Map: 5

Based in Monterrey and Mexico City, Banorte is one of Mexico’s largest commercial banks, offering a variety of financial products to individuals and businesses. The bank is the holding company of UniTeller, a leading US-based global payments company that enables transfers to more than 200,000 cash pickup points and more than 5,000 bank and mobile wallet accounts across more than 120 countries worldwide. It also offers payment, FX and banking services to other banks and fintechs in the sector.

In November 2024, UniTeller completed its acquisition of More Payment Evolution, significantly expanding the company’s market reach and adding new B2B capabilities to the business, as Uniteller CEO Alberto Guerra told FXC at the time. The company is now aiming to bring its expanded B2B payments solution to more clients across LatAm.

Barclays

Founded: 1690

CEO: C.S. Venkatakrishnan

Customer focus: Consumers, SMEs, Large Enterprises

Focus region: UK

Years on Top 100 Map: 7

Barclays is a British multinational bank with headquarters in London, UK. It operates in 38 countries and employs over 91,000 staff. In 2024, its revenue grew 2% to $34.2bn (£26.8bn), while total assets amounted to $1.9tn (£1.5tn). The bank serves 48 million customers, and its international payments service allows money to be sent to over 90 countries and up to 60 currencies

Barclays also offers payment, FX and banking services to other banks in the sector, while the bank’s fintech unit serves many hundreds of cross-border payment companies across the globe. In April 2025, the bank announced a partnership with Brookfield Asset Management to spin out its payment acceptance business into a standalone business, with a majority stake passing to Brookfield at an unspecified point after three years.

BNP Paribas

Founded: 1848

CEO: Jean-Laurent Bonnafé

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: France

Years on Top 100 Map: 5

Established in 2000 by a merger of leading French bank BNP and international investment bank Paribas, the history of BNP Paribas stretches back to the early 19th century. Today, the bank has 178,000 employees in 64 countries. In 2024, the bank’s revenues rose by 3% to €48.8bn ($52.8bn) and as of April 2025, its market capitalisation was around €84bn ($91.3bn). It offers cash management services among its cross-border payments capabilities, as well as providing payment, FX and banking services to other banks and fintechs in the sector.

The bank appointed new Chief Information Officer Marc Camus in April 2025. In December 2024, BNP Paribas participated in a series of wholesale settlement solution trials using distributed ledger technology transactions with the Eurosystem. This came after the bank signed a series of deals with Ant International to enable thousands of BNP Paribas’ merchant clients to accept payments from more than 25 international mobile partners via Alipay+ in July 2024.

BNY

Founded: 1784

CEO: Robin Vince

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: US

Years on Top 100 Map: 6

BNY (formerly BNY Mellon) was established in 2007 through a merger of Mellon Financial, which was founded in 1870, and the Bank of New York, which was founded by Alexander Hamilton in 1784. In 2024, the bank saw revenues rise 5% to $18.6bn and at year end had $52.1tn under custody and/or administration.

BNY’s FX Payments solution allows money to be sent to over 160 countries and received in more than 50 countries. It also offers payment, FX and banking services to other banks and fintechs in the sector. The bank partnered with OpenAI to develop an AI platform in February 2025, and in the same month reportedly sent the largest instant payment in US history. In August 2024, the Commonwealth Bank of Australia and BNY struck a deal to facilitate 24/7 global payments from overseas to Australian bank accounts.

Booking.com

Founded: 1996

CEO: Glenn D. Fogel

Customer focus: Consumers, Travel Retailers

Focus region: Netherlands, Global

Years on Top 100 Map: 3

Based in Amsterdam, the Netherlands, Booking.com has become one of the world’s largest travel agencies, allowing consumers to make bookings at hotels across 229 countries, with more than 29 million reported total accommodation listings across the site. The company’s Payments by Booking.com system facilitates guest payments across a variety of payment methods, including credit cards, debit cards and payment services such as PayPal, Apple Pay, Google Pay and Alipay.

Booking Holdings – the holding company that operates Booking.com as well as several other travel search engines – reported an 11% rise in revenues to $23.7bn for 2024. In January 2025, Booking.com partnered with Ant International-owned merchant payments provider Antom to integrate payment options that will allow it to expand across numerous Asian markets including Hong Kong, Indonesia, Malaysia and more. Booking Holdings has also been working to integrate generative AI in its offerings, in particular Booking.com’s AI Trip Planner.

BVNK

Founded: 2021

CEO: Jesse Hemson-Struthers

Customer focus: Payment Service Providers, Fintechs, Payroll Providers, Payment Networks

Focus region: UK, Europe, USA

Years on Top 100: 1

Based in the UK, BVNK is one of a number of stablecoin and web3 players to be added to the Top 100 map this year in recognition of the growing importance of the sector. A stablecoin-based B2B2X provider, BVNK enables customers to send and receive stablecoin payments as well as launch stablecoin products that interoperate with their fiat-based solutions. Its target markets include fintechs, payment service providers, marketplaces and global payroll, with clients including Rapyd, Deel and Trust Payments.

Having previously appeared on our 2023 30 Most Promising map, BVNK has seen significant growth over the past few years. In 2024, it saw its payments volume climb 200% YoY to $10bn – with annualised volume having passed $12bn by the end of Q1 2025 – as well as launching its stablecoin payments orchestration solution Layer1. After raising $50m in a December 2024 funding round led by Haun Ventures alongside investors including Coinbase Ventures, Avenir and Tiger Global, as well as attracting further investment from Visa in May 2025, it is now looking to expand beyond its largely UK and Europe focus to the US market.

How can FXC Intelligence help me find the right partner to build a cutting-edge payments solution?

C-G

Checkout.com

Founded: 2009

CEO: Guillaume Pousaz

Customer focus: Merchants, Fintechs

Focus region: Global

Years on Top 100 Map: 6

Launched as a cloud-based payment platform in Singapore, Checkout.com has over 1,000 employees in 19 global offices, with a headquarters in the UK. It specialises in processing international payments for ecommerce businesses and other fintechs, and offers an all-in-one payment solution for merchants that eliminates the need for intermediaries. The company processes payments across more than 150 currencies.

In 2024, Checkout.com reported 45% YoY net revenue growth in its core business, added more than 300 enterprises to its client base and now has more than 40 merchants processing over $1bn annually on its network. Checkout.com has launched virtual and physical card issuing, allowing its clients to create payment cards for their customers. In early 2025, the company entered strategic partnerships with Ebay, Temu and Mastercard.

