While Q3 has been quieter for cross-border payments in terms of M&As and funding rounds, there have still been some noteworthy developments. Below, we take a look at some of the key moves in the space.

Expansion was a key theme for acquisitions in Q3. In August, US-based fintech Global Payments announced it was acquiring payment processor EVO Payments to expand its services to new markets, including Poland, Germany, Chile and Greece.

Meanwhile, money transfer player Remitly acquired Israel-based Rewire to help improve its core product and Western Union now aims to bring its digital wallet offering to Brazil through its acquisition of Te Enviei. This was one of several moves made in Latin America as the market recovers for migrant workers after the pandemic.

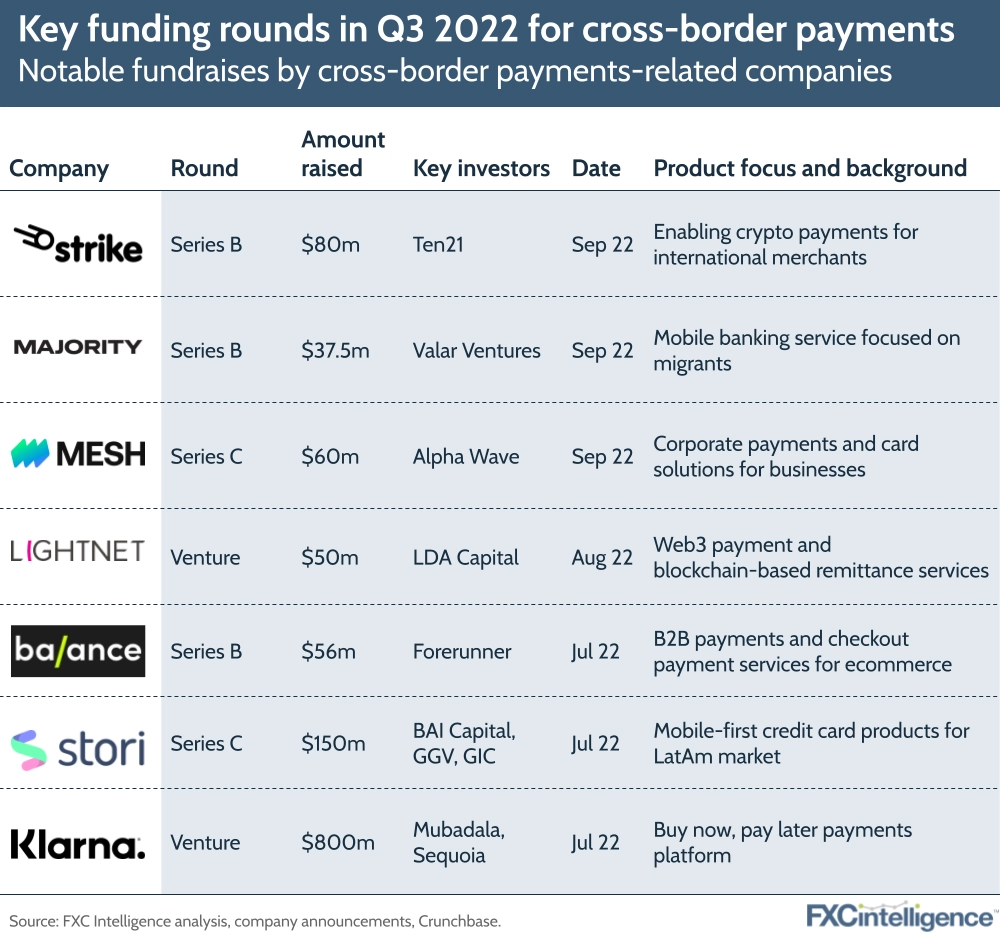

While there haven’t been as many big funding rounds in Q3 (potentially due to a global economic downturn) there have been some standouts. Buy now, pay later player Klarna reported an $800m funding raise back in July, although its valuation dropped by 85%. Meanwhile, Mexican credit card startup Stori reached unicorn status after its $150m Series C round.

In crypto news, US-based Strike raised $80m for its ecommerce crypto payments platform, while Singapore-based Lightnet raised $50m to develop blockchain-based remittance services in the Asia-Pacific region. Meanwhile Majority, one of several migrant-focused neobanks we’ve explored recently, raised $37.5m in its Series B.

As companies in the space announce their results for the season, we’ll be here with more in-depth analysis. Stay tuned for updates.

How are crypto providers competing with traditional players?