CIBC

Founded: 1867

CEO: Victor G. Dodig

Customer focus: Consumers, Businesses

Focus region: Canada

Years on Top 100 Map: 4

Based in Toronto, Canada, the Canadian Imperial Bank of Commerce (CIBC) is one of the country’s biggest providers of banking and financial services. It provides a variety of commercial and banking services to 14 million clients in Canada, the US and worldwide. It enables peer-to-peer remittances to 130 countries through its Global Money Transfer service. It also offers payment, FX and banking services to other banks and fintechs in the sector. In addition, CIBC runs online-only bank Simplii Financial, which offers a number of cross-border-related services, including international student banking and a USD savings account.

In its 2024 annual report, CIBC noted that it had expanded its range of digital first solutions for CIBC by enabling real-time, no transfer-fee remittance to GCash, Maya, WeChat, bKash and M-PESA. In January 2024, CIBC partnered with Visa to add its Visa Direct services, which will allow CIBC and Simplii clients to send money to digital wallets in a range of destinations such as the Philippines, China, Bangladesh and Kenya.

Circle

Founded: 2013

CEO: Jeremy Allaire

Customer focus: Businesses, Financial Services, Crypto-Native Companies

Focus region: US, Global

Years on Top 100: 3

Headquartered in New York, US, Circle is a leading provider of stablecoin-related solutions that this year returns to the Top 100 as this sector gains industry momentum. Best known as the issuer of USDC, the most widely used US dollar-backed stablecoin across mainstream financial institutions, Circle also issues the Euro-backed EURC and has a host of developer services designed to support development of USDC-based financial products.

Adoption of USDC has climbed significantly over the last year, with more than $60bn currently in circulation. This has also helped Circle’s revenue to surge in recent years, topping $1.7bn in 2024. Although USDC is already used in a variety of real-time settlement applications, including by players such as Félix and BCRemit, this year Circle stepped up its payments network presence with the announcement of the Circle Payment Network, a stablecoin-based global money movement network based on stablecoins, which is currently at the pilot stage.

Citi

Founded: 1812

CEO: Jane Fraser

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: US

Years on Top 100 Map: 7

Based in New York City, Citi is a leading international bank serving 19,000 institutional clients across 180 countries. The bank’s Treasury and Trade Solutions division serves global businesses with solutions that provide greater transparency into incoming payments, help them initiate payments securely and facilitate trade worldwide. As part of this, Citi’s WorldLink solution is widely used across the sector and has enabled cross-border payments for over 30 years, allowing Citi to issue payments in more than 135 currencies. The bank also offers payment, FX and banking services to other banks and fintechs in the sector.

The bank released a report on cross-border payments in October 2024, in which it said that nearly half of 100 financial institutions in a survey said they saw room for improvement in extracting higher revenue from their cross-border payments products. In its FY 2024 results, Citi saw its cross-border flows reach $380bn, a 6% increase on FY 2023, while Q1 2025 saw flows pass $95bn.

Convera

Founded: 2009

CEO: Patrick Gauthier

Customer focus: B2B Payments, SMEs, Large Businesses, Fintechs, Financial Services

Focus region: US, Global

Years on Top 100 Map: 4

Convera provides FX risk management, international payments and education payment services to over 20,000 customers, spanning more than 140 currencies and over 200 countries and territories. It has over 250 partners globally and claims to be the largest non-bank global B2B payments platform.

Formerly Western Union Business Solutions, itself formed from the acquisitions of Custom House in 2009 and Travelex Global Business Payments in 2011, US-based Convera was formed in 2022 from a $910m private equity buyout from parent Western Union. The company is focused on customers across B2B, B2C and C2B, and is pursuing the fragmented B2B market as a strong growth opportunity. Recent partnerships include Unlimit and Ascent One to enhance international payments for students, as well as AP platform Routable to provide a wider payments network for its business clients.

Corpay Cross-Border Solutions

Founded: 1992

Group President: Mark Frey

Customer focus: SMEs, Corporates, Institutional, Fintechs, Financial Services

Focus region: North America, Latin America, Europe and Australasia

Years on Top 100 Map: 7

US-based Corpay Cross-Border Solutions allows businesses to track, manage and automate global B2B payments across several cross-border and card-based solutions. In March 2024, its parent company FLEETCOR rebranded to take on the name of its corporate payments division, then known just as Corpay. With regards to that division, the company says it facilitates more than 4.1 million payments annually across over 200 countries and more than 21,000 customers.

Corpay saw its cross-border payments revenue rise by 20% in FY 2024, while Corpay’s wider B2B payments-focused corporate payments segment saw 26% revenue growth to $1.2bn. In February 2025, Corpay Cross-Border Solutions introduced multicurrency accounts, which Group President Mark Frey told us would offer a one-stop-shop solution for corporates making payments globally. In April 2025 it also saw Mastercard buy a 3% stake, valuing Corpay Cross-Border Solutions at $10.7bn. The company deployed $1.3bn in capital in 2024 to acquire three companies – GPS, Paymerang and Zapay – and in 2025 acquired a minority stake in AvidXchange as part of a deal to take the AP automation player private.

DBS

Founded: 1968

CEO: Tan Su Shan

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: Singapore

Years on Top 100 Map: 7

DBS is a leading financial services provider based in Singapore. It now operates across 19 markets, with more than 12 million customers. It also offers payment, FX and banking services to other banks and fintechs in the sector. The bank’s DBS Globesend solution for cross-border payments spans 132 currencies and 190 countries. In 2024, DBS saw total income rise 10% to SGD 22.3bn ($16.7bn).

DBS is a participating bank in PayNow – the real-time payments service that allows Singapore users to send and receive money instantly, and which has recently been connected to Malaysia’s DuitNow and India’s Unified Payment Interface system to enable cross-border instant payments. In June 2024, it announced a deal to power UAE-based bank Mashreq’s cross-border P2P payments across APAC, Europe and the Americas, while in October 2024, the bank rolled out a suite of blockchain-powered banking services for institutional clients.

Deel

Founded: 2019

CEO: Alex Bouaziz

Customer focus: Large Enterprises, SMEs

Focus region: US, EMEA, Africa

Years on Top 100 Map: 2

Deel is a provider of global payroll and compliance services that serves businesses hiring international employees and contractors. The company says it has onboarded 500,000 workers globally and processed $10bn in global payroll for more than 35,000 businesses worldwide. The company serves more than 150 countries with its global HR platform.

In total the company has raised $979m, including $300m it accrued in a secondary share sale in February 2025. Deel’s annual revenue run rate rose by 70% to $800m in 2024. Deel has partnered with numerous providers in the cross-border payments space, including Brex, Paysend and Wise. In 2024, it acquired Munich-based AI business Zavvy as well as Africa-based payroll and HR company PaySpace.

Deutsche Bank

Founded: 1870

CEO: Christian Sewing

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: Germany

Years on Top 100 Map: 7

Deutsche Bank is a leading German bank that provides financial services for consumers and businesses. The bank’s total revenue in 2024 rose by 4% to €30.1bn ($32.6bn). Through its FX4Cash platform, Deutsche Bank facilitates cross-border payments in more than 130 currencies, enabling vendor/supplier payments, royalty payments, international payroll and more. It also offers payment, FX and banking services to other banks and fintechs in the sector. Deutsche Bank serves many of the larger cross-border payments companies globally and also offers clients its own tracker for international payments.

In March 2025, Deutsche Bank partnered with popular Spanish mobile payment solution Bizum to enable corporate businesses to accept the payment method. It has also been growing its presence in APAC, investing in Singapore-based fintech Partior in November 2024 and having launched merchant solutions in Australia, India, Indonesia and South Korea in December 2024.

dLocal

Founded: 2016

CEO: Pedro Arnt

Customer focus: Merchants, Fintechs

Focus region: LatAm, APAC, Middle East, Africa

Years on Top 100 Map: 7

Uruguay-based dLocal provides a payment platform that facilitates cross-border payments and online transactions for merchants and their customers. The company has more than 1,000 employees and supports payment operations for merchants across 40+ countries and over 900 payment methods.

dLocal says it processed $25.6bn – $11.9bn of which was cross-border – and saw revenues increase 15% to $746m in its 2024 results. The company secured a payments licence in the UK in January of this year, allowing it to expand payments services to merchants in the country. It has also seen a number of partnerships to expand over the last year, including with Ria, MoneyGram, Aza Finance, Belmoney and Airtel Mobile Money.

Ebanx

Founded: 2012

CEO: João Del Valle

Customer focus: Large Enterprise Merchants, Payment Companies, Fintechs

Focus region: LatAm, Africa, Asia

Years on Top 100 Map: 6

Ebanx is a leading payment solutions company based in Brazil offering pay-in/payout services, fraud and risk management and B2B payments services. The company’s cross-border payments platform is used by more than 1,000 merchants to directly integrate with payment partners, as well as accept more than 200 payment methods. Ebanx’s services enable more than 930 million customers to make purchases on international websites. It has operations in 17 LatAm markets, 11 African countries and one country in Asia (India).

Ebanx has been making further strategic expansions into these markets, as well as supporting payments for companies in APAC, North America and Europe. In March 2025, the company introduced Robert-Jan Lieben as new Vice-President of Commercials in Europe to help expand partnerships with European tech companies seeking to serve emerging markets. Ebanx has raised more than $460m in funding over three rounds, with the most recent being a Series B funding round in June 2021.

Euronet (Ria, XE)

Founded: 1994

CEO: Michael J. Brown

Customer focus: Remittances, Consumers, SMEs, Fintechs

Focus region: US

Years on Top 100 Map: 7

Headquartered in Leawood, US, Euronet provides financial services and products to more than 200 countries around the world. It has three divisions with the largest, money transfer, now accounting for nearly half of all revenues. Euronet owns two major international money transfer companies, Ria and XE, which focus on remittances and consumer and SME payments respectively. Euronet also offers its platform and payout network to other industry players through its Dandelion solution.

Euronet’s revenues increased 8% to $4bn in 2024, with growth driven partly by direct-to consumer digital transactions spurring an 8% increase in money transfer revenue to $1.7bn. The company is also growing its retail segment with its number of network locations rising to 625,000 annually as of Q1 2025. Also in its Q1 results, the company announced a new integration with Visa Direct, which will enable payouts to four billion cards worldwide in addition to Euronet’s existing money transfer network spanning 4 billion bank accounts and 3.2 billion digital wallets.

Fireblocks

Founded: 2018

CEO: Michael Shaulov

Customer focus: Banks, Fintechs, Exchanges, Liquidity Providers, Hedge Funds

Focus region: US, Global

Years on Top 100: 1

Another addition as part of our inclusion of stablecoin players, Fireblocks is a US-headquartered provider of stablecoin infrastructure used for applications including cross-border payments, remittances, treasury management and stablecoin payments across both fiat and cryptocurrency-based payments. Centring trust and security in its offering, the company includes players such as Worldpay, HSBC, Visa and Banking Circle among its customers.

Having processed more than $10tn in transactions since it launched in 2018, Fireblocks handles more than 35 million payment transactions a month, which it reports is around 15% of global stablecoin volumes. This last year has seen it continue to grow in reach and presence, including with the addition of a Japan office as well as the announcement of partnerships with SMBC, AWS, Google Cloud and Circle Payments Network.

Fiserv

Founded: 1984

CEO: Frank Bisignano (Michael P. Lyons to take over from July 2025)

Customer focus: SMEs, Large Enterprises, Merchants, Financial Services Companies

Focus region: US, Global

Years on Top 100 Map: 7

Fiserv delivers financial services – including account processing, digital banking, card issuer services and payment processing – to more than 100 countries, with clients including more than six million merchants and almost 10,000 financial institutions. The company says it has nearly 1.6 billion issuing accounts on file. Fiserv reported its revenues grew 7% to $19.1bn in 2024, driven primarily by its merchant acceptance segment.

In April 2025, the company announced it had signed a deal to buy Brazilian fintech Money Money to support SMEs in the country, adding to other recently announced acquisitions of payments solutions providers Pinch Payments and CCV, and closed its Payfare acquisition in March 2025. The company is looking to expand the scale and reach of its Clover PoS solution, having launched across numerous countries recently such as Brazil and Australia.

Flutterwave

Founded: 2016

CEO: Olugbenga Agboola

Customer focus: SMEs, Large Enterprises, Fintechs

Focus region: Africa

Years on Top 100 Map: 5

Flutterwave is a Nigerian fintech providing payment infrastructure for global merchants and payment service providers in Africa. Businesses can collect payments and process payouts globally across more than 30 currencies with Flutterwave’s API, and currently supports more than one million business clients and more than two million individuals. As of the release of its 2024 annual report in February 2025, Flutterwave has processed more than 890 million transactions – valued at $34bn in total.

The company said that in 2024, nearly 50% of businesses on Flutterwave received payments from new geographic locations, highlighting the continued demand for the company’s services. In 2025, Flutterwave has continued to grow its reach in Africa, having secured licences to expand payment operations to Zambia and Ghana, as well as signing a business payments deal with the Small and Medium Enterprises Development Agency of Nigeria. The company named Mitesh Popat as its new CFO in September 2024, when it also expanded the reach of its remittance app to 49 US states.

Flywire

Founded: 2009

CEO: Mike Massaro

Customer focus: B2B and Corporates in Education, Healthcare, Travel

Focus region: US, Global

Years on Top 100 Map: 7

Headquartered in Boston, US, Flywire provides a payments platform and bespoke software to clients across the education, healthcare, B2B and travel markets. The company enables payments for more than 4,500 clients across 140 currencies spanning 240 countries and territories worldwide.

In Flywire’s 2024 results, the company reported revenues had increased 22% to $492m, with total payments volume reaching $29.7bn. During this year, the company acquired SaaS business Invoice to bolster its B2B payments segment, though cross-border education and travel payments continue to be the core driver of its revenues. The company has increasingly been building traction in Asia, having integrated education payments via the State Bank of India in February 2024. In February 2025, the company announced it was going through a restructure while also acquiring software and payments platform Sertifi.

Global Payments

Founded: 1967

CEO: Cameron Bready

Customer focus: SMEs, Large Enterprises, Merchants, Financial Services Companies

Focus region: North America, Europe, APAC, LatAm

Years on Top 100 Map: 7

Based in Atlanta, US, Global Payments offers payment technology and services to merchants and financial institutions, with a primary focus on ecommerce. With over 27,000 employees, the company serves more than four million customers in over 170 countries.

In April 2025, Global Payments – alongside FIS and GTCR – announced that it would be acquiring payments processor Worldpay in a $24.25bn deal, while selling its Issuer Solutions segment to FIS under a new partnership. This is expected to grow the company’s annual transaction volume to $4tn, making it one of the largest payments processors in terms of transaction volume globally. In its 2024 earnings report, the company announced its adjusted net revenues had increased 6% to $9.2bn.

Goldman Sachs

Founded: 1869

CEO: David M. Solomon

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: US

Years on Top 100 Map: 7

Headquartered in New York, Goldman Sachs provides financial services spanning investment banking, securities and asset management for individuals, businesses and organisations. As of December 2024, Goldman Sachs overall has a headcount of 46,500 across offices in over 40 countries, and has a market cap of $170bn+ as of early May 2025.

It also offers payment, FX and banking services to other banks and fintechs in the sector. The bank’s domestic and global payments services – Transaction Banking – offers domestic and cross-border payments as well as liquidity, escrow and banking-as-a-service solutions. Goldman Sachs saw net revenues rise by 16% to $53.5bn in 2024.

Founded: 1998

CEO: Sundar Pichai

Customer focus: Consumers

Focus region: Global

Years on Top 100 Map: 2

Google is a multinational company with services across search engine technology, computer software, ecommerce, consumer electronics, AI and online advertising. The company’s Google Pay mobile payment service is used by millions of users to make cross-border payments worldwide. Google Pay is used to make payments on websites, in shops and in apps through cards saved to a Google Account.

In February 2024, Google announced it was going to replace Google Pay with Google Wallet – the company’s digital wallet platform that enables users to store payment methods, passes, tickets, keys and IDs on their Android phones – in the US. In January 2024, India’s National Payments Corporation of India partnered with Google Pay India to expand the use of the country’s Unified Payments Interface (UPI) system to other countries globally, with Google Wallet launching in the country in May 2024.

Grupo Elektra

Founded: 1950

CEO: Gabriel Alfonso Roqueñí Rello

Customer focus: Consumers, SME

Focus region: LatAm

Years on Top 100 Map: 2

Grupo Elektra is a financial services and retail corporation that offers a variety of ecommerce, money transfer and financial services, focusing on the LatAm market. Its financial division is made up of Banco Azteca, Purpose Financial, Afore Azteca, Seguros Azteca and Punto Casa de Bolsa.

The company’s remittances service, Elektra Go Lite, enables transfers to Banco Azteca digital accounts, as well as more than 2,000 Elektra and Banco Azteca branches through the Elektra Go Lite App. Elektra has historically partnered with a diversified network of money transfer operators to help power its services, including MoneyGram, transNetwork, Western Union and Remitly, and added new partnerships with MaxiSend and InterCambio in 2024.

How is FXC Intelligence’s data helping the cross-border ecommerce industry?

H-O

HSBC

Founded: 1865

CEO: Georges Elhedery

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: UK, Asia

Years on Top 100 Map: 7

Based in London, HSBC is one of the biggest financial services organisations in the world, with approximately 41 million customers and a network spanning 58 countries and territories. Through its Global Money Account product, it’s possible to send up to £50,000 per day to over 200 different countries and regions across more than 50 currencies, with instant payments available to other HSBC Global Money Transfers accounts. HSBC also offers payment, FX and banking services to other banks and fintechs in the sector.

HSBC facilitated over $850bn in trade in 2024, as well as generating $26.3bn in revenue from transaction banking. From 1 January 2025, the company implemented a new structure with a separated Corporate and Institutional Banking segment containing its Global Banking and Markets Business. HSBC has continued to grow its corporate arm through the launch of its new Smart Transact Platform, as well as partnerships with China’s Cross-Border Interbank Payment System and network provider Dandelion.

iBanFirst

Founded: 2013

CEO: Pierre-Antoine Dusolier

Customer focus: SMEs, Large Enterprises

Focus region: Europe

Years on Top 100 Map: 7

Founded in France and based in Belgium, iBanFirst offers an online platform for multicurrency transactions. It now allows businesses to send and receive payments in 30 currencies to and from 180 countries. The company serves more than 10,000 clients worldwide. As of a May 2024 press release, the company had more than 350 employees in 10 European countries and was processing a volume of transactions worth almost €2bn a month ($2.16bn based on exchange rates in May 2024).

In March 2025, iBanFirst reported it had been granted an Electronic Money Institution licence from the UK’s Financial Conduct Authority, with which it would plan to scale its operations in Europe. The company reported its European turnover grew by around 30% to €65m ($70m) in 2024.

IDT

Founded: 1990

CEO: Samuel Jonas

Customer focus: Consumers, Remittances, Mobile Top-Ups

Focus region: Israel, US, Global

Years on Top 100 Map: 5

Originally a telecommunications company, IDT Corporation is a global provider of communications and payment services. The company owns National Retail Solutions (NRS), a provider of PoS and payment processing services for retailers. As of July 2024, IDT’s BOSS Money remittances service enables remittances to 49 countries in Latin America and the Caribbean, Africa, Europe and Asia with a network including over 235,000 cash payout locations worldwide. BOSS Revolution allows mobile airtime top-ups to over 230 carriers across 93 countries, as well as international calling.

IDT’s fintech segment contributed $121m to total revenues of $1.2bn in its FY 2024 results (financial year ending in July 2024). In January 2025, Boss Money announced that it was expanding its remittance services to Venezuela, Brazil and Eritrea, having handled more than two million money transfers in December 2024, a new monthly record.

Intermex

Founded: 1994

CEO: Bob Lisy

Customer focus: Consumers, Remittances

Focus region: US, Canada, LatAm, Europe

Years on Top 100 Map: 7

Miami-based Intermex enables international money transfers, primarily between the US and Latin America and the Caribbean. In total, the company enables money transfers to more than 60 countries from the US, Canada and Europe.

Intermex maintains an omnichannel approach that prioritises cash-based retail transfers, particularly for money sent from the US to the LatAm region, though it has increased its attention on digital transfers. The company completed its acquisition of competitor La Nacional’s non-US assets in 2023, through which it expects to boost digital transactions in Europe while bolstering existing agent numbers in the US. Intermex reported that the number of transactions sent or received digitally grew 10% to surpass 20 million in 2024.

JPMorgan Chase

Founded: 1799

CEO: Jamie Dimon

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: US

Years on Top 100 Map: 7

With a history dating back to the end of the 18th century, JPMorgan Chase is now the largest bank in the US and the fifth largest in the world. JPMorgan Chase provides FX and payment services to many other financial institutions and cross-border payment companies around the globe. In 2024, the bank’s revenues rose by 12% to $177.6bn. It also offers payment, FX and banking services to other banks and fintechs in the sector.

JPMorgan Chase saw average daily payment volumes of 59.7 million with an average daily value of $10.2tn. J.P. Morgan’s Cross-Currency Solutions enable customers to send money in more than 120 sending currencies and receive in more than 40 currencies, across more than 200 countries and territories. The bank has been exploring the use of blockchain in cross-border payments, particularly through its Kinexys solution. Most recently, JPMorgan Chase launched a new partnership with Indian bank Axis Bank in March 2025 to enable 24/7 global clearing services through the US for Axis’ commercial clients.

LianLian Global

Founded: 2003

Chairman: Xiaosong Zhu

Customer focus: Ecommerce, Marketplace Merchants

Focus region: China

Years on Top 100 Map: 7

LianLian Global is an independent cross-border payments fintech based in China that focuses on ecommerce and marketplace payouts. It serves 5.9 million companies worldwide with global accounts supporting more than 100 countries and regions, more than 60+ ecommerce platforms and more than 130 currencies. It has also partnered with major banks including Citi, Deutsche Bank and J.P. Morgan to power its solutions, which are used by ecommerce companies such as Amazon, Shopify and Walmart.

In April 2025, the company announced it had partnered with B2B payments platform Veem and remittances provider 12Victory. It also partnered with Klasha in December 2024 to enable payment options between China and Africa, and launched a global business payment product, Yueda card, with Visa in November 2024. It has also explored the use of stablecoins in cross-border payments, partnering with RD Technologies in August 2024 to deliver a stablecoin-powered settlement network. The company’s parent LianLian DigiTech went public on the Hong Kong Stock Exchange in March 2024.

Lloyds Bank

Founded: 1765

CEO: Charlie Nunn

Customer focus: Consumers, SMEs, Large Enterprises

Focus region: UK

Years on Top 100 Map: 7

Considered one of the big four banks in England and Wales, Lloyds Bank has 28 million customers worldwide, as of December 2024. Businesses and individuals can send international payments to over 100 countries using its Internet Banking service, as well as make use of the bank’s SEPA Direct Debit services. It also offers payment, FX and banking services to other banks and fintechs in the sector.

In September 2024, it was confirmed alongside 40 other financial institutions as being involved in the Bank for International Settlements cross-border tokenisation initiative ‘Project Agora’. In October that year, it successfully completed a trial of a distributed ledger technology-based payments system alongside Santander and UBS.

M-PESA

Founded: 2007

CEO: Sitoyo Lopokoiyit

Customer focus: Remittances

Focus region: Africa

Years on Top 100 Map: 5

Founded by Vodafone and Safaricom (a leading telecoms provider in Kenya), M-PESA is a mobile phone-based international money transfer service. It serves more than 60 million customers every month across eight African countries, connecting them with more than 970,000 merchants, five million businesses and more than 600,000 agents across the continent. Altogether, the company processes over $4bn annually in cross-border money transfers.

In Safaricom’s 2024 annual results, it reported that M-PESA’s revenue grew 20% to KSh 140bn (around $1.08bn, based on mid-market exchange rate on 31 December 2024). Alongside Visa and Safaricom, M-PESA launched a virtual card in 2022, allowing 30 million of M-PESA’s users to make cashless payments at Visa-enabled merchants. In 2023, M-PESA announced strategic partnerships with Amazon and TerraPay to facilitate global remittances.

Mastercard

Founded: 1966

CEO: Michael Miebach

Customer focus: Consumers, Businesses, Merchants, Financial Institutions

Focus region: US, Global

Years on Top 100 Map: 7

Mastercard is a US-based financial services company, payment processor and the owner of one of the world’s biggest card networks. Altogether, Mastercard serves customers in more than 220 countries and territories worldwide. It also enables cross-border payments through its money movement portfolio Mastercard Move, which facilitates global payments for customers in more than 150 currencies to over 200 markets.

The company saw revenues rise 12% to $28.2bn in its 2024 results, processing a gross dollar volume of $9.8tn, with cross-border volume rising 18%. In 2024, it announced cross-border partnerships with Nexi, Worldpay, The Clearing House and Alipay. Mastercard Move continues to grow with recent new additions including Instapay, MoneyGram, Centiglobe and ACE Money Transfer.

Mercado Libre

Founded: 1999

CEO: Marcos Galperin

Customer focus: Consumers, Merchants

Focus region: LatAm

Years on Top 100 Map: 3

Mercado Libre is an ecommerce business that was founded in Argentina but is now based in Uruguay. The company provides ecommerce and payments services across 18 countries, with a focus on LatAm markets such as Argentina, Brazil, Mexico, Colombia, Chile and Peru. Serving more than 100 million annual unique buyers for the first time in 2024, Mercado Libre consists of its commerce business, Mercado Libre, and its fintech arm Mercado Pago. The company amassed $21bn in net revenue in 2024, with Mercado Pago accounting for $8.6bn (up 24.8%) of revenue on the back of total payment volumes rising 34% to $197bn.

In September 2024, Mercado Pago applied for a banking licence in Mexico, where it is already one of the country’s biggest digital wallets. Earlier, in August 2024, the company launched its own USD-backed stablecoin in Brazil, while in February it extended a partnership with Western Union to enable US and Canadian Western Union customers to send money to Mercado Pago wallets in Mexico.

Monex

Founded: 1985

CEO: Mauricio Naranjo

Customer focus: SMEs, Corporates, Institutional, Fintechs

Focus region: North America, LatAm, Europe, APAC

Years on Top 100 Map: 7

Monex is a specialist in commercial foreign exchange services, providing international payment and FX risk management solutions to more than 70,000 clients globally across its various brands, including Banco Monex, Monex USA and Monex Europe. With more than 2,800 employees handling $11.1bn in total assets in 2024, the company facilitates the delivery of international payments through its region-specific, online digital payment platforms. It has offices in North America, Latin America, Europe and Asia.

In June 2024, Monex USA integrated with Payments Exchange from Fiserv, allowing it to expand its cross-border payments offering for its financial institution clients. Monex has launched several partnerships to facilitate global B2B payments in 2025, including with customer data platform Identifee, securities trading platform Asset Match and cross-border payments infrastructure providers Coba and Payall.

Moneycorp

Founded: 1962

CEO: Velizar Tarashev

Customer focus: SMEs, Large Enterprises, Consumers

Focus region: Europe, Americas, APAC, Middle East

Years on Top 100 Map: 7

Moneycorp is an international payments company with headquarters in the UK. It provides corporate and personal money transfer services across 120 currencies and more than 190 countries, as well as FX risk management solutions. In 2023 (the most recent year for which figures are available), Moneycorp traded £71bn, with revenues of £223.5m.

Over recent years, the company has shifted away from the travel money segment to re-focus on B2B payments, although it does remain active in the higher-end consumer segment. In 2024, the company partnered with Pryor Global to facilitate seamless market entry and international payment solutions in Brazil, and it has also partnered with BankClarity, providing clients access to live market rates from 14 partner banks and improving straight-through processing of cross-border payments.

MoneyGram

Founded: 1940

CEO: Anthony Soohoo

Customer focus: Remittances, Consumers

Focus region: US, Global

Years on Top 100 Map: 7

Tracing its roots back to 1940 as Travellers Express, MoneyGram has since become one of the biggest money transfer companies in the world, with one of the largest cash payout networks globally. More than 50 million MoneyGram customers a year send money online, or at approximately 450,000 global retail locations, to recipients in more than 200 countries.

Back in 2023, MoneyGram went private as part of a $1.8bn acquisition deal with private equity firm Madison Dearborn Partners. The company has been shifting increasingly towards digital money transfers, as well as non-remittance consumer money transfers. Anthony Soohoo took over as CEO in October 2024, with Luke Tuttle becoming CTO in February 2025.

In April 2025, MoneyGram partnered with Mastercard Move to enable direct-to-card fund transfers to Mastercard users in 38 receiving markets. The same month, the company made a deal with Plaid to authenticate pay-by-bank transfers and in May launched MoneyGram Ramps, an API-based solution to simplify the embedding of crypto on and off-ramp functionality.

MTN Mobile

Founded: 1994

CEO: Ralph Mupita

Customer focus: Consumers, Businesses

Focus region: South Africa

Years on Top 100 Map: 3

MTN Mobile is a mobile money solution that facilitates payments across various countries in Africa, including international money transfers, mobile phone top-up, purchases or bill payments. It is part of MTN Group, a mobile telecoms company in Africa that has 291 million customers across 16 markets. The group’s fintech revenue grew by 29% in constant currency terms to R22.5bn (around $1.2bn based on 2024 exchange rates), which contributed to a 12.6% rise to its overall revenue figure of R188bn ($10.3bn).

In February 2024, MTN Group Fintech saw a $200m investment from Mastercard, which acquired a minority stake in the company. The deal valued the company at $5.2bn, and saw the two businesses launch a prepaid virtual card aiming to enable users of MTN’s MoMo ewallet to pay out to 100 million acceptance points worldwide. In December of the same year, MTN worked with Mastercard as well as education technology company Arifu to help digitise financial services for around one million small businesses in Cote d’Ivoire and Uganda.

Mukuru

Founded: 2004

CEO: Andy Jury

Customer focus: Remittances

Focus region: Africa

Years on Top 100 Map: 6

Mukuru offers cash collections and bank and mobile wallet top-up services, allowing people to send money to Africa from the rest of the world. With more than 16 million customers, the company has enabled over 250 million money transactions globally. It operates in over 70 countries across over 570 remittance corridors.

Through 60 partnerships, the company enables more than 100 brands to provide cash-out points. In January 2025, Mukuru debuted its mobile wallet in Zambia to support more than three million customers in the country. This follows an expansion to Uganda in early 2024, when the company also distributed aid to disadvantaged recipients in Africa.

NatWest

Founded: 1968

CEO: Paul Thwaite

Customer focus: Consumers, SMEs, Large Enterprises, Fintechs, Financial Services

Focus region: UK

Years on Top 100 Map: 7

Officially established via a merger of National Provincial Bank and Westminster Bank in 1968, National Westminster Bank (NatWest) is now the UK’s largest retail and commercial bank, serving 19 million people. Its FXmicropay service, which is targeted at corporate and financial institutions, provides automated FX and cross-border payments and related services.

Natwest achieved total income of £14.6bn ($18.7bn) in 2024, a rise of 2% excluding notable items. The bank noted 10% non-interest income growth, driven by strong performance in its payments, foreign exchange and debt capital markets segments. In November 2024, Natwest launched a virtual card payment tool for businesses expenses based on its mobile virtual app card and tokenisation technology in partnership with Mastercard.

Nium

Founded: 2014

CEO: Prajit Nanu

Customer focus: Remittances, Fintechs, Ecommerce, Financial Services

Focus region: APAC, Europe, US

Years on Top 100 Map: 7

Nium offers cross-border pay-in and pay-out services to a full range of corporates, fintechs and financial service companies. The company facilitates real-time payments across 100 markets and payouts across more than 220 markets. Nium serves over 130 million customers and supports platforms providing financial services to more than three billion people.

Nium has raised a total of $338m in funding to date, and was valued at $1.4bn in its last funding round in 2024. Nium has formed a number of partnerships recently, including making a deal with Ecobank to enable real-time cross-border payments across 35 African markets and joining Partior’s blockchain-based clearing and settlement network. In November 2024, the company launched Verify, a real-time verification platform for businesses to help reduce errors and inefficiencies around global payments.

Nuvei

Founded: 2003

CEO: Philip Fayer

Customer focus: Merchants, Ecommerce, SMEs, Enterprises

Focus region: US, Canada, Europe

Years on Top 100 Map: 1

Canadian fintech Nuvei provides a variety of payments solutions to businesses and ecommerce, serving SMEs and larger corporations. Its suite of products include pay-in and disbursement, card issuing, banking, real-time payment processing and an ecommerce platform that enables access to over 700 payment methods. The company says it connects businesses to customers across more than 200 markets and enables payments across 150 currencies.

In April 2024, Nuvei announced it was being acquired by Advent International through a deal worth $6.3bn, as part of which it was delisting from the Canadian stock market. This deal was completed in November 2024. Recently, Nuvei has taken significant steps to expand into the APAC market, having launched a new Japanese HQ in Tokyo in January 2025, adding to offices in China, Hong Kong, Australia and Singapore. In February 2025, Nuvei partnered with Temu to integrate more localised payment options with its ecommerce platform. Also in February, the company announced it had appointed a new CPO, Moshe Selfin, as well as a new Chief Risk and Compliance Officer, Chad Gerhardstein.

OFX

Founded: 1998

CEO: Skander Malcolm

Customer focus: Consumers, SMEs, Merchants, Fintechs

Focus region: APAC, Europe, US

Years on Top 100 Map: 7

Founded in Australia, OFX is a provider of FX and global payments solutions that enables international money transfers to more than 170 countries across more than 50 currencies. The company reported a fee and trading income of A$115m ($78m) in its earnings results for H1 2025 (spanning April-September 2024), when it saw 133,000 active clients – the majority of which were high-value consumer money transfers, with 25% being corporate clients. The company has more than 700 staff across offices in eight locations.

In September 2024, OFX expanded its presence in Europe by introducing a new team across several cities across Germany. Back in July 2023, OFX closed its acquisition of spend management platform Paytron, which followed earlier investment in treasury management company TreasurUp and the acquisition of FX provider Firma; in combination, these acquisitions have seen OFX expanding further into the B2B space and North America.

Onafriq

Founded: 2009

CEO: Dare Okoudjou

Customer focus: Merchants, SMEs, Financial Services

Focus region: Africa

Years on Top 100 Map: 4

Onafriq (formerly MFS Africa) is a pan-African company operating the largest digital payments gateway on the continent. It connects more than 500 million mobile money wallets across 41 African countries and 1,700 corridors. Altogether, the company serves more than 470,000 enterprise and merchant customers and is connected to 180 mobile network operators, money transfer operators and banks.

Onafriq has raised around $220m in funding, with its latest round being a $100m Series C in June 2022. The company has partnered with Western Union to extend services across millions of mobile wallets in Africa from over 200 countries and territories and in April 2024, Mastercard and Onafriq announced a partnership to support better access to mobile payment services. Alongside Flutterwave and Yellowcard, Onafriq joined Circle’s stablecoin-based payment network in April 2025, according to industry reports.

Orange Money

Founded: 2008

CEO Orange Money Group, Africa and Middle East: Aminata Kane Ndiaye

Customer focus: Remittances

Focus region: Côte d’Ivoire, Africa

Years on Top 100 Map: 5

Orange Money is a platform for mobile-phone based money transfers owned by Orange, a French international telecoms company. Since launching in Côte d’Ivoire, the service has amassed more than 160 million customers in 17 countries. In 2020, Orange expanded its financial services offering with the launch of its own bank, Orange Bank Africa.

In October 2024, Orange Money made a deal with Mastercard that would enable millions of Orange Money wallet holders to access digital payments through Mastercard’s global merchant networks by 2025. Earlier, in May 2024, Orange Money partnered with Revolut to enable the latter’s customers to payout to a number of African countries, including Botswana, Guinea-Bissau, Côte D’Ivoire, Madagascar and Sierra Leone.

P-S

Papaya Global

Founded: 2016

CEO: Eynat Guez

Customer focus: Large Enterprises, Mid-Market Companies, Startups, HR Teams

Focus region: US, Middle East, Europe, APAC

Years on Top 100 Map: 2

Papaya Global offers global payroll management services for large businesses, including SentinelOne, Wix, Toyota and Microsoft. The company enables pay-ins in 15 currencies and payouts in 130 currencies across more than 160 countries, and claims to have $34bn under management. Its payment solutions are powered by J.P. Morgan and Citibank.

In 2022, Papaya Global bought Azimo, a London-based remittance provider, as part of a strategy to expand partnerships with B2B payment providers and remittance companies and build out its network. In April 2024, Papaya Global partnered with payment processor dLocal to expand Papaya’s presence in the LatAm region, while in March 2025 it enlisted compliance solutions provider Sumsub to provide AI-powered automation solutions for verification and fraud prevention.

Paxos

Founded: 2012

CEO: Charles Cascarilla

Customer focus: Enterprises, Financial Institutions, Fintechs, Crypto Exchanges

Focus region: US, UK

Years on Top 100 Map: 1

Another stablecoin and web3 player being added to this year’s Top 100, Paxos offers regulated blockchain infrastructure solutions to financial institutions, fintechs and digital platforms (such as crypto exchanges). Its products span stablecoin acceptance and payouts, as well as crypto brokerage infrastructure. The company also issues several USD-backed stablecoins that can be used in cross-border payments, including PayPal USD (PYUSD), Pax Dollar (USDP) and Global Dollar (USDG). It has raised total funding of $544m and partnered with companies including PayPal, Mastercard and Stripe.

Paxos launched its new stablecoin payments acceptance platform for merchants in October 2024, adding Stripe as a first customer, and in the same month also announced its intention to integrate with Stellar’s open-source blockchain. In February 2025, Paxos completed its acquisition of Finland-based Membrane Finance, making Paxos a fully licensed EMI in Finland and in the EU, which will allow it to issue euro-denominated stablecoins and expand its services across Europe.

Payoneer

Founded: 2005

CEO: John Caplan

Customer focus: SMEs, Merchants, Freelancers, Corporates, Financial Services

Focus region: US, Europe, APAC

Years on Top 100 Map: 7

Based in New York, US, Payoneer provides an international payments platform to online sellers, large businesses. freelancers and financial institutions. The company has more than five million customers and has more than 2,000 employees worldwide across over 25 global offices. It became a publicly traded company in June 2021.

In its 2024 results, Payoneer reported that revenues rose 18% to $978m, with volumes rising 21% to $80.1bn. The company continues to see strong growth in Latin America and the APAC region, driven by its focus on Ideal Customer Profiles – customers that handle larger amounts of money through its platform. The company also announced that it had secured regulatory approval for its acquisition of a China-based payments service provider, which will make it one of few Western companies to hold a payments licence in the country.

PayPal (Xoom)

Founded: 1998 (Xoom founded 2001)

CEO: Alex Chriss

Customer focus: Consumers, SMEs, Merchants

Focus region: US, Global

Years on Top 100 Map: 7

Headquartered in the US, PayPal operates an online payments platform that allows businesses and consumers to send and receive payments online. As of its 2024 results, the company has around 434 million active accounts across more than 200 countries/regions. It saw cross-border total payment volumes rise 4% to $183m in 2024.

PayPal owns and operates Xoom, an international money transfer service that enables cash transfers via bank deposit, cash for pickup and cash delivery to nearly 160 countries. In November 2024, PayPal announced that Xoom would begin allowing its disbursement partners to use PayPal USD – its USD-backed stablecoin launched in 2023 – to settle cross-border transfers through its Xoom platform. At its investor day in February, the company spoke about its P2P payments strategy, with the company targeting 10% YoY P2P payments TPV growth by 2027 (i.e. surpassing $550bn).

Paysend

Founded: 2017

CEO: Ronald Millar

Customer focus: Remittances, B2B

Focus region: Europe, Americas, APAC

Years on Top 100 Map: 7

Paysend is an international money transfer service serving over 10 million customers, co-founded by CEO Ronald Millar and Chairman Abdul Abdulkerimov. The company leverages card networks to enable P2P money transfers, as well as instant and global payout services for businesses spanning more than 170 countries.

Paysend has raised a total of $336.4m in funding. In March 2024, Paysend announced an agreement with Currencycloud, giving its customers access to multicurrency wallets and helping the company expand its network across the US as well as the EMEA and APAC regions. This year, the company has partnered with Uzbekistan’s local card schemes Humo and Uzcard to enable cross-border business payments to the country, and also made a deal with Tink to enable pay-by-bank capabilities for international transfers.

PingPong

Founded: 2015

CEO: Yu Chen

Customer focus: Merchants, SMEs

Focus region: Asia, Europe, US

Years on Top 100 Map: 7

PingPong helps more than one million online merchants save money across cross-border payments, VAT payments, supplier payments and more. Through PingPong’s cross-border payments solution, customers can make international transfers to 195 countries, as well as manage more than 25 currencies in a multicurrency wallet. Merchants are able to accept card payments in more than 50 currencies and across more than 170 local payment methods.

PingPong has processed over $200bn in transaction volume and expanded to 32 offices worldwide. It achieved unicorn status in 2020, and has received a total of $122m in funding. In July 2024, PingPong was granted a payments licence to facilitate cross-border and domestic payments for businesses in Indonesia. In March 2025, Best Buy Canada became the latest major merchant to enlist PingPong to provide cross-border payment services for its online marketplace.

Railsr (Equals Group)

Founded: 2016

CEO: Philippe Morel

Customer focus: SMES, Large Enterprises

Focus region: UK, Europe

Years on Top 100 Map: 1

Railsr is an embedded finance company focused on integrating financial services such as digital wallets, accounts, payments and card systems for fintechs, sports clubs, retailers or other brands. At the end of April 2025, Railsr merged with Equals, a UK-based provider of foreign exchange services founded in 2007 that facilitates international payments for individuals and corporations.

Prior to the merger, Equals contained Equals Money, its broader bank account product pitched at SMEs, and Equals Money Solutions, its international payment network for large enterprises. According to Railsr, the merged company will integrate its products and services to introduce “exciting” new features to simplify global financial solutions for businesses.

Rapyd

Founded: 2016

CEO: Arik Shtilman

Customer focus: SMEs, Ecommerce, Fintechs

Focus region: Global

Years on Top 100 Map: 6

Founded in Israel and based in the UK, Rapyd facilitates cross-border payments for businesses through a single platform spanning several financial services, including payment acceptance, disbursement and digital wallets. The company helps businesses accept payments from 100+ countries, as well as across more than 900 locally preferred payment methods, and send from more than 190 countries.

In March 2025, Rapyd announced it had raised $500m at a valuation of approximately $4.5bn, with funds used to complete its $610m acquisition of European payment processor PayU – the funding round, which took Rapyd’s total funding to over $1bn, was one of the biggest Israel’s tech industry has ever seen. With the PayU acquisition, Rapyd’s annual revenues have surpassed $1bn while its workforce has reached 1,600 employees.

RBC

Founded: 1864

CEO: Dave McKay

Customer focus: Consumers, SMEs, Large Enterprises

Focus region: Canada

Years on Top 100 Map: 7

One of Canada’s largest banks, RBC has more than 97,000 employees, serving 17 million customers across 29 countries. The bank has a US-based banking offering designed specifically for Canadians, providing them instant cross-border transfers and 50,000+ no-fee ATMs. It also offers payment, FX and banking services to other banks and fintechs in the sector. The bank saw revenues rise by 11.4% to C$57.3bn ($41.8bn) in 2024